Electric Vehicle Whitepaper

COVID-19 RECOVERY: SPEED BUMP OR ACCELERANT FOR THE EV MARKET?

Tuesday September 22, 2020

Article Highlights

- From understanding maintenance costs and battery life to the availability of incentives, education is paramount to driving consumer EV interest.

- Access to EV charging nationwide will continue to play a critical role in consumer purchase and adoption, as well as the transition to an all-electric fleet future.

- The industry needs to move quickly to advance capabilities to extend battery first life and provide appropriate end-of-life options to protect our communities and the environment.

TAILWINDS, HEADWINDS AND WHIRLWINDS

Still raging its way around the world, COVID-19 delivered an unprecedented sucker punch to the automotive industry. And while there’s universal agreement the industry will recover, it will look very different when it emerges. Part of that conversation will be how we do business (virtually); the other part will be whether our appetite for Electric Vehicles (EV) will be kicked farther down the road or revved up thanks to the smog-free blue skies we’re seeing for the first time in decades.

In fact, a study published by the Nature Climate Change found significant drops in daily global carbon dioxide emissions, with a peak year- over-year decline of 17% in early April.

Early signs suggest that while the EV market will take a hit in 2020, it will be more stall out than vanishing act. In fact, recent signs suggest that any stall out may have more to do with long production lead times and less about dimming ambition by OEMs. How long the stall out will last is a point of much conversation.

Fact of the matter is the push to electric is inescapable as carmakers scramble to meet strict emissions targets in Europe, China and nationally, including California and an ever- growing list of states that have adopted or are poised to adopt California’s zero-emissions mandate. Moreover, many manufacturers have spent billions of dollars in research on EV technology, which has been underway for years, with many billions more committed in the years to come. Some OEMs have literally bet their whole future on these vast investments, making it unrealistic to reel in.

Despite the pandemic, 2020 will see Volkswagen debut the I.D. Crozz. Volvo will launch the XC40 Recharge utility vehicle; and Audi will add the e-tron Sportback to its line, although not all have been confirmed for the U.S. Ford’s highly anticipated Mach-E SUV is still slated to launch in the U.S. in late 2020, but European deliveries won’t happen until early 2021.

EV plans delayed

Other automakers have delayed EV introductions. The Mercedes-Benz EQC is delayed for North America to focus on its European launch in Q1 2021. Rivian has delayed its EV truck and SUV models into 2021. Lordstown Motors pushed back the unveiling of its Endurance EV pickup. GM has delayed the refresh of the Chevrolet Bolt EV to the 2022 model year from 2021, but insists other EVs remain on track like the GMC Hummer EV, Cadillac Lyriq and Cruise Origin shuttle.

Struggling

Troubles continue for EV maker Faraday Future with its founder filing for personal bankruptcy to resolve billions of dollars of personal debt. Chinese EV company Byton has been temporarily suspended since July, but is reportedly ready to resume full operations in September 2020. Shares of Chinese EV maker Kandi Technologies plummeted after its highly anticipated product unveiling in August resulted in just a few hundred pre-orders.

EV OEM valuations are skyrocketing

For the market, Summer 2020 has been head-turning for the EV industry. In July, Tesla surpassed Toyota to become the world’s most valuable automaker. As of August 17, Tesla’s market value of $342 billion also surpassed Procter & Gamble and Walmart may be next. Nikola went public in June after a reverse merger while Lordstown, Canoo, Fisker and Hyliion are working with a special purpose acquisition company (SPACs) to raise capital.

Long-term, EVs are on target

By 2025, there will be more than 600 different battery electric vehicles (BEV) and hybrid electric vehicles (HEV) models available globally. Bloomberg New Energy Finance forecasts global BEV sales will grow from 1.7 million in 2020 to 8.5 million in 2025, 26 million in 2030 and 54 million in 2040, representing 58% of anticipated new car sales. Three accelerants will fuel this growth:

- Costs: Battery costs continue to fall, enabling EVs to achieve cost parity with equivalent gas cars soon, not to mention well-known lower total cost of operation versus ownership.

