Cox Automotive December Forecast: Sales Pace Continues to Slow as 2020 Stumbles Across Finish Line

Tuesday December 22, 2020

Article Highlights

- Annual vehicle sales pace in December is expected to finish near 15.5 million, down from last month’s 15.6 million pace and last year’s healthy 16.8 million pace. With extra selling days in December 2020, sales volume is expected to rise 1.9% from year-earlier levels and finish near 1.54 million units.

- With extra selling days in December 2020, sales volume is expected to rise 1.9% from year-earlier levels and finish near 1.54 million units.

- Fourth quarter performance helps 2020 finish down only 15.3% versus 2019, a surprising result after a 34.1% plunge in Q2.

ATLANTA, Dec. 22, 2020 – Boosted by year-end sales and extra selling days, light vehicle sales in the U.S. for December are expected to finish near 1.54 million, a 1.9% increase over last December. The gain is a bit misleading, however, as there are 28 shopping days this month, three more than last year and five more than last month. With that many extra days for vehicle shoppers to acquire new wheels, a volume increase is more than expected. When volume is viewed on a seasonally adjusted basis, the sales pace is forecast to fall to a 15.5 million seasonally adjusted annual rate (SAAR), down from last month and down nearly 7% from last December’s 16.8 million pace.

According to Charles Chesbrough, senior economist at Cox Automotive: “December new-vehicle sales should show a year-over-year increase thanks to the three additional shopping days. But concerns about the virus, more state-directed lockdowns, and the ongoing economic recession are likely to constrain holiday sales. The passage of more government stimulus this week is good news overall, but we do not expect new government stimulus to impact the new-vehicle market in any noticeable way in December.”

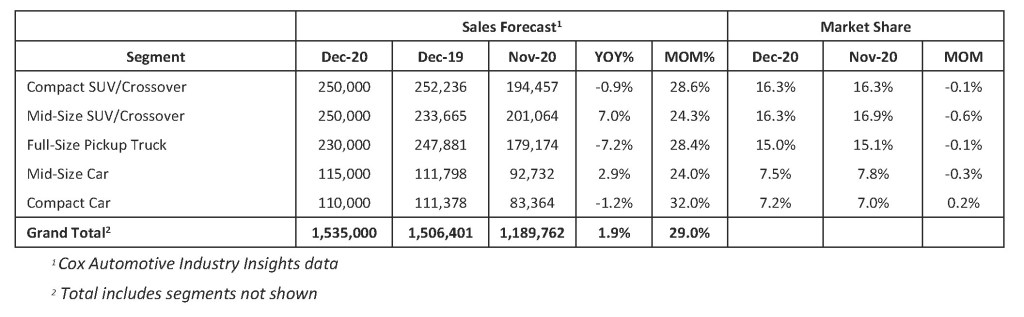

December 2020 Sales Forecast Highlights

- New light-vehicle sales are forecast to increase nearly 30,000 units, or 1.9%, compared to December 2019. When compared to last month, sales are expected to rise nearly 350,000 units, or nearly 29%.

- The SAAR in December 2020 is estimated to be 15.5 million, below last year’s 16.8 million level, and a slight decrease from last month’s 15.6 million pace.

December 2020 Forecast

All percentages are based in raw volume, not daily selling rate.

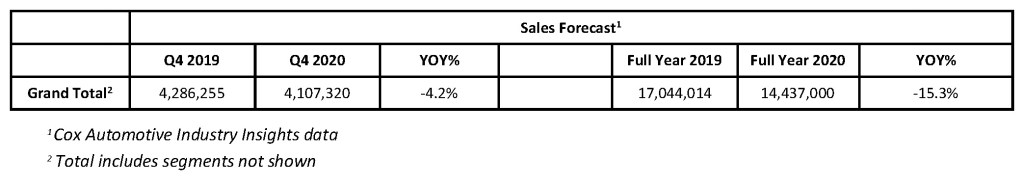

2020 Sales Benefit from Strong Retail Demand

Full-year 2020 sales are forecast to end down 15.3% from 2019. After a 34.1% drop in Q2, improvements in Q3 and Q4 salvaged what many in the industry thought would be a far worse year. 2020 will be the first year below 17-million sales since 2014. Still, as Cox Automotive Chief Economist Jonathan Smoke notes, “This year presented the economy and the auto market with incredible challenges. As we close the year, it is remarkable to see how well the industry performed. Retail vehicle sales will end the year down less than 10% despite losing six weeks of the most important time of the year.”

Smoke added, “Supply constraints likely prevented even better volume performance, but most manufacturers and dealers enjoyed improved profitability as a result of limited supply and robust demand. We enter 2021 still battling the COVID-19 pandemic, but the distribution of vaccines gives us confidence that the economy and the auto market will both see continued progress once we get through the winter.”

Full Year 2020 Forecast

All percentages are based in raw volume, not daily selling rate.

JOIN US: COX AUTOMOTIVE INDUSTRY INSIGHTS 2021

Plan to join Cox Automotive Chief Economist Jonathan Smoke, Senior Economist Charlie Chesbrough, and the Industry Insights team for an expanded quarterly update on Friday, Jan. 8, 2021, at 11 a.m. EST. As a new year dawns for the automotive industry, this 90-minute webcast will kick off with Cox Automotive data and insights on both the new- and used-vehicle markets for 2020, as well as 2021 forecasts and what the team sees in the year ahead.

Afterwards, we will turn our attention to the Manheim Used Vehicle Value Index, covering Manheim Market Report prices, segment performance, rental risk pricing and more. Plus, Zach Hallowell, senior vice president, Manheim Digital, will share an update on data and developments in digital.

About Cox Automotive

Cox Automotive Inc. makes buying, selling, owning and using cars easier for everyone. The global company’s 27,000-plus team members and family of brands, including Autotrader®, Clutch Technologies, Dealer.com®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital®, VinSolutions®, vAuto® and Xtime®,are passionate about helping millions of car shoppers, 40,000 auto dealer clients across five countries and many others throughout the automotive industry thrive for generations to come. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with annual revenues of $21 billion.

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com