Data Point

Cox Automotive Analysis: Honda Motor Company’s Quarterly U.S. Market Performance

Wednesday February 7, 2024

Article Highlights

- Honda sales rose 32% to 337,511 vehicles.

- Honda boosted incentives by 65% to a still-low average of $1,646 per vehicle.

- Honda’s ATP held steady at $38,188.

Strong U.S. sales in the waning months of 2023 should help lift Honda Motor Co.’s fortunes when it reports quarterly financial results February 8.

In the quarter ended September 30, Honda Motor in Japan posted profits up by a third, prompting it to raise its forecast for the fiscal year that ends March 31. Much of that optimism came from vastly improved production and inventory and healthy U.S. sales.

In the quarter ended December 31, the Japanese automaker’s third fiscal quarter, American Honda had a beefy 32% increase in Acura and Honda brand sales in the quarter. Though the automaker boosted incentives significantly compared to extremely low incentives a year ago, its spending remained well below the industry average and lower than before the pandemic and global computer chip shortage. American Honda’s average transaction price held steady, though it is up significantly from five years ago.

“In 2023, we were finally able to meet the pent-up demand for our products, with both brands rebounding and American Honda finishing the year up over 30%. We projected a strong recovery, and we achieved that,” Mamadou Diallo, American Honda’s senior vice president, told a media roundtable in January.

He added that in 2024, the automaker plans to keep capitalizing on hybrid models – the hybrid CR-V was 2023’s best-selling hybrid – and light trucks. America Honda also launches its first high-volume battery-electric vehicles in 2024. Both brands expect higher annual sales in 2024.

Here are some data points from Cox Automotive on Honda’s quarterly market performance in the U.S., one of its most important markets.

Honda Sales Jump on Improved Inventory

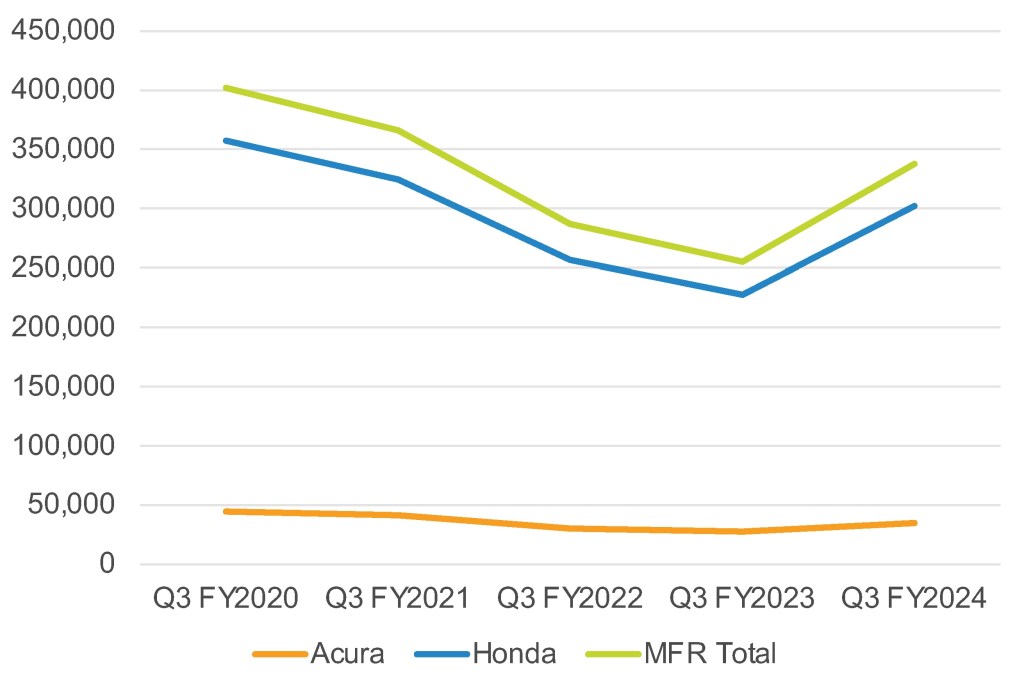

American Honda’s U.S. sales totaled 337,511 vehicles, up 32% from the year-earlier quarter, according to Cox Automotive calculations. Despite the rise, American Honda’s sales in total, as well as each of its brands, have not returned to sales levels of 2020 and earlier. In the same quarter of 2019, American Honda sold more than 400,000 vehicles.