2. Fleets: Companies and cities are converting fleets, which leads to bulk purchases that drive up sales numbers and further drive down prices. Further, fleets often enjoy the strongest ROIs from BEV platforms.

3. Consumers: Batteries keep getting better, leading to greater efficiency, extended range and faster charge times, helping improve consumer sentiment.

Although the majority of Americans agree that if we all drove electric vehicles, we could reduce oil consumption and pollution, only a third would consider buying one anytime soon. And it’s largely due to the fact that the industry is still in early innings when it comes to educating and delivering support about the real and perceived consumer pain points of cost, battery life and charging infrastructure.

This white paper describes how education, investment and policy can unlock the advantages of electric vehicles that will lead to greater adoption, and why there’s good reason to remain bullish on the future of the EV market.

REAL AND PERCEIVED COSTS ARE MAJOR ROADBLOCKS

According to the 2019 Cox Automotive Evolution of Mobility Study: The Path to Electric Vehicle Adoption, there are very clear perceived barriers to more widespread acceptance and adoption of EVs by both consumers and dealers: cost, battery life and charging infrastructure.

The study found that while perceptions of initial costs for EVs are more than internal combustion engine (ICE) vehicles, the reality is the price gap between EVs and gas- powered vehicles is closer than most realize and continues to tighten. In tracking average transaction price from 2018-2020, EV pricing is up 3.1% versus 3.7% for ICE vehicles.

Maintenance and fuel get high marks

On the other hand, the study cites the widespread belief that it costs less to charge and maintain an EV than a gas vehicle. In many ways, an EV is mechanically simpler than a conventionally powered vehicle. There are far fewer moving parts in an electric motor than a gasoline engine, and EVs avoid many common automotive components that will eventually fail and need replacing.

All of that seems to be born out by the impressive, yet little-known numbers around cost-to-operate recently published by Kelley Blue Book: Average 5-year total cost-to- operate a personal EV is a whopping 58% less than a comparable gas vehicle, with 60% in fuel savings and 25% in service cost savings versus gas counterparts.

With the introduction of the EV, the paradigm is changing from a mileage-centered service profile to battery health.

Electricity isn’t free by any means, but it’s much cheaper than gasoline, even with some of the recent COVID-19-related pressures to the oil and gas industries. The cost to drive an electric car 100 miles can be as low as $4, while 100 miles with gas will cost an estimated $10.87, at about 30 mpg; 10,000 all-electric miles every year saves about $700 annually (and eliminates tailpipe emissions).

Battery life is greatly misunderstood

Understandably, consumers have serious reservations over battery life and the costs associated with battery replacement. According to Consumer Reports, properly cared for under the right conditions, an electric car’s battery pack should last considerably longer than 100,000 miles — well above the 65,000-mile lifespan respondents in the Cox Automotive study believe.

Furthermore, many electric car manufacturers offer very robust 8-year/100,000-mile warranties on the high-voltage battery systems in their cars. Often longer than the warranties offered on the other components of the vehicle, it shows that electric vehicle manufacturers have a high degree of confidence in EV battery life expectancy. Kia, for example, covers the battery packs in its electric cars for 10 years/100,000 miles, while Hyundai goes a step further by bumping it up to lifetime coverage.2

Regardless, replacing an electric vehicle’s battery is an expensive proposition. Even though the battery on the Nissan Leaf is projected to last 10 years, replacing it with a new one could set you back anywhere from $4,000 to nearly $10,000, depending on the capacity. A new battery pack for a Chevrolet Bolt EV is reportedly priced well over $15,000, and that’s not including labor. If battery work is needed, however, modules can often be replaced for significantly less than the cost of the entire pack. In fact, a manufactured battery comes in at about half the cost of a replacement.

The price of lithium-ion batteries — which power the bulk of electric vehicles — drop to around $100 kwh by 2024, from $156 kwh per BNEF as of 2019. These price drops are due to ever-larger factories that benefit from economies of scale, manufacturing efficiencies and innovations, fierce competition in the battery industry and new battery chemistry technologies.

