Data Point

Consumer Snapshot: Electric Pickup Trucks

Friday January 22, 2021

A whopping 2.9 million pickups were sold in the U.S. last year, making up roughly 20% of the entire auto market. While electric vehicles (EV) receive significant consumer and media attention, they remain a very small portion of new-vehicle sales each month. That may well change, though, as a new breed of full-size EV pickups enters the stage.

Cox Automotive is interested in this intersection of pickup trucks and EVs. While EV share is expected to increase in the coming years, consumer adoption rate will dictate just how quickly. Full-size pickups could be the accelerant the market needs. In a recent Cox Automotive Consumer Snapshot study, we asked in-market consumers about their views of the popular, most well-known EV pickup trucks about to enter the market.

Electric Pickup Truck Consideration is Growing

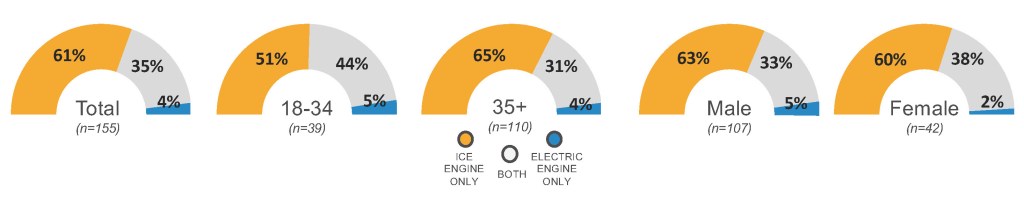

Nearly 2-in-5 consumers in market for a pickup truck in the next 2 years are considering an electric pickup truck. Research shows that younger consumers are more likely to consider an electric pickup truck with 44% of 18-34-year-olds indicating that they are interested in both internal combustion engine (ICE) and EV options.

Half of the consumers in market for an EV pickup truck find the current selection of electric vehicles to be appealing.

“Our research shows new EV pickup trucks are leading more consumers to consider an EV product.” – Vanessa Ton, senior manager, Cox Automotive

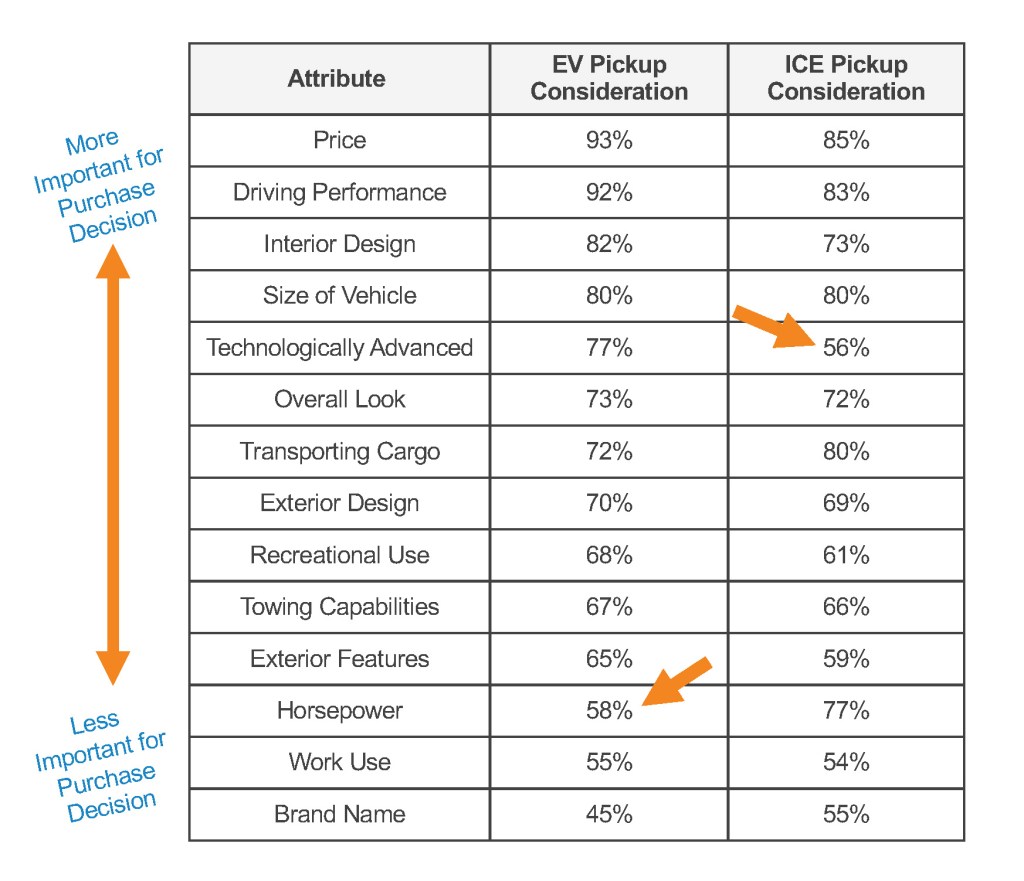

Most Pickup Truck Shoppers Have Similar Priorities

In most cases, attributes that matter to ICE pickup shoppers also matter to consumers considering EV pickup trucks. Price, performance, design, size all matter most; brand name, work use are less important.

