Mobility White Paper

Ready or Not, Mobility Is Transforming the Automotive Industry

Monday July 29, 2019

Article Highlights

- With the growing need for integrated transportation providers, dealers can transform the automotive business themselves – before a third-party gains a toehold to marginalize them to the sidelines. The mainstreaming of new mobility services is an opportunity for dealers more than it is a threat.

- Dealers can stair-step their way into mobility by creating different demand patterns across an existing pool of assets to help build incremental profit while effectively competing with the latest consumer mobility trends. At the same time, dealers will be poised to offer consumers the ultimate experience in transportation flexibility and convenience that will not only help build recurring relationships but also recurring revenue for your dealership.

- The good news: Dealers don’t have to get a line of credit. They don’t have to buy a building. They don’t have to hire a bunch of people. They’ve already have everything they need sitting on their lot.

EMBRACING THE CHANGE: If You Don’t, Someone Else Will

History has proven if a better system comes along and it’s viable, people will use it. It’s entirely plausible that taxicab companies considered that there could be a better way to dispatch their vehicles. But their missed opportunity opened the door for a third-party – Silicon Valley-funded Uber – who revolutionized the ride-hailing industry away from taxicab dominance through simplicity, convenience, and a cutting-edge app.

With the growing need for integrated transportation providers, dealers can transform the automotive business themselves – before a third-party gains a toehold to marginalize them to the sidelines. The mainstreaming of new mobility services is an opportunity for dealers more than it is a threat.

As transportation preferences evolve, the automotive industry is trying to show customers they understand the shift toward on-demand and alternative consumer transportation needs and that they have relevant new products and services to offer. The increasing expansion and adoption of new mobility services are already prompting dealers to rethink their existing business models, as well as explore new ones.

Dealers who’ve been in the business 10, 20, 30 years also understand that the automotive industry is a highly cyclical one, sensitive to economic expansions and downturns. Recession-proofing is all about finding ways to expand your customer base to seize success in any economic scenario. Easing into mobility services is a way to stand out from the competition by being the transportation provider of choice to all consumers – including the growing number of consumers who are relying more and more on alternative transportation methods to get around. It’s about taking care of a customer’s car as well as their total transportation needs.

WHAT IS MOBILITY AS AN AUTOMOTIVE SERVICE?

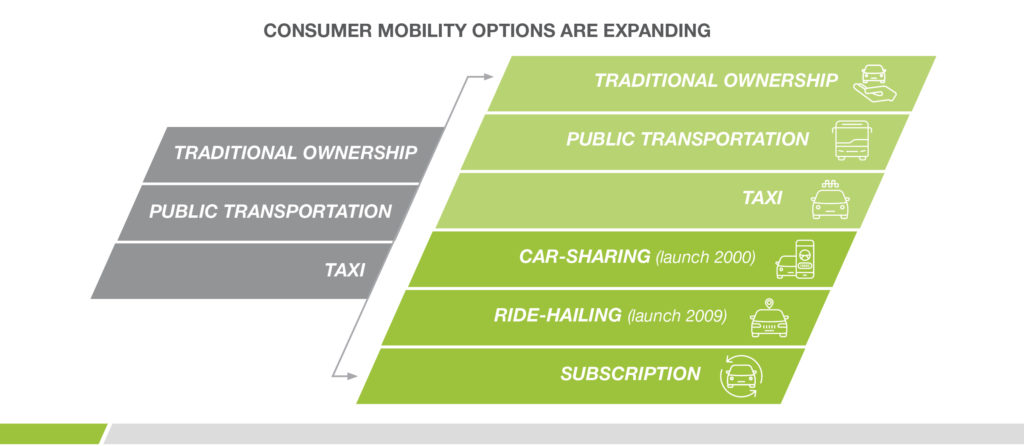

Mobility is a user-centric concept – recognizing that transportation products and services must be responsive to the needs, habits, and preferences of consumers. Emerging trends in mobility technology, such as the rise of ride- hailing, car sharing, and subscription services are changing the way people use, value, and relate to personal vehicles. These new mobility services are contributing to a change in preferences, away from vehicle ownership and towards “vehicle usership,” exploring new business models that do not necessarily involve the user owning a vehicle and having all the inconveniences associated with it.

A wider cultural shift in how people consume is already underway, moving from an ownership model to an access model. Companies like Spotify, an audio-streaming platform, and Rent the Runway, an online service that provides designer dress and accessory rentals, are great examples of how usership services have entered the mainstream. Consumers are now paying to access things temporarily that they used to buy outright.