Inconsistent incentives hampered by poor awareness

Except for models from General Motors and Tesla, all mainstream, mass-produced full-electric vehicles on sale in America qualify for a $7,500 federal credit. General Motors and Tesla have exceeded the sales volume cap of the federal program, making their vehicles ineligible for the full credit (or any federal credit, in the case of Tesla). In December 2019, Congress declined to expand the federal credit program, but recently under the Moving Forward Act the House has advanced legislation to the Senate, including provisions to expand the federal incentive vehicle cap.

For leased EVs, the tax credit goes to the leasing company that’s offering the lease, not the buyer.

They sometimes price the value of the tax credit into the lease’s monthly payments, so the buyer may get part of the tax credit’s benefits in the form of lower monthly payments, but it isn’t mandatory.

EV tax credits cannot be passed on, either. Only the original registered owner of an eligible vehicle can claim the federal tax credit. Even if the original registered owner didn’t apply for the credit for some reason, it cannot be passed along to a subsequent buyer. In that case, it might turn out that a new model with the tax credit is a better deal than a used one if the federal tax credit program means the list price for the new model is reduced by up to $7,500.

Additionally, nearly half of U.S. states offer some incentives for buying an electric vehicle, too. But while the majority of Americans support the idea of tax breaks or other incentives, and even those who aren’t actively considering buying an EV say such a break would encourage them to do so, eight out of 10 of people don’t know whether any are available in their state.

Moreover, the COVID-19 pandemic has thrown state budgets into disarray, jeopardizing current and future incentive programs.

Leadership on vehicle electrification is critical to tackling climate change, protecting consumers and fleet managers from volatile oil prices, maintaining the competitiveness of U.S. automakers and creating 21st-century manufacturing jobs.

Incentives, such as tax credits and rebates, encourage EV sales while automakers scale up manufacturing and technology improves. Much of the additional cost of making an EV is due to the battery and this scale-up of EV manufacturing, along with improved and innovative battery technology, will reduce the cost of manufacturing EV batteries and make EVs more cost-competitive.

This is a substantial boon to consumers looking to enter the electric vehicle market. Time and again, drivers note price as their main concern when buying a car — whether electric or gas-powered — making these incentives essential to increasing EV adoption. On the horizon is also potential for a used EV incentive as contemplated by the Moving Forward Act approved by the House.

Registration fees much debated

Highway-related excise tax revenue totaled $40.5 billion in 2019, 41% of all excise tax revenue. Gasoline and diesel taxes, which are 18.4 and 24.4 cents per gallon, respectively, make up over 90% of total highway tax revenue, with the remaining from taxes on other fuels, trucks, trailers and tires. Gas taxes are states’ largest source of revenue for repairing and maintaining roads and bridges.

Not tied to inflation or the Consumer Price Index, it’s been 27 years since the federal gas tax was raised. To put it in perspective, many of us were watching “Seinfeld” in its original incarnation. Yet over those 27 years, the cost of building and maintaining roads, bridges and transit has shot up, leaving the highway trust fund, which pays the federal portion of highway and transit projects, running on empty. With the cost of concrete, asphalt, machinery and labor going up, and with less gas being used in more fuel-efficient cars and more EVs on the road, the purchasing power of the gas tax has been sliced by almost two-thirds. IHS forecasts BEVs and full hybrids will account for around 5.6% of sales in 2020 – about 800,000 cars and trucks out of 14,400,000 units overall. In anticipation of the growing number of EV vehicles displacing gas models, states are positioning themselves to make up for lost gas tax revenue by levying special registration fees.

In 2019, according to the National Conference of State Legislatures, 28 states charged from $50 to more than $200 a year for EVs, and 14 states had annual fees for plug-in hybrids that also use gasoline. The fees are generally in addition to standard vehicle registration fees.

According to Consumer Reports, EV fees on average generate 0.04% of state highway revenues in states where they have already been instituted, as of 2019.

