Data Point

September CPO Sales Come in Strong, Top 2 Million Units Year to Date

Wednesday October 18, 2023

Article Highlights

- Certified pre-owned (CPO) sales in September totaled 254,976, up nearly 14% year over year, with a slight month-over-month dip.

- Year-to-date CPO sales have exceeded 2 million units, up nearly 9%.

- Cox Automotive upgraded its CPO forecast at the end of Q3 and expects CPO sales to finish the year between 2.6 and 2.7 million units.

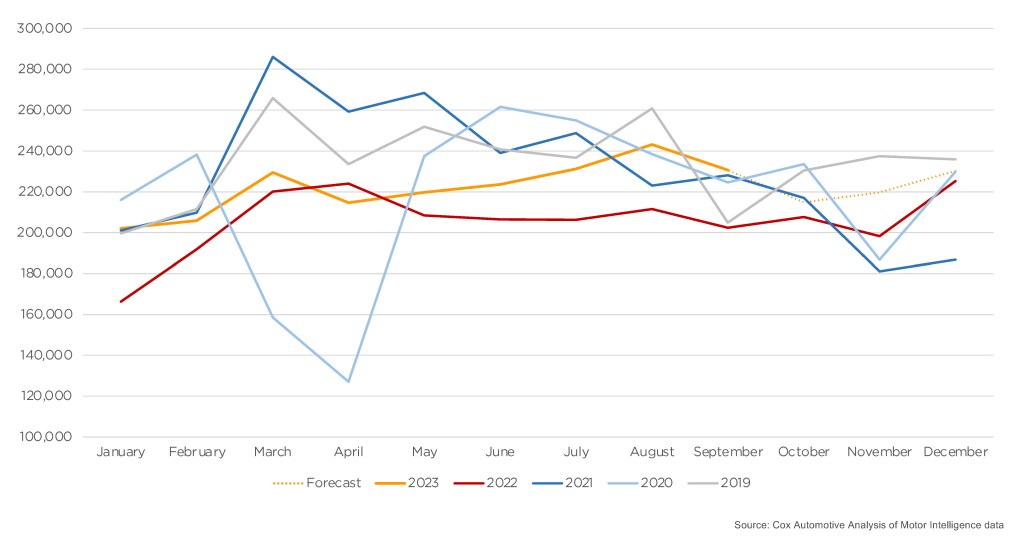

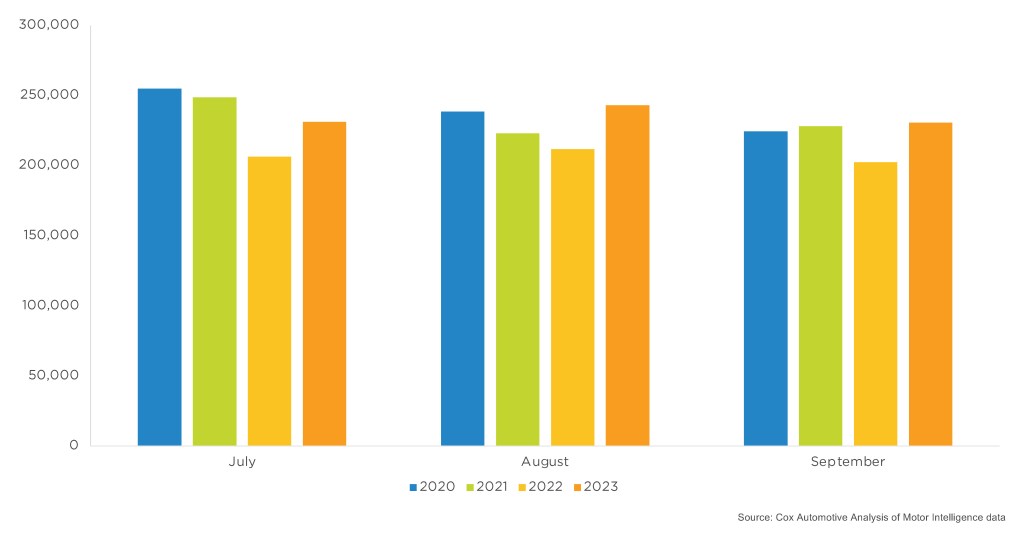

Certified pre-owned (CPO) sales in September totaled 254,976, an increase of more than 28,000 – nearly 14% – year over year, but a slight month-over-month dip due to one less selling day. September’s total was down 12,514 units, a 5% decrease, from August’s number.

“CPO sales over the last three months have been the highest in any month since July 2021,” said Chris Frey, senior manager of Economic and Industry Insights at Cox Automotive. “We are still waiting for the expanded eligibility programs noted earlier this year to fully bear fruit. Some brands have looked stronger recently, and those could be the early signs of success. At the same time, improving new-vehicle inventory levels and higher sales incentives are keeping some buyers in the new market – not in CPO.”

September CPO Sales

CPO Sales Surpass 2 Million Units Year to Date

Year-to-date CPO sales have exceeded 2 million units, up nearly 9% or 112,799 units compared to the same period last year. Luxury CPO sales have increased an impressive 12%, with Acura, Genesis and Lexus leading the way. Meanwhile, non-luxury CPO sales were up 8%.

CPO MONTHLY SALES

Asian brands are benefiting from supply recovery, and their CPO sales are up close to 14%. European brands are up 6%, while the Detroit Three are lagging the industry average with only a 3% increase in CPO sales year to date.

CPO is outperforming the used-vehicle market so far in 2023. For comparison, according to Cox Automotive estimates based on vehicle registration data, total used-vehicle sales in September decreased 3.2% from August to 3.0 million units. The seasonally adjusted annual rate, or SAAR, is estimated to have finished September near 35.8 million, up from last September’s 35.1 million pace, but down from August’s upwardly revised 36.0 million level. Year to date, retail used vehicle sales are down less than 1% through the end of September.

Cox Automotive upgraded its CPO forecast at the end of Q3 and expects CPO sales to finish the year between 2.6 and 2.7 million units.

“Clearly, CPO sales show demand is there, partly due to the affordability challenges that persist in the new market,” Frey noted. “The only factor holding back CPO is limited supply.”