This shift isn’t just about personal economics or reducing the cost of ownership because consumers are sometimes paying more to access products. It is a redefinition of what it means to “own” and whether or not permanent possession of a product is more valuable than access. In fact, some would argue that access is ownership. Consumer expectations of access are infiltrating the automotive industry and dealerships can seize this opportunity.

The 2018 Cox Automotive Evolution of Mobility Study shows that consumers are reconsidering whether vehicle ownership is even a necessity, with almost 4 in 10 consumers agreeing that while transportation is necessary, owning a vehicle is not – up since 2015. And while a 4-point increase may not seem so significant, it does suggest the early stages of a shift in how consumers view transportation – and more specifically, vehicle ownership. The results indicate that by simply broadening the accessibility of alternative transportation methods such as public transportation, ride- hailing, and car subscription, consumers will likely increase their usage of these alternatives.

Mobility services are part of an incremental change in travel behavior. New mobility solutions indisputably represent a catalyst for innovation in the automotive industry, prompting automakers to innovate by developing mobility solutions of their own and experiment with new business models and revenue sources. This gradual change is also creating opportunities for car dealerships to adapt and maintain their market position as a fully integrated transportation provider. But what does that look like in real life?

It can mean getting more out of your loaner fleet. Or wringing extra value out of cars coming off-lease. Or car subscription offerings ranging from simple to complex – in addition to the traditional selling, leasing, and servicing new and used cars. Savvy dealers are exploring mobility solutions to diversify their revenue sources and meet the growing consumer demand for transportation flexibility and convenience.

The Mobility Wave Is Expanding into Smaller Cities and Towns, Too

The growth of new mobility services is having a profound impact on the way society and individuals think about transportation, on their expectations, and on the way transportation is organized and paid for. This evolution is already underway.

And it’s not just in dense, urban coastal areas. Well-known ride-hailing companies are making inroads in small cities and even rural communities. While ride-hailing services are currently less widespread in rural areas, they represent a big step toward moving America away from being a car-dependent society. Currently, technological infrastructure – namely good cell service – can be one of the biggest challenges in rural areas, but that won’t always be the case. The expansion of cellular and broadband technology may have the most significant impact when it comes to reaching smaller towns. Meantime, rural-friendly ride-hailing alternatives have emerged to fill in the gaps. So if dealers outside the city limits think that mobility services won’t affect their future business, think again.

Automotive Mobility Is Technology-Enabled

Over the last few years, we’ve heard about a digital disruption on the horizon. In reality, it’s already here. We’ve arrived at the intersection of elevated consumer expectations and technological advances. As disruptive companies leverage breakthroughs in cloud, mobile, social, and artificial intelligence technology to deliver personalized, valuable, and immediate experiences, customers have more choices than ever. As a result, they grow to expect this superior experience from any business they engage with. Connected processes, such as seamless hand-offs or contextualized engagements based on earlier interactions, are very important to winning their business. Keep in mind that technology isn’t the final solution; it’s merely an enabler.

PERSONAL CAR OWNERSHIP ISN’T GOING AWAY BUT…

Personally owned vehicles still dominate consumer transportation. And while research shows that consumers will rely significantly less on personally owned vehicles in the future, personal vehicle ownership will still be prevalent.1 No one expects new mobility services to completely replace traditional car ownership.

It’s just that cars are being viewed less as a singular source of personal transportation and more as a piece of the evolving transit ecosystem. It’s more of a more “car-lite” approach, instead of eschewing the personal vehicle completely.

Consumer preferences and technological breakthroughs are adding up to a fundamental shift in individual mobility behavior. In the past, consumers used their cars as “all-purpose” vehicles, no matter if commuting alone to work or taking the whole family to the beach. But now, they want the flexibility to choose the best solution for a specific purpose, on demand, and via their smartphones. Findings from the 2018 Cox Automotive Evolution of Mobility Study reinforce this idea. According to the study, one- third of consumers are open to new transportation methods for getting around rather than owning their own vehicle.

While only 12% of consumers said they plan to reduce the number of vehicles they own in the next five years, 36% said they were interested in owning fewer vehicles.1 As exposure and education to alternative transportation methods grow over time, this could mean that more consumers would consider decreasing the number of vehicles they personally own. After all, individuals are already increasingly using multiple modes of transportation to complete their journeys, and goods and services are increasingly delivered to (rather than fetched by) consumers. As a result, the traditional business model of car sales will be complemented by a range of diverse on-demand mobility solutions that proactively discourage private car use.