All of that is well and good. Regardless of the motor vehicle type, it’s logical that anyone who uses our roads should be on the hook to help maintain them. But it’s not that simple. Many of those same states that are imposing EV fees (in addition to registration fees) also offer incentives to buy EVs. For prospective buyers, that doesn’t compute. And for manufacturers, it’s a disincentive effectively penalizing efficiency and innovation.

Case in point is the state of Georgia: Prior to its zero-emissions vehicle (ZEV) fee, Georgia was one of the nation’s most thriving ZEV markets. When the state legislature repealed its $5,000 tax credit in 2015 and imposed a $200 annual registration fee, sales of EVs tanked by almost 90%.

CHARGING INFRASTRUCTURE IS BIG BOTTLENECK

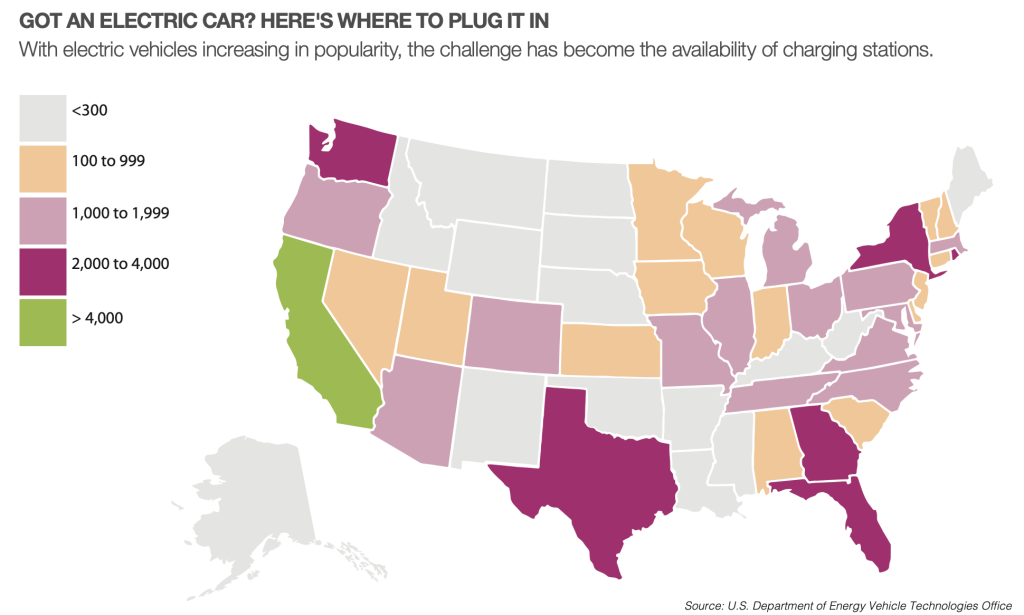

Numerous studies have shown that consumers won’t consider EVs because they worry about the lack of access to charging stations. According to the U.S. Department of Energy, more than 80% of EV charging happens at home, where EV owners have set up their own chargers. Many drivers can also charge their batteries at their workplaces. Charging in a single- family home, usually in a garage, allows EV owners to take advantage of low, stable residential electricity rates — so low that running an EV over the course of a year can cost less than running an air conditioner.

For many residents in the United States who live in multi-unit housing dwellings (MuDs), such as apartment complexes and condominiums, the majority do not have a power outlet accessible necessary for home charging. Plug-in electric vehicle (PEV) charging stations provide property owners with a unique way to help attract and retain residents and foster a more environmentally sustainable community; however, there are a number of obstacles to installing electric vehicle service equipment (EVSE). Foremost is the variable and often high cost of EVSE installation at an MuD site, and other unique considerations, ranging from parking and electrical service access to billing and legal concerns.

Studies also show that consumers are more likely to buy an electric car when they see stations around town. While fears about range anxiety are largely exception-based — even the cheapest EVs sport enough range to serve nearly all of a driver’s daily needs — the dearth of charging stations is a real concern on longer trips, and it is deterring consumers from going all-electric.