Honda U.S. SALES PERFORMANCE FOR Q3 FISCAL YEAR 2024

Honda brand sales soared by 33% to 302,391 in the quarter. All but one model, the Passport, had sales gains. Its best-selling CR-V was up 67% to just shy of 100,000 units, approaching the sales levels of 2018 and 2019. The Civic had a 42% hike to 53,500 units. Honda’s other volume model, the Accord, had a modest 4% gain to 45,745 units.

The HR-V was up 54%, setting a new quarterly record of 35,172 sales. The Ridgeline also set a quarterly record with sales up 19% to 12,433. Pilot sales edged 9% higher.

Acura sales climbed 27% to 35,120 units. All Acura models had higher sales than a year ago except for its volume-leading MDX, which had a 4% sales decline to 12,680 units. The RDX is closing in on MDX as the best-seller, with sales up 140% to 12,026 vehicles. The Integra had a 4% gain to 7,256, and the TLX was up 34% to 3,158.

Honda’s U.S. Market Share Rose

Honda vastly outperformed the overall market in the quarter. Industry sales were up 8%, while Honda’s were up 32%. That put Honda’s overall market share at 8.65%, up 1.58 percentage points above the year-earlier quarter. Still, Honda’s share has not returned to pre-pandemic, pre-chip shortage levels, when its share was above 9% as time

The individual brands have improved their share but have not returned to earlier levels. Honda brand’s market share hit 7.75%, up 1.45 percentage points from the year before. Acura’s market share edged up to 0.90%.

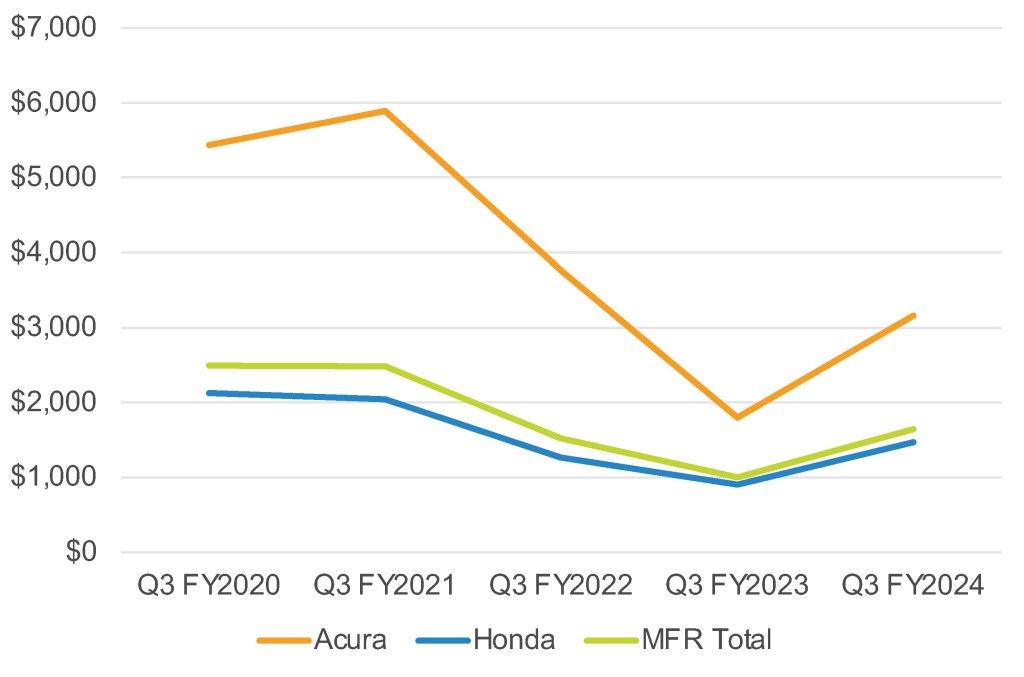

Honda Boosted Incentives, But They Remain Low

Honda boosted incentives to an average of $1,646 per vehicle, up 65% from historical lows of a year ago when inventory was tight, according to Cox Automotive calculations. As has long been the tradition, Honda spent far less than the industry average of $2,511 per vehicle on incentives.

