Press Releases

Cox Automotive Forecast: New-Vehicle Sales in January Expected to Maintain Healthy Pace Set in December

Monday January 29, 2024

Article Highlights

- The new-vehicle sales pace (SAAR) in January is expected to hold steady near the same level as December, finishing at 15.8 million, up 0.7 million from last January’s 15.1 million pace.

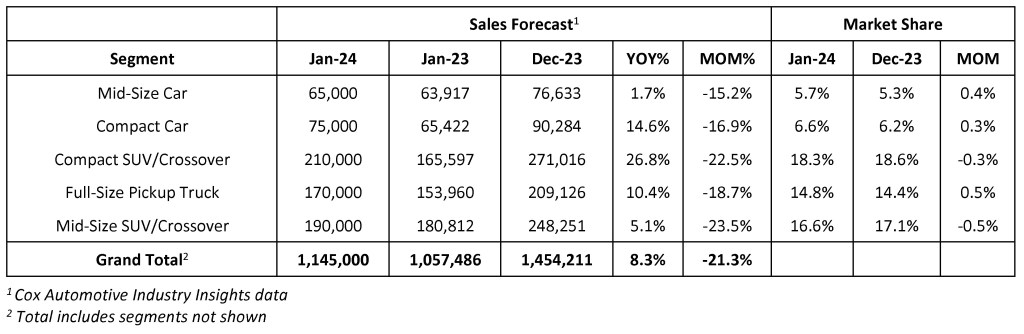

- January’s sales volume is forecast to rise 8.3% year over year and reach 1.14 million units; volume will be down notably versus December – more than 20% – as January is typically the industry’s low-volume month.

- New-vehicle inventory in early January was 2.66 million units, up 50% from January 2023.

New-vehicle sales in January came in lower than the Cox Automotive forecast, as a likely pullback from hotter-than-expected sales in December and colder-than-expected weather across much of the country in the middle of the month combined to hold consumers back. Total new-vehicle sales in January are now estimated at 1.08 million, below our forecast of 1.15 million, but up from year-ago levels. Compared to December 2023, new-vehicle sales in January were off by more than 26%.

January is typically one of the lowest-volume sales months in any given year – and last month was a slow one for retailers. In fact, despite some individual highlights, sales volume in total last month was the lowest reported since January 2023. An estimate of fleet sales suggests they were mostly flat year over year, with a minimal gain supported by one extra selling day. Retail sales volume, also benefitting from that extra day of sales, gained just over 4%. The January sales pace is now initially estimated at 15.0 million, down from 15.1 million in January 2023 and the lowest point since March last year, when the market pace struggled to hit 14.9.

Cox Automotive continues to believe the new-vehicle market will deliver slow growth in the year ahead and finish with a total sales volume of nearly 15.7 million. The slow January start – below our forecast – suggests “slow growth” is indeed what the market is in for.

ATLANTA, Jan. 29, 2024 – January new-vehicle sales, when announced next week, are expected to show gains over last year’s product-constrained market. Cox Automotive forecasts sales volume in January to increase 8.3% over January 2023, a market that was still recovering from severe product shortages. Typically, January is the low-volume leader in any given year; volume in January is forecast to be down 21.3% month over month. December, historically, is the high-volume month in any given year.

The seasonally adjusted annual rate (SAAR), or sales pace, in January is forecast by Cox Automotive to finish near 15.8 million, down just slightly from the 15.9 million SAAR in December but up 0.7 million over last year’s pace. The SAAR has bounced between 15.0 and 16.0 million throughout 2023, and this month’s results are expected to remain within these boundaries.

“January is normally one of the slowest months for vehicle sales, as the December hangover and cold weather keep car and truck shoppers from wandering dealer lots,” said Charlie Chesbrough, senior economist at Cox Automotive. “This January will be no exception, compounded by a few large storms and deep freezes across the country, which likely had an additional negative impact on sales. Unlike last year, though, available inventory and incentives will not be a problem.”

Fleet sales are expected to be a key contributor to total new-vehicle sales in January and throughout 2024. Fleet sales were down slightly in October and November due to the UAW strike, but they rebounded in December. January is expected to continue that rebound, with strong commercial and rental vehicle sales anticipated. Cox Automotive is forecasting fleet sales in 2024 will increase more than 7% from 2023 and grow faster than retail sales.

January 2024 New-Vehicle Sales Forecast

January has 25 selling days, one more than last year but one less than last month.

About Cox Automotive

Cox Automotive is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, auto manufacturers, dealers, lenders and fleets. The company has 29,000+ employees on five continents and a portfolio of industry-leading brands that include Autotrader®, Kelley Blue Book®, Manheim®, vAuto®, Dealertrack®, NextGear Capital™, CentralDispatch® and FleetNet America®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on X, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com