To be clear, it’s not just consumers who want to see more chargers. Charging stations are a boon to automakers that want to sell electric cars as well as to power utilities that want to sell more electricity. Some utilities and automakers are investing huge sums into setting up charging stations, including Volkswagen’s commitment to spend $2 billion on EV charging infrastructure as part of their settlement over the diesel emissions scandal. But by and large, automakers and power companies are not putting a lot of money toward charging infrastructure.

Complicating matters is a web of “charging network providers,” called electric vehicle service providers (EVSPs), companies that operate charging stations under a variety of business models. Many rely on proprietary software and subscriber service models, resulting in different pricing structures and service offerings for subscribers versus non-subscribers.

EVSPs historically tended to operate their respective networks as islands, lacking communication or integration with other networks (or “interoperability”), compelling EV owners to have multiple subscriptions, instead of being able to stop at any charging station for a “plug-and-play” experience. More recently, several EVSP networks have reached an agreement to implement roaming capabilities enabled by interoperability (something akin to the interoperability of financial and banking systems).

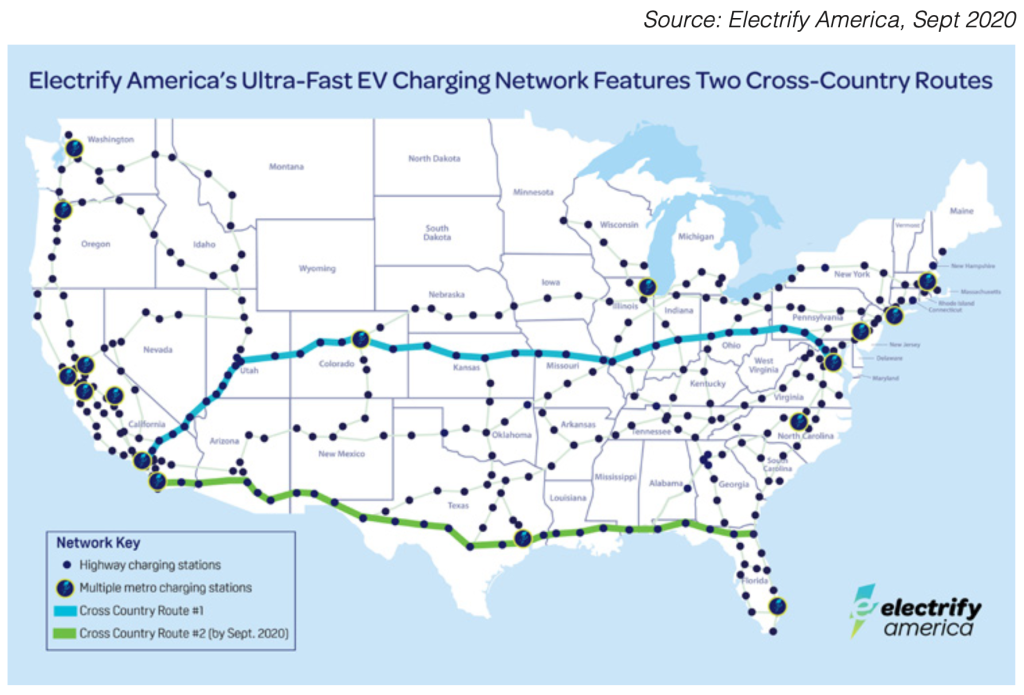

In July 2020, Electrify America completed its first cross-country route, which allows EV drivers to travel from coast to coast using the largest open DC fast-charging network in the U.S. It is the first of two cross-country routes the network will complete this year, and spans 11 states and over 2,700 miles to take drivers from Los Angeles to the nation’s capital Washington D.C.

Putting chargers in their place

Based on IHS Markit’s June 2020 forecast, they expect 4 million annual sales of BEVs and full hybrids in 2030. While electric passenger cars will represent the largest plug-in EV sector in volume, electric fleets such as buses, trucks and vans are expected to grow rapidly in the coming decade, which will drive up demand for depot-based as well as publicly available charging infrastructure significantly.