Research shows that 77% of ICE shoppers view horsepower as important versus only 58% of electric pickup truck shoppers. Regarding technology, 77% of shoppers interested in electric pickup trucks indicated that the vehicle being technologically advanced was important to them as opposed to only 56% of ICE shoppers.

“Where our consideration groups diverge is how they view horsepower and technology. ICE buyers prioritize horsepower; shoppers interested in EVs care more about technology.” Vanessa Ton, senior manager, Cox Automotive

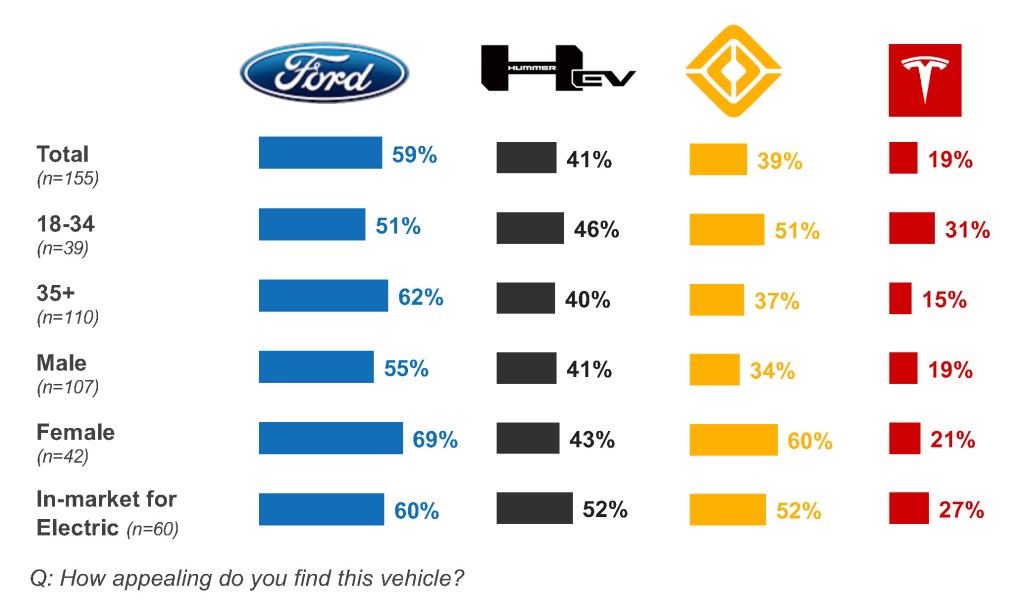

Ford Leads the Pack on Image Based Appeal

When shown images of each vehicle, without brand and model indicators, and without product details, 3-in-5 consumers find the Ford F-150 Electric pickup truck appealing, perhaps indicating familiarity is attractive.

“Tesla and Rivian R1T scored well with younger buyers, and Rivian performed well among female buyers as well.” – Vanessa Ton, senior manager, Cox Automotive