THE ROLE OF THE DEALERSHIP: A RETROSPECTIVE AND A FORECAST

In the pre-Internet days, car shoppers would have to visit multiple dealerships to compare prices and get a feel for where the good deals were. Salespeople provided hard-to-find information about the vehicle, features, pricing, and a chance to kick the tires and test drive. Dealer also created access to financing/lending sources at a time when the direct lending business was much more cumbersome. Plus, customers felt they found a friendly resource, familiar faces – a dealership they could trust in their community. This value-add mix was compelling and translated into higher gross margins.

But in this current era of transparency and digital shopping and selling, consumers can compare vehicle prices from every dealership in town without ever getting off the couch. With information readily available online, market power has shifted to car buyers. Amid this environment of shrinking margins and cutthroat competition, today’s dealers have to be laser focused on selling volume, having the right inventory at the right price, and a smooth transition from online to in store. And the culture of convenience, ease, flexibility, and speed means that the customer experience needs to meet – and exceed – these growing expectations.

But with the rise of mobility, what do consumers value most? What are they willing to pay up for? Of course, accessibility and affordability impact consumer consideration of mobility alternatives. But consumers also base their buying decisions on additional factors. People are especially loyal to businesses that consistently provide exceptional value with minimum friction or stress. Give customers what they want and they’ll buy more, be more loyal, and share their experiences with friends. As the future of mobility arrives, dealerships need to reorient their traditional operations to appeal to growing consumer demand for personalization, convenience, flexibility and customization.

PERSONALIZATION IS SPREADING TO THE AUTOMOTIVE INDUSTRY

Personalization is when a business understands your needs as a customer and meets them. They just “get” you.

Data analytics helps product and service providers become more knowledgeable about what consumers want and are adapting their operations to respond accordingly. Depending on the degree of personalization offered, analytical tools are key to matching the right consumer to the right experience.

Personalization requires a re-think about how dealerships operate. The growing demand for personalization presents dealers with myriad opportunities. While cars are typically mass- produced, their sales and utilization can be modified by dealerships to meet customer preferences. Data analytics can help dealers make vehicle and service offerings more cost-effective and efficient, optimizing inventory to provide customers with the right solution at the right time.

New, innovative, and integrated transportation solutions are being brought to market to address consumer challenges. For sustained success, dealers will need to adapt and enhance their offerings as these consumer needs evolve. To do so effectively means being ahead of the game – understanding, before your competitors do, how consumer demand will change and what mix of transportation solutions will help. In the future, dealerships that do not incorporate an element of personalization in their offerings risk losing revenue and customer loyalty.

The Premium of Convenience

In today’s hyper-connected world, convenience is the ultimate currency. Busy consumers are demanding products, places, spaces, and processes to help overcome everyday obstacles to effortless living. Shortcuts, easy-to-use, automated, intelligent and digitized options for every conceivable lifestyle item, incident, and interaction are the order of the day.

Convenience IS a competitive advantage for automotive dealers. Convenience is no longer an alternative; it’s imperative. Customers want convenience and won’t settle for bad, complicated, or cumbersome experiences. Convenience is a universal draw and a motivator for customers to choose your offerings over another. It’s also a salient indicator of how well a dealership has committed to easing the lives of its customers.

Flexibility and Customization

Consumer choice has increased steadily since Henry Ford’s Model T, when buyers could pick any color so long as it was black. Empowered by social networks and digital devices, consumers are increasingly dictating what they want, when and where they want it. They are also willing to pay more to be actively involved in the process.

Customization is an even greater degree of personalization, where consumers have some limited options to modify the product, that is, the vehicle itself. It’s already possible to configure a new vehicle with different choices for colors, seats and accessories. If you want to switch cars relatively often and drive new vehicles, leasing has been the only option until now.

To meet the consumer demand for even greater flexibility, a proliferation of offerings dot the automotive landscape. OEMs have launched car subscription services, where consumers can still switch cars, but more often, depending on the program. On top of that, the cars will be delivered to customer’s location and insurance is included.

There are also third-party car subscription services. Car-sharing services like Zipcar, Turo, and even non-traditional automotive solutions like Steer allow consumers to book cars by the hour or day. They also cover gas, insurance, parking and maintenance.