Electric vehicles used for short commutes can be plugged in at home or the office daily; the worry stems from longer trips. No one wants to experience “range anxiety,” wondering how far they can drive before the next charge and where to find a station before the battery dies. It’s the electric vehicle equivalent of driving a traditional car on the 401 in Los Angeles with the gas gauge needle hovering on empty. What’s more, you need to know which public charging station can accommodate your plug type and knowing which stations are available is also helpful (usually available through an app).

Because fully charging an EV takes anywhere from 45 minutes to several hours, it is a planned and deliberate activity, best-suited to being positioned where other activities can be conducted while the EV battery is charging – shopping, eating at a restaurant, maybe seeing a movie or a hotel stay.

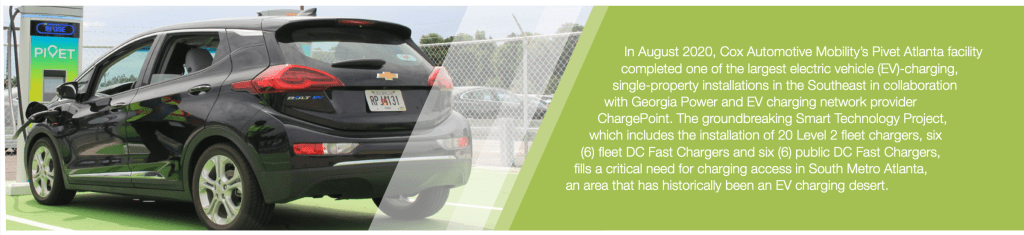

For widespread adoption of EVs, consumers and fleets need a robust network of high-speed charging stations. And right now, it’s a bit of the wild west. Building out the infrastructure — chargers, grid upgrades, software and communication networks — is a massive business opportunity and also a colossal challenge.

Kinds of chargers

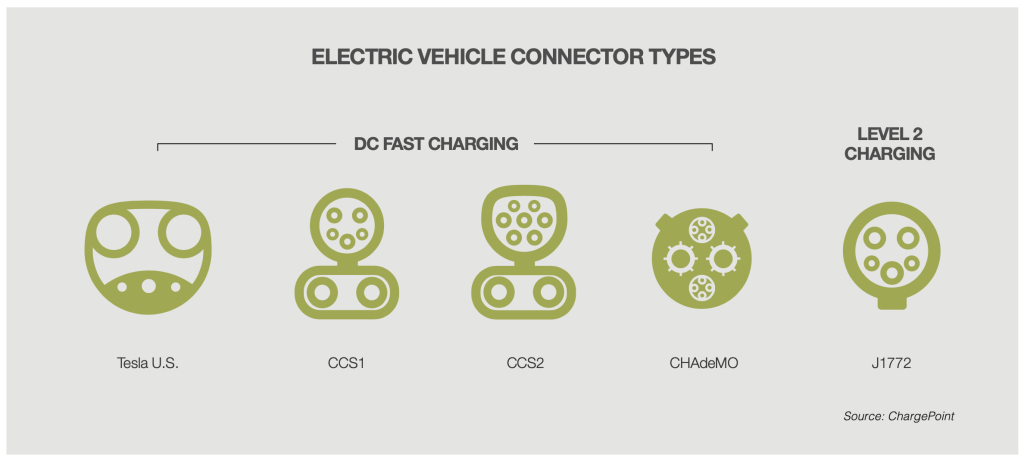

Then there are the levels of charging and incompatible types of DC charging. Some vehicles can only charge at the L1 and L2 level; others can accommodate DC fast charging. There are three different, incompatible types of DC charging: CHAdeMO, SAE CSS and Tesla’s proprietary system. Remember the days of VHS and Beta? It’s not unlike that. The good news is many of the DC fast chargers have plugs that can service both the CHAdeMO (mostly Asian EVs) and CSS (European and American) types. Tesla’s chargers don’t work with non-Tesla vehicles, but can charge the other two with an adapter. Luckily, we are already starting to see some consolidation in U.S. charging as Nissan has moved from CHAdeMO to CCS fast charging for their new Ariya electric crossover.