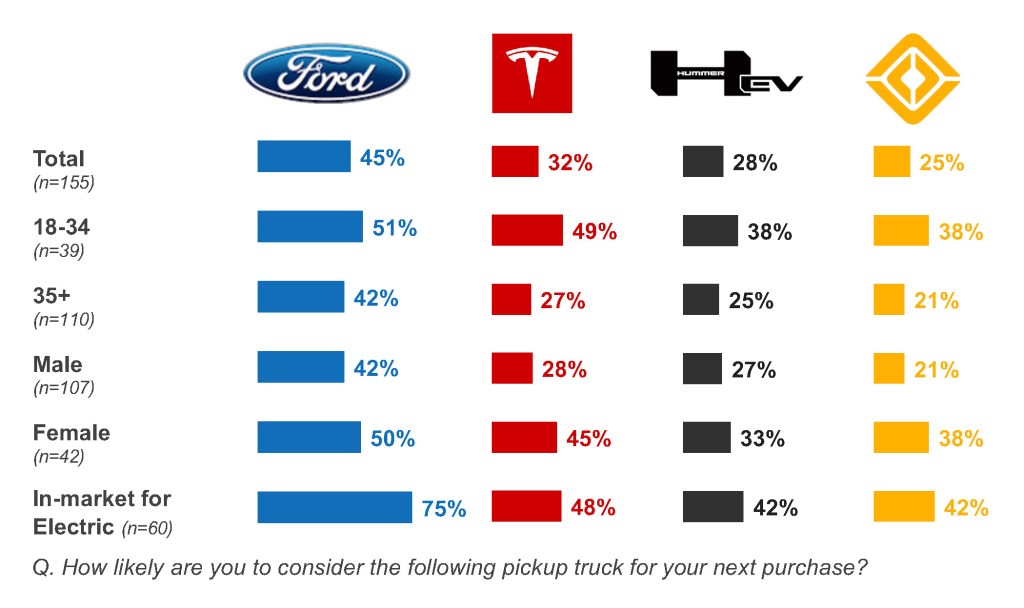

Ford Leads EV Pickup Truck Consideration, Tesla Follows

The Ford F-150 Electric has the highest consideration likelihood, once branding and product attributes are revealed. Three-quarters of those in the market for an electric pickup are likely to consider the Ford F-150 Electric.

Tesla comes in second with 48% of shoppers looking for an electric pickup stating that they would consider Tesla Cybertruck, with young and female shoppers showing the most interest.

“The strength of the Tesla brand helps drive consideration.” – Vanessa Ton, senior manager, Cox Automotive

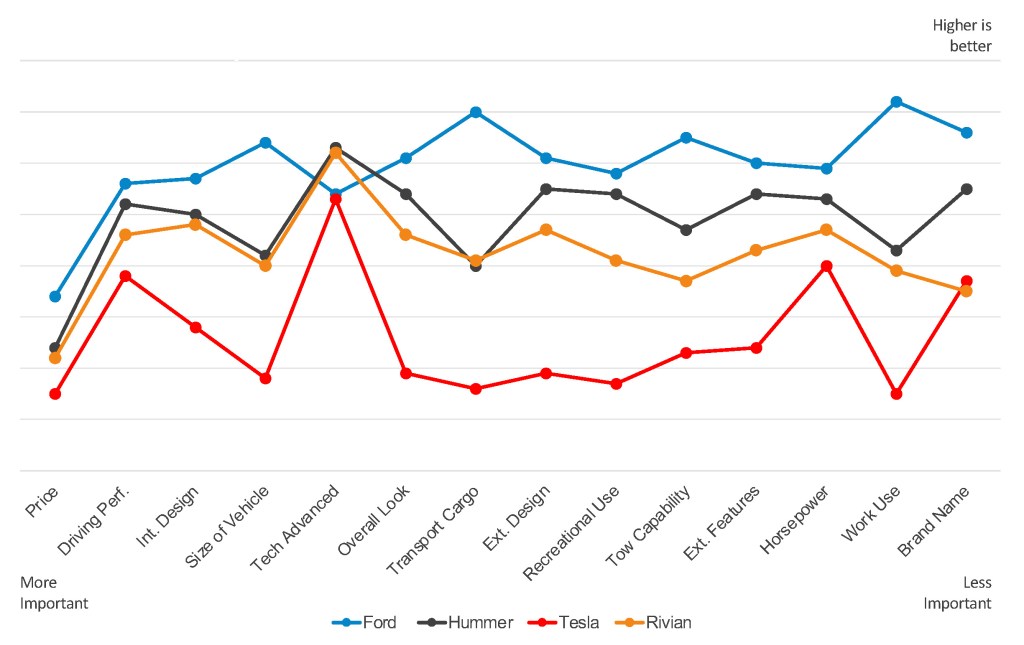

Ford Wins Attribute Race, Tesla and Rivian Lag Behind

Ford’s historic strength in pickup trucks likely drives higher scores in EV pickup consideration. Ford leads in every attribute except tech advanced, where Hummer and Rivian are nearly tied for the lead.

Nothing about the Tesla Cybertruck is traditional, which is likely by design as Tesla has long shunned convention. However, pickup truck shoppers in this study were not overly impressed — ranking Tesla the lowest across the gamut of attributes that mean the most to pickup truck shoppers. Only on the strength of the Telsa name was Cybertruck able to best the Rivian RT1.

Rivian is a relative unknown in the market and faces an uphill challenge in competing with better known brands like Ford, Hummer and Tesla. Rivian has no dealer network yet, no stores, no history. However, the traditional proportions of the RT1 are familiar to shoppers (unlike with Cybertruck), and Rivian’s imagery and communications clearly speak a language that pickup truck buyers understand.

“Tesla’s unique, non-traditional design likely impacts consideration and the vehicle’s comparative attribute performance.” – Vanessa Ton, senior manager, Cox Automotive

The Cox Automotive Consumer Snapshot Electric Pickup Trucks study involved surveying 155 in-market consumers that were shopping for a pickup truck, including 60 in market for an electric (EV) pickup truck. The survey was in field from Nov. 25-Dec. 2, 2020. Results are directional. Note: Cox Automotive is an investor in Rivian. Learn more.