WHY CAR SUBSCRIPTION IS THE WAY OF THE FUTURE FOR DEALERSHIPS

Subscription Culture Is Already Deeply Entrenched

The business movement toward a subscription-based model has firmly entered the mainstream, spurred by successful outfits like Netflix, Spotify, Costco, and Amazon. Subscription revenue is growing because companies have a more intimate understanding of their customers’ behavior, wants, and needs. A subscription model is a fundamental transformation in the nature of customer engagement. It changes the focus from pushing products to customers to servicing customer needs in an ongoing, dynamic relationship. Subscription-based companies can listen, engage, and continually service their customers’ expanding interests. They can also develop their products iteratively, providing ever-growing value to customers.

As a result, consumers today are less willing to pay larger amounts for products or services upfront. Instead, they now prefer to use a car or bike for a day, rather than committing to the full cost of owning one forever, or at least for its useful life. And consumers can now access goods from groceries, to luxury items like purses and gowns, to commodities like razors, to meal delivery kits – all for monthly fees. The subscription business model has infiltrated industry after industry from ecommerce to media to retail to transportation.

Subscription services establish a continual, positive feedback loop between a company and customers. Providers set and then meet customer expectations, establishing a recurring revenue stream. Consumers receive the ease of access, a fixed rate, and personalization inherent with subscription services. So customer loyalty is built right in, which keeps them subscribed.

Car Subscription Is Much More than Multi-Vehicle Programs

Forget everything you’ve heard about car subscriptions. You know, that it’s only for really rich people rotating between high-end cars and could never work for the mass market. Wrong.

Subscription is merely an asset or a class of assets with business rules and a price point. It can include a new car, cars coming off-lease, or concierge services. Subscription services can accommodate walk-ins. Or upselling, cross- selling, or adding accessories.

The dealership of the future will be an integrated transportation provider. That means instead of only being able to sell or lease a new or used car, subscription empowers dealers to sell more to those very same customers as well as reach a whole new customer base. A traditional car buyer can also have a subscription for other services; so can a lessee. A subscriber can also become a traditional vehicle owner or lessee. For example, a vehicle in the loaner pool can be a loaner car or used as a paid extended test drive or an on-demand rental. Multiple demand patterns across the same vehicle means potentially more dealer profit.

Subscription creates levers to help dealers manage their business in a different way. It doesn’t have to be all-or-nothing. And there’s no need to start with the most difficult and the most challenging proposition: multi-vehicle subscription services that allow consumers to switch in and out of several vehicles on demand.

DIPPING YOUR TOE INTO MOBILITY SERVICES INSTEAD OF DIVING HEADFIRST INTO THE DEEP END

Dealers recognize that change is coming, but don’t feel equipped to offer consumers the mobility services they seek. The good news is that Rome wasn’t built in a day and neither should your mobility business.

Let’s face it, introducing new technology and processes at your store is hard. You can’t just “turn it on” and reap the benefits. It takes patience and commitment. In fact, the implementation process of standing up a new profit center is so crucial to your long-term success that it’s advisable to start slowly. Certainly, there are dealers who go with an “all-in” approach with a multi-vehicle subscription offering, but there are better ways to dip your toe in the water and build a foundation for your mobility evolution.

More good news: You don’t have to get a line of credit. You don’t have to buy a building. You don’t have to hire a bunch of people. You already have everything you need sitting on your lot.

You can stair-step your way into mobility by creating different demand patterns across your existing pool of assets to help build incremental profit while effectively competing with the latest consumer mobility trends. At the same time, you’ll be poised to offer consumers the ultimate experience in transportation flexibility and convenience that will not only help build recurring relationships but also recurring revenue for your dealership.

After all, many consumers want to buy or lease a new or used car just like they always have, whereas some want to ditch cars completely to go with a subscription-type model. Others want to use a combination of both or something else altogether. This growing shift in consumer preferences simply means that different people want to access transportation in different ways. Uber, Lyft, Fair, Hertz My Car, Mercedes-Benz Collection, Porsche Passport, and others are already alternatives to traditional dealerships, so there’s more competition for your customers. That’s why it’s important to step up your game, too.

HERE’S HOW TO EASE YOUR DEALERSHIP INTO THE NEW MOBILITY SERVICES:

Telematics in Loaner Fleets – Putting telematics devices in loaner or other fleet vehicles is a simple way to get started and to create value. Dealers gain insights about that car that they can use to their benefit.

Telematics help fleet providers track location, mileage, fuel consumption, and other data. This valuable information can indicate the right time to cycle the car out of fleet for the best possible wholesale or retail price. It also provides alerts for when the vehicle ventures outside a geo-fenced area for a security check on your asset.