Most EVs can be plugged into an ordinary 120-volt outlet, but charging is slow — about 40 hours to fully charge a battery. The most popular charger resembles the 240-volt outlet commonly used for larger electrical appliances in the home that require more energy, which provides 10–20 miles of range per hour of charging. A full charge could take about 9 hours. The third choice, a direct current (DC) “fast charging” outlet, which depending on kw capability (some are 50kw, others are 150kw and the newest are 350kw), loads about 150 miles of driving into the car in only about an hour and 20 minutes. The Porsche Taycan accepts 270kw thus can give a faster charge.

As fast charging and battery technologies continue to evolve, experts anticipate charging times to drop even further.

Who pays?

Despite the fact that 2020 is going to slow down the EV industry, the EV is here to stay. And states are being asked to decide whether utility companies should be building charging stations and passing the cost to their customers. But is it fair to force all electricity consumers to pay for a service that only a few, relatively affluent, people will use?

Right now, public charging stations are owned or operated by private charging companies, utilities, local government or a public-private partnership. Some charging companies require a membership to recharge an EV at their stations. Some require a physical membership card; others use log-in technology through a mobile device. Some of the charging companies have partnerships so you can use your account with one to charge at another’s stations.

More utilities are beginning to see EV charging as a business opportunity and a potential way to manage grids. Many are taking a proactive approach to plan for the integration of EVs. Other EV charging companies like Volta are using innovation and advertising to subsidize the cost of EV infrastructure build out.

In California, home to nearly half of all EVs in the U.S., three of the state’s largest utilities are building more than 37,000 charge ports at workplaces, apartment complexes and public locations. Elsewhere, some state utilities are building charging stations for which only customers who use them will foot the bill. Other states have declined to go that route altogether, insisting it’s a private sector issue for a private charging station company or automakers.

Environmental advocacy groups, including the National Resources Defense Council (NRDC) and the Sierra Club, say utilities should be involved in expanding charging stations because it’s the only way to get enough electric vehicle infrastructure built for the U.S. to meet its air quality goals.

“Utilities may not be the most innovative companies in the world but they are good at deploying boring electrical infrastructure that doesn’t break,” says Max Baumhefner of NRDC. “That’s what EV drivers want and it’s sorely lacking at this point.”

One compromise may be for utilities to build the underground infrastructure for a charging station and leave the above-ground installation to a private company, an arrangement called a “make-ready.” States that move forward on policies facilitating EV growth can reduce consumer costs, lower emissions and help their utilities grow. Those that don’t could face a sudden need to build the infrastructure to maintain grid reliability and keep customer costs low. Collaboration among diverse stakeholders — utilities, automakers, infrastructure providers, regulators, building facilities managers — will be key to deploying EV infrastructure more rapidly.

AVERTING UNINTENDED CONSEQUENCES: REPURPOSING AND RECYCLING

Electrifying transportation is one of the biggest keys to solving the climate crisis. In 2018, the total global stock of BEVs and HEVs stood at nearly 6 million. By 2030, the International Energy Agency (IEA) estimates this number will have reached between 130–250 million. Even today, batteries are starting to pile up into a problem, posing another environmental challenge: what to do with them once they’re off the road.

These batteries are valuable and recyclable, but because of technical, economic, regulatory and other factors, less than 5% are recycled today. Many of the batteries that do get recycled undergo a high-temperature melting- and-extraction, or smelting, process similar to ones used in the mining industry. Those operations, which are carried out in large commercial facilities — today mostly in Asia, Europe and Canada — are energy-intensive, at odds with clean transportation. The plants are also costly to build and operate, and require sophisticated equipment to treat harmful emissions generated by the smelting process. And despite the high costs, these plants don’t recover all valuable battery materials.

