Retail sales were stronger than expected in September. While category performance was mixed, only clothing and home-related categories were down in the month compared to August.

New construction trends were mixed again in September with permits down, starts up, multifamily weak, but single family more stable. Existing home sales declined again in September to the slowest pace since October 2010.

New initial jobless claims are declining in October, but continuing claims are up modestly. The labor market is not as strong as it was a year ago, and claims have increased in 2023, but both initial and continuing claims are lower now than before the pandemic started.

Auto Outperformed Stronger-Than-Expected September Retail Sales

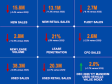

The initial retail sales report for September showed stronger-than-expected consumer spending growth.

The 0.7% increase was more than the 0.6% increase expected, and the August increase was upwardly revised to 0.8% from the 0.6% gain first reported. The auto sector outperformed the rest of the retail market as sales excluding motor vehicles and parts increased 0.6%, while sales of motor vehicles and parts increased 1.0%.

Category-level performance was mixed in September. Miscellaneous stores (3.0%) and non-store retailers (1.1%) had the largest gains. Clothing and clothing accessories stores (-0.8%), furniture, home furnishing, electronics, and appliances stores (-0.4%), and building material and garden equipment stores (-0.2%) were the only major categories that saw declines in September.

Retail sales were up 3.8% from a year ago on a nominal basis, which was up from 2.9% in August and the strongest year-over-year performance since February.

Compared to last year, five of 12 major categories were down, with furniture, home furnishing, electronics, and appliance stores (-4.4%) and building material and garden equipment (-4.0%) down the most. Motor vehicles and parts were up 6.2% year-over-year, while food services and drinking places (+9.2%) was the category up the most. Adjusted for inflation using the CPI, retail sales increased 0.3% for the month and were up 0.1% from a year ago.

Residential Construction Starts Were Mixed in September

Residential construction starts increased about as expected in September, but downward revisions were made to August. Permits declined, but the decline was less than expected.

The mixed story extended to the type of home being constructed as the weakness in permits was all in multifamily, and the overall permitting trend suggests that starts will at least remain stable if not improve gradually in future months.

The seasonally adjusted annualized rate of starts increased by 7.0% when 7.8% was expected, and August’s decline of 11.3% initially reported was revised to a larger decline of 12.5%. Permits declined 4.4% when a 5.7% decline had been expected. The increase in starts was in both single-family and multifamily, but multifamily increased by 18% while single-family increased by only 3%.

After the September increase, total starts were down 7.2% from a year ago but were up 4.5% compared to September 2019. Permits were up by 7% compared to 2019 in single-family but down by 13% in multifamily. The permit trends reflected stable potential performance ahead in total but with more of a shift to single family, as single-family increased 2% but multi-family declined 14%.

Permits were down 7.2% from a year ago in total, up 11.6% in single-family, but down 29.7% in multifamily. Permits lead starts, so the permitting pace at 1.473 million units was ahead of the 1.358 million starts pace, which indicates that starts are not likely to decline much in future months.

Existing Home Sales Fell to Slowest Pace Since October 2010

Existing home sales declined again in September, but the decline was less than had been expected. The existing home sales SAAR declined 2.0% to 3.96 million from 4.04 million in August. At the September rate, existing home sales were down 15.4% from a year ago and to the slowest pace since October 2010 following the Great Recession.

Inventory increased 2.7% to 1,130,000 units, which was down 8.1% from a year ago. Inventory keeps moving quickly, as 69% of the homes sold in September were on the market for less than a month, and the typical time on market was 21 days, which was up from 20 days in August and 19 days in September last year. The months’ supply of homes for sale increased to 3.4, which is still roughly half of what is considered normal.

The median sales price declined to $394,300, which was up 2.8% from a year ago. The housing market remains very sensitive to mortgage rates, which have surged to new 23-year highs in recent days. The existing home market is very constrained by supply and will be as long as rates remain high since existing mortgages are much lower than what’s possible now. The limited existing home market creates some opportunity in the new single-family home market when existing homes cannot expand to meet demand needs, but high mortgage rates limit just how much demand homebuilders will see.

Jobless Claims are Lower Now Than Before the Pandemic

Initial jobless claims declined by 13,000 to 198,000 for the week ending October 14. That was 16,000 less than what we saw in 2020 before the pandemic and was the lowest level since January.

Continuing claims increased by 29,000 from a week ago, moving the total up to 1.73 million as of October 7. That level was 161,000 lower than it was prior to the pandemic but the highest level since July.