Data Point

Cox Automotive Analysis: Quarterly Toyota U.S. Market Performance

Thursday August 6, 2020

Article Highlights

- In the recent quarter, Toyota’s operating profit plunged 98% to about $129 million, and its global sales fell to 1.85 million vehicles.

- Toyota boosted overall incentives by 18% to an average of $2,715 per vehicle, according to Kelley Blue Book calculations.

- Toyota saw hefty increases in Average Transaction Prices (ATPs), helping to offset higher incentives.

Toyota eked out a small profit for the quarter ended June 30, thanks to immediate cost cutting, including R&D outlays, and a faster-than-expected rebound in China. It still expects to make $7 billion in this fiscal year.

In the recent quarter, Toyota’s operating profit plunged 98% to about $129 million, and its global sales fell to 1.85 million vehicles.

Toyota executives said earnings through the rest of its fiscal year, which ends March 31, 2021, are subject to change due to uncertainty regarding the pace of economic recovery and new waves of the coronavirus. Toyota currently expects net profit for the year to be nearly $7 billion, down 64%.

Global retail sales for Toyota likely will fall 13% to 9.1 million vehicles, with declines in almost every region, including a 14% drop in North America. Toyota expects sales to reach year-earlier levels by end of 2020 and start growing again early in 2021.

Here are some data from Cox Automotive on Toyota’s quarterly market performance in the U.S., one of the Japanese automaker’s most important markets.

Sales and Market Share

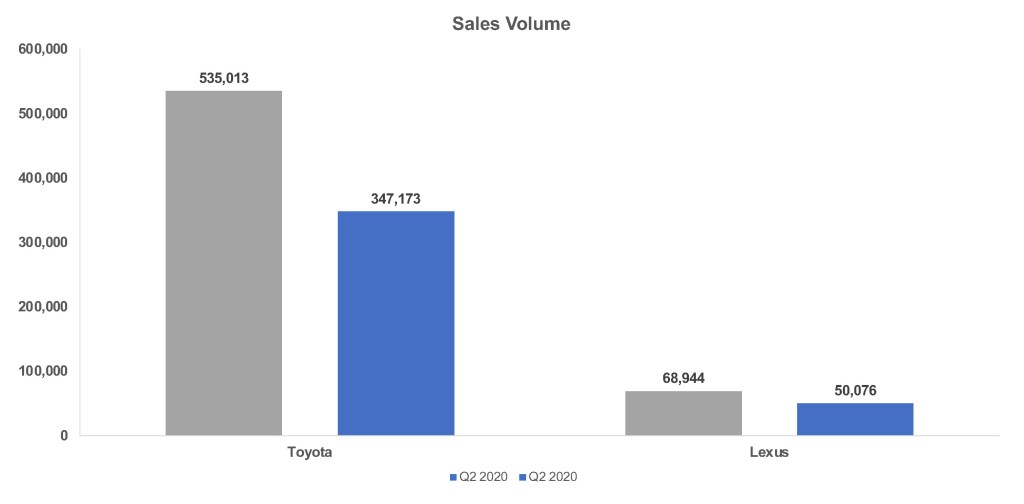

Toyota sold 397,249 in the U.S., a decline of 34% from the year-ago quarter. Sales of Toyota branded vehicles dropped 35% to 347,173 vehicles. Lexus sales fell 27% to 50,076 vehicles.

The sales decline caused Toyota’s overall share to slip slightly to 13.69% from 13.77% a year ago, according to Cox Automotive data. The Toyota brand dropped to 11.97% market share from 12.20%. Lexus gained share, up to 1.73% from 1.57%.

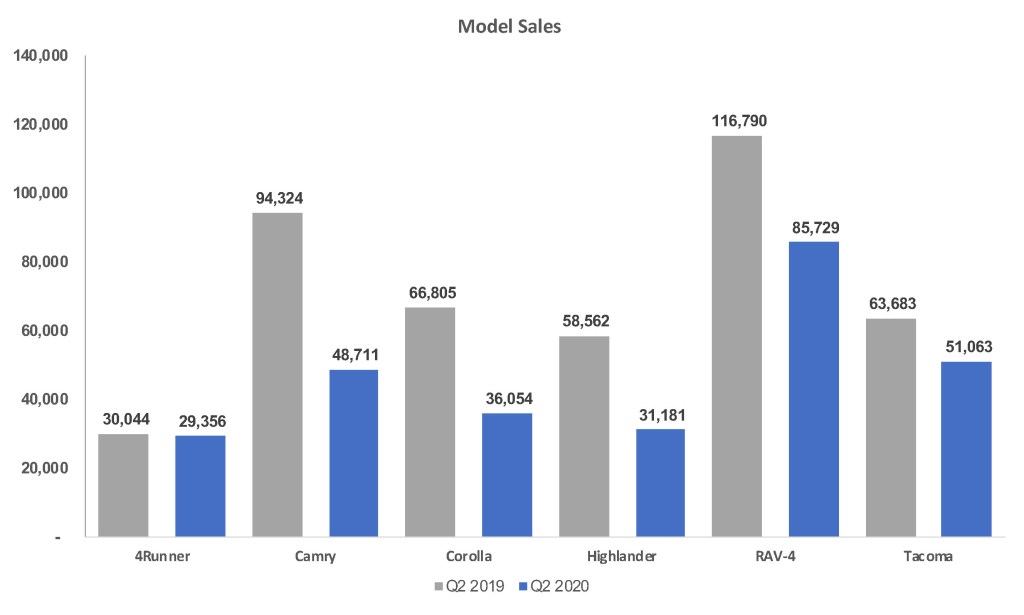

Toyota models with the lowest sales declines were the 4Runner SUV and CH-R crossover, both down only 2%; the Tacoma and Tundra pickup trucks, down 7% and 20%, respectively. Highlander sales were down 47%. The redesigned model has been in slow launch at the Indiana plant that makes them.