Fuel costs are also a large portion of a loaner fleet’s spend. Telematics allow providers to charge more accurately for fuel, even when the interior gas gauge hasn’t budged much. Monitoring vehicle health is another way telematics helps fleets save on fuel use, with real-time monitoring of oil life, tire pressure, and engine hours. It ensures proactive fleet maintenance to avoid more serious and costly repairs.

Telematics can also provide rich consumer data that can be useful for long-term business planning. Mobility success requires automotive players to anticipate market trends sooner and to explore new business models as well as their economical and consumer viability. In order to do that, they need to proactively analyze consumer preferences, aided by telematics. These tracking tools can enable a sophisticated level of scenario planning and agility to identify and scale new, attractive business opportunities.

Implement Technology-Enabled Service Pickup & Delivery – Customers are motivated by a service experience that is convenient and stress-free. Dealers that offer service mobility concepts – like valet service – overcome the hurdle of distance, which can be a reason

customers don’t return to the dealership of purchase for service.1

Service pickup and delivery can generate customer-pay and OEM-pay revenue to the dealership’s service department and helps increase the utilization of their service lanes, creating more high margin repair orders. It can also ensure that service customers who can’t make it to dealership on Friday aren’t racking up weekend miles on the loaner. Plus those now weekend-idle loaners can be used up to generate other kinds of revenue.

Offer Paid Extended Test Drives – Some customers want an experience that’s more than just getting in a car with a salesperson and driving around the corner. They could be willing to pay to have longer, short-term access to that vehicle, to use it in their real life, going through carpool or to the mountains. It’s a way to generate dealership revenue, create value, listen to the customer, learn about them through that experience, and use those insights to sell them a car. It’s a great opportunity to build trust and differentiate your business from the competition.

Offer Vehicle-On-Demand – This offering is nothing like the national rental car companies we’re all familiar with; it’s more of a loyalty- based program. Consider your car customer who needs extra seating and luggage space for a family vacation. Vehicle-On-Demand allows current customers who need transportation on a very temporary basis to pay-as-they-go for access to different vehicles. Dealers can marry each purchase with access to specific vehicles, such as an SUV or a truck. For added convenience, vehicles can be delivered, with the rental agreement being executed at the customer’s location.

Offer Single VIN Subscription – Single VIN Subscription allows dealers to monetize excess used-vehicle inventory to serve as a “used lease” or to supply vehicles for people in the “gig economy,” like Lyft drivers or delivery drivers for Amazon or Instacart. Now there’s no need for dealers to sell cars that come out of the loaner pool underwater for a loss. They can place it in a single VIN subscription for a few months then wait for the depreciation to catch up to exit out of that vehicle when the time is right. It’s ideal for customers who are in the area temporarily like travel doctors/nurses, academics, ex-pats, consultants, snow birds – those who just need a car for say, six months, and are not interested in the commitment to buying or leasing. Single VIN subscriptions can also fill the gap between leases or custom orders.

Offer Multi-Vehicle Subscription – This is the business model getting all the buzz in the media right now. It’s the ultimate driving product that allows customers to flip between vehicles by using a special smartphone app to manage the subscription as needs change. The current programs are dominated by OEMs, often with geographic locations limited to a handful of major metropolises. There are also third-party startups, not connected with automakers, that offer subscriptions for mostly used or specialty vehicles and vary more widely in pricing and offerings.

Stair-Stepping into Mobility Services with Clutch Technologies

Mobility decouples the cons of car ownership from the pros, putting dealers in the asset risk management business and the customer management retention business as an integrated transportation services provider. This transformation is a significant opportunity for dealers to streamline operations and unlock capital from redundant infrastructure, while taking on a wider service portfolio that contributes to better margins. The focus shifts from the customer experience of driving a vehicle to experiencing the dealership brand. This integrated aftersales value proposition can create more frequent, repeat customers.

Part of the challenge is striking the right balance between hardware, software, and the emerging auto ecosystem. One key to long-term success is leveraging a strong strategic partner whose strengths complement a dealership’s core business.

Cox Automotive’s Mobility brand, Clutch Technologies, has a customizable platform to support dealers in taking the right mobility steps for their business and location, with the opportunity to expand or pivot when the time is right. Clutch Technologies has the unmatched expertise to manage all aspects of operations, including data analytics, customer engagement, and fleet utilization. So dealers never have to go it alone.

Sources:

1) 2018 Cox Automotive Evolution of Mobility Study