Advancements are also taking place for cleaner recycling technologies using hydrometallurgical processes and direct cathode recovery with a bevy of start-ups working on solutions in this space.

Prime candidates for a second life

EV lithium-ion batteries are designed for about 14 years of useful life to accommodate the demanding needs of vehicles. For example, at the moment, vehicle manufacturers typically offer an 8–10-year warranty for the battery of their plug-in products — notably higher than the 5-year powertrain warranty for most non-plug-in counterparts. However, these batteries still contain at least 70% of their total capacity and many years of operation after they’re no longer fit for vehicles, making them prime candidates for less- demanding, stationary applications, such as residential and commercial electric power management, power grid stabilization and renewable energy support.

Electric vehicles sold globally through 2020 could provide between 120 and 549 GWh in energy storage capacity by 2028 — representing a significant amount of storage capacity that is both cost-effective and more environmentally friendly than lead- acid batteries. Many companies such as Groupe Renault, Nissan Motor Company and Toyota Motor Corporation are testing the economic and operational viability of different applications.

In February 2019, the Department of Energy launched the Lithium-Ion Battery Recycling Prize. It is a $5.5-million prize competition in three phases designed to spark innovation in developing methods to collect, sort, store, and transport spent and discarded Li-ion batteries in the United States safely and efficiently.

The intent is to find concepts that can capture 90% of all Li-ion batteries nationwide for eventual recycling. Recovering the key materials in these batteries — most importantly, cobalt — could be crucial to keeping the country’s competitive edge in EVs as the demand for these vehicles increases. There is mounting evidence of continued interest and progress. This month, the Federal Consortium for Advanced Batteries (FCAB) was launched to accelerate the development of a robust, secure, domestic industrial base for advanced batteries.

As EV growth takes off over the next decade, battery demand could exact a toll on our environment and communities given its fragile supply chain that has often sparked human rights concerns. The following efforts are needed to support the positive growth of the EV battery industry:

- Advancement of technologies to enable closed-loop systems for EV battery management

- Move toward more standard battery design and charging technologies

- Adoption of standard battery age and health tracking protocols

- Innovation to reduce the friction in battery transport

- Technology-neutral policies to reduce uncertainties for OEMs, second-life battery companies and potential customers

Sustaining a successful second-life market

Although the end-of-life market for lithium-ion batteries already shows some clear patterns, it is still young. There is room for innovation, transparency and standardization to ensure the industry is ready for the massive number of batteries that will become available in a few short years.

The industry needs to move quickly to advance capabilities to extend first life and provide appropriate end-of-life options that protect our communities and the environment. By some projections, more than 500,000 EV batteries will reach end-of-life in the United States by 2025.

A standard and consistent set of data about the battery, including its chemistry, service events, value and health will enable tomorrow’s battery ecosystem. The above information, in combination with a standard battery health score, are great first steps to facilitating appropriate service and end-of-life decisions for the batteries of all electric vehicles, from heavy-duty to micro- mobility and solar.

Conclusion

DRIVING EV GROWTH AND ADOPTION

Cross-industry collaboration

EV advancement is facilitated when industries and organizations unite for a common purpose. Not only will cross-industry collaboration help fuel EV innovation and consumer adoption, there are also significant opportunities for every business and stakeholder that touches EVs to drive growth, from cell manufacturers all the way to recyclers.

As the world of electric vehicles becomes more mainstream, Cox Automotive continues to innovate, build capabilities and extend our collaboration with industry partners. Our goal is to ensure we’re all enabling this new market in support of a closed-loop service ecosystem together.

Key opportunities:

• Battery health and certification capabilities. Evolve existing partnerships with traditional and new EV OEMs by providing battery health and certification services.

• Standardization where possible. From cells to packs, to transport packaging to charging infrastructure – standardization can simplify the EV battery production, ownership and service experience and reduce costs.

• Consumer education. Continuous and up-to-date education on electric vehicles for purchase and in-life support; easy EV shopping experience.