In contrast, Toyota car sales saw the biggest declines: Avalon, down 58%; Camry, down 48%; and Corolla, down 46%.

Toyota struggled with extremely low inventory during the quarter even though its plants are back up and running in the quarter. Both the Toyota and Lexus brands had been at or near the bottom of lowest inventory for several weeks. In particular, the Toyota RAV4, which had sales fall 27%, is in high demand but with one of the lowest supplies in the industry. Likely Toyota would have sold more RAV4s if it had them.

The only Lexus model to post higher sales was the GX SUV. Toyota recently announced it would discontinue sales of the GS as consumers prefer SUVs to sedans like the GS.

Incentives

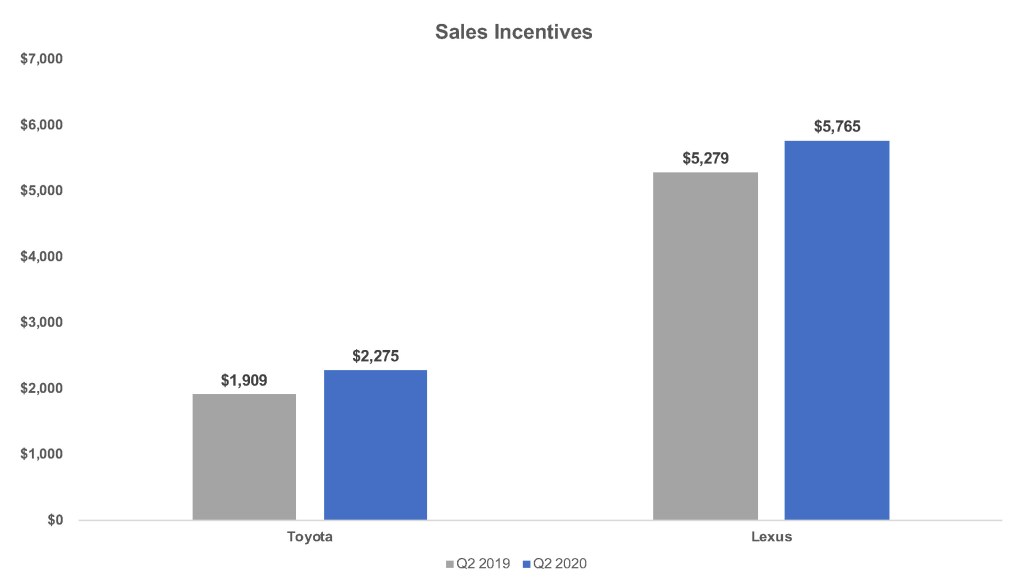

Toyota boosted overall incentives by 18% to an average of $2,715 per vehicle, according to Kelley Blue Book calculations. That is the highest amount for the quarter for the past five years but still relatively low in the industry.

The Toyota brand had a 19% increase in incentives to an average of $2,275, still below than in the same quarter in 2017. Lexus incentives rose 9% to $4,765 per vehicle, its highest for the quarter over the past five years.

Prices

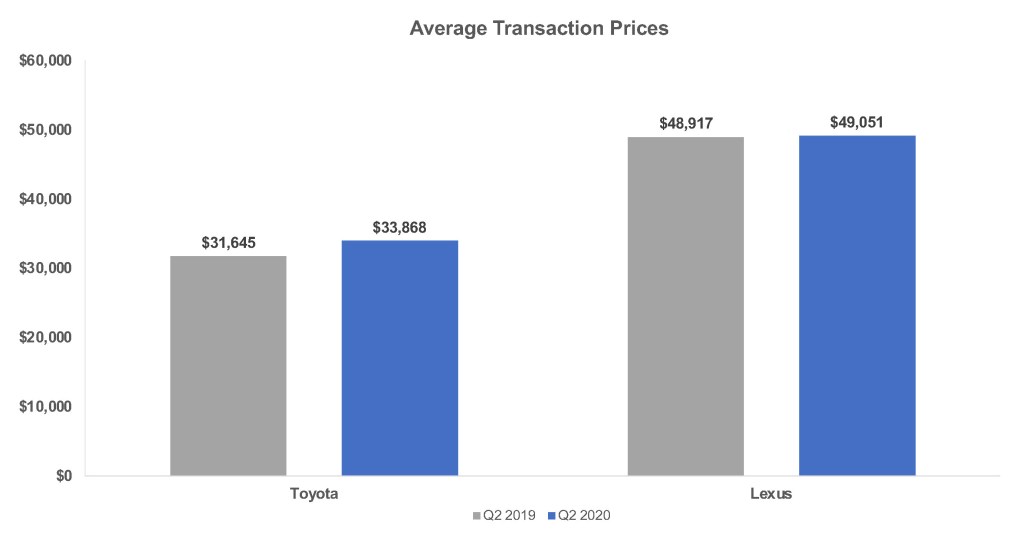

Toyota saw hefty increases in Average Transaction Prices (ATPs), helping to offset higher incentives. Toyota’s ATPs for both brands was $35,782, up 6% from a year ago, according to Kelley Blue Book calculations.

The increase came from the Toyota brand, which had a 7% increase in ATP to $33,868. The new Highlander followed by the 4Runner had the biggest ATP increases with the RAV4, Tacoma and Tundra posting hikes as well.

Lexus’ ATP was about flat at $49,051. The RC’s ATP skyrocketed by nearly 16% to $58,340.