Data Point

A Segment is (Re)Born

Thursday June 3, 2021

Article Highlights

- Only 31% of consumers are even aware that compact trucks will be launching this year and only about 20% may consider one in the future, according to a recent Cox Automotive snapshot study.

- Cargo space is the top factor – by a wide margin – for consumers who would consider a compact truck over a more traditional SUV, followed by fuel efficiency and price.

- Nearly a third of consumers would not consider a compact truck over an SUV for any reason.

Update – As speculated in the April 14 article on the rebirth of the compact truck segment, Ford confirmed today that it is adding an all-new compact pickup called Maverick to its Built Ford Tough lineup. The company will debut the 2022 Ford Maverick on its new U.S. TikTok channel on Tuesday, June 8.

Prior to the reveal of the Hyundai Santa Cruz and Ford Maverick, Cox Automotive conducted a snapshot study to explore the appeal and awareness of compact pickup trucks. The Maverick garnered the highest appeal rating among the competitive set, followed by the Santa Cruz.

Since its announcement of the 2022 Santa Cruz in April, Hyundai has shared some additional details on its first pickup truck, which is also in the compact category. Though pricing has not been announced, the Santa Cruz will have four trim levels, six exterior colors, and a choice of two engines

Original article published on April 14, 2021

With Hyundai revealing a much-anticipated Santa Cruz compact pickup tomorrow and rumors of a small Ford Maverick all but confirmed, the obvious question is: Can the rebirth of the compact pickup truck take the industry by storm? The segment’s comeback is far from assured.

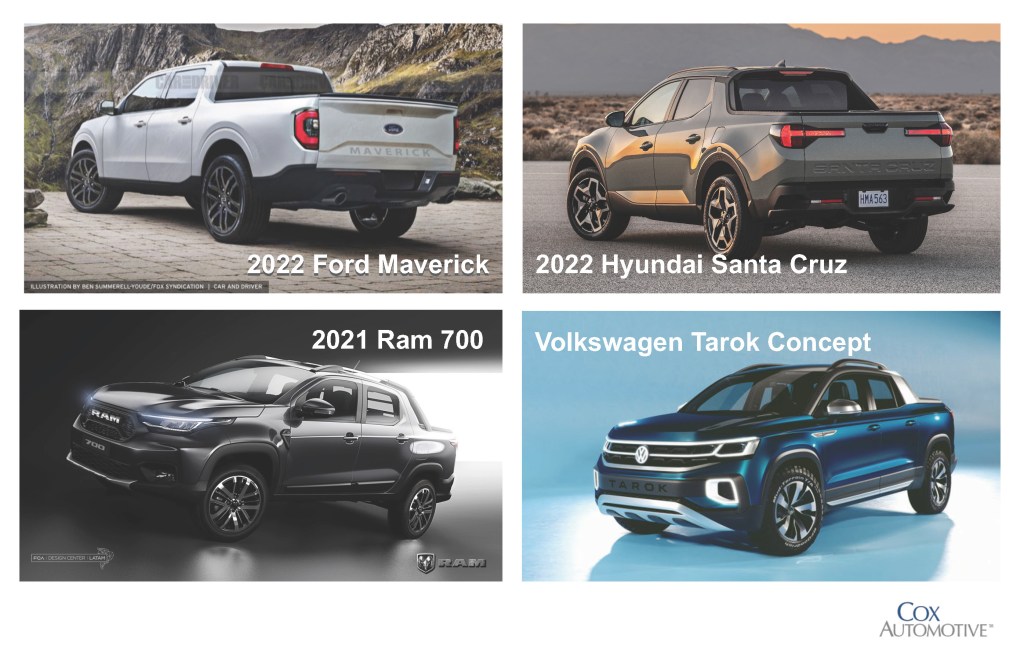

Recently, Cox Automotive conducted a snapshot study to explore the appeal and awareness of compact pickup trucks. The study surveyed 270 consumers in mid to late March to gauge perceptions of the compact pickup segment and appeal of specific models, including two scheduled to launch this year in the U.S. – the Ford Maverick and Hyundai Santa Cruz – along with the Ram 700 available now in Latin America and the Volkswagen Tarok concept.

“The key challenge for the industry and dealers will be to heighten awareness of this re-emerging segment,” notes Vanessa Ton, senior industry intelligence manager, at Cox Automotive. Only 31% of consumers are even aware that compact trucks will be launching this year and only about 20% may consider one in the future.

The compact truck segment has its work cut out as it will be competing against top volume segments including SUVs and larger pickups. According to the research, cargo space is the top factor – by a wide margin – for consumers who would consider a compact truck over a more traditional SUV, followed by fuel efficiency and price. Nearly a third of consumers would not consider a compact truck over an SUV for any reason, indicating the compact truck is likely a niche segment with a unique selling proposition.

| Reasons for Considering Purchasing a Compact Pickup Truck Over SUV | Percentage of Respondents |

| Cargo space | 40% |

| Fuel efficiency | 29% |

| Price | 27% |

| The size of the vehicle | 24% |

| Performance | 21% |

| Handling | 19% |

| Fun to drive | 16% |

| Design/Styling | 15% |

| Easy to find parking | 12% |

| Ride height | 11% |

| Easy ingress/egress | 9% |

| Projects a cooler image | 6% |

| Nothing would make me purchase over an SUV | 31% |

In terms of competing with larger midsize and full-size pickups, consumers cited fuel efficiency and price as the top factors for choosing a compact truck. One in four respondents said they would not consider a smaller pickup over a larger one for any reason.

Ford’s traditional truck design will likely provide a competitive edge in the market. When respondents were shown only images of the new trucks, with make and model hidden, the Ford Maverick garnered the highest appeal rating among the competitive set, followed by the Hyundai Santa Cruz. The VW Tarok and Ram 700 ranked 3rd and 4th, respectively.

| Appeal of Vehicle (Extremely/Very Appealing)* | Percentage of Respondents |

| Ford Maverick | 51% |

| Hyundai Santa Cruz | 42% |

| VW Tarok | 39% |

| Ram 700 | 33% |

If the compact pickup segment does indeed get traction, it is likely to spur other OEMs to get into the game. When asked, consumers indicated they would like to see the top 3 Japanese brands – Honda, Toyota and Nissan – enter the segment, as well as the other domestic truck leader, Chevy.

The pickup truck market boomed last year with purchase consideration surpassing cars for the first time. Trucks are top of mind with American shoppers, and the Ford Maverick and Hyundai Santa Cruz may find their footing in this market with the right volume projections, pricing and regional allocation. Maverick is rumored to have sales targets of 100,000 in its first full year, while Santa Cruz plans to start slow with less than 15,000 scheduled for production in 2021. The industry will be watching. Who knows? If everything aligns, maybe a star will be (re)born.