Data Point

CPO Sales Rolling in 2019

Tuesday October 15, 2019

Article Highlights

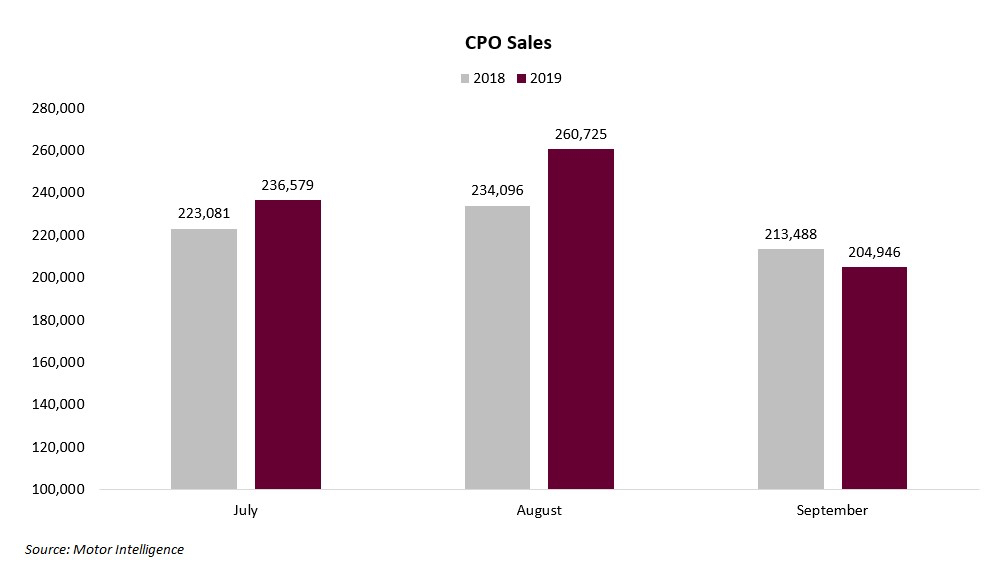

- Sales of certified-preowned (CPO) vehicles decreased 4% year over year in September but were up 4.7% in Q3 versus Q3 2018.

- This year CPO sales are up 2.4% versus 2018 with over 2.1 million CPO units sold through September.

- A recent Cox Automotive CPO Shopper Study found that 68% of CPO shoppers are open to purchasing a new car.

Sales of certified-preowned (CPO) vehicles decreased 4% year over year in September but were up 4.7% in Q3 versus Q3 2018. For the month, 204,946 CPO units were sold.

This year CPO sales are up 2.4% versus 2018 with over 2.1 million CPO units sold through September. CPO sales are growing at a comfortable pace above 2018’s record-setting performance of 2.7 million CPO units sold for the year. Favorable supply of vehicles entering the market will continue to support used retail sales. In 2019, Cox Automotive is estimating 4.1 million off-lease vehicles will return to the market, a peak in off-lease numbers. Next year off-lease supply is forecast to equal the 2019 record.

As has been the case all year, Toyota, Honda and Chevy are the biggest players int he CPO market and collectively represent almost a third of all CPO sales. Toyota and Honda continue to see their CPO sales grow, with the brands up 10% and 7% respectively, while Chevy CPO sales are down 9% in 2019.

Meanwhile, new-vehicle sales dropped 11.3% in September, down 1.1% this year. A recent Cox Automotive CPO Shopper Study found that 68% of CPO shoppers are open to purchasing a new car. For luxury CPO intenders, 73% are open to purchasing a new vehicle.

While the CPO Shopper Study revealed a high percentage of CPO intenders are open to considering a new alternative, shopping behavior demonstrates opportunities for automakers to capitalize on that sentiment. The gap between average CPO list price $27,737 and average new-vehicle transaction price $37,325, is down 3% year over year through August 2019.

In taking a closer look at model-level cross-shopping, there are varying degrees of CPO to new alternative version cross-consideration. CPO is typically viewed as a bridge from used to new, but with special financing offers and lucrative incentives, in some instances, purchasing new makes even more financial sense that purchasing a CPO unit.

On average, CPO truck shoppers are more likely to shop the new alternate, whereas CPO sedan shoppers are less likely to shop the new model version, according to the study.

Within the truck segments, average cross-shopping is 48.2% for midsize, 52.5% for light duty and 57.4% for heavy duty trucks.

Download the full Cox Automotive CPO Shopper Study below for more details on new-vehicle upsell opportunities based on CPO shoppers cross-considering new model versions.