Honda U.S. INCENTIVE SPENDING FOR Q3 FISCAL YEAR 2024

Acura had the biggest hike, with incentives up 75% to an average of $3,156. That is still well below the $5,000-plus average incentives before the pandemic and chip shortage.

Honda brand incentives got a 63% lift to an average of $1,471, still well below the $1,800 to $2,100 average per vehicle before the pandemic, and well below the industry average.

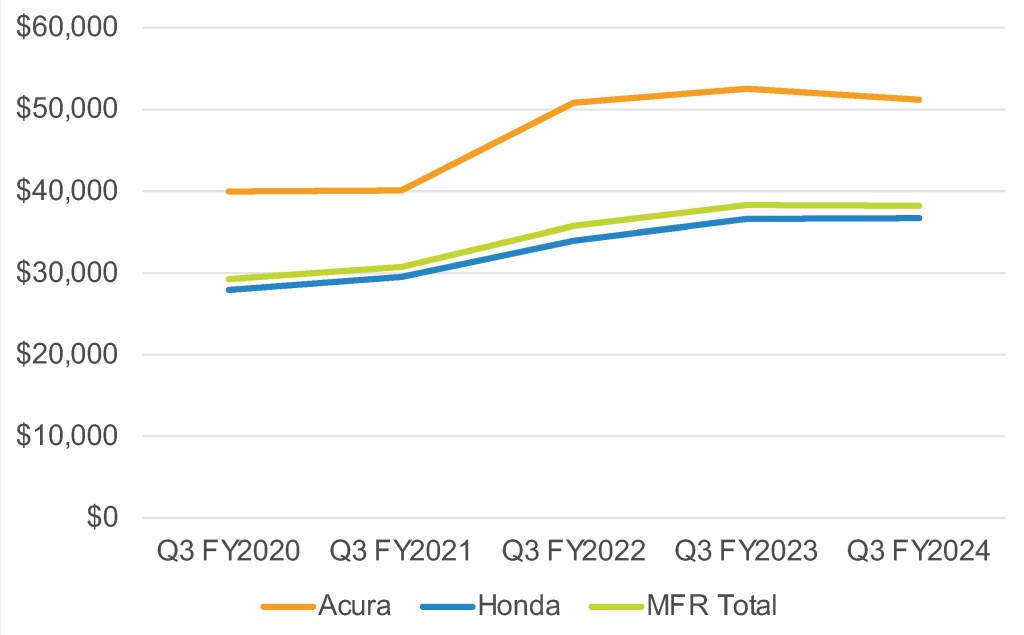

Honda’s Average Transaction Price Held Steady

American Honda’s overall average transaction price (ATP) was roughly flat with a year ago at $38,1888, according to Cox Automotive calculations. Still, in the same quarter in 2019, ATPs were below $30,000.

Honda U.S. AVERAGE TRANSACTION PRICE FOR Q3 FISCAL YEAR 2024

Acura’s ATP fell 3% to $51,146. Still, for the past three years, Acura’s ATP was above $50,000 when it ranged between $40,000 and $42,000 before the pandemic. The Integra, Acura’s least expensive model, had a 6% gain in ATP to $39,200. The TLX had a 3% rise to $49,978. Acura’s most expensive model, the MDX, had a 2% dip in ATP to $60,306. Still, that is $11,000 more than in the same quarter of 2018.

Honda brand’s ATP held steady at $36,683, still well higher than the $27,940 in the same quarter in 2020. The ATPs for most of Honda’s models were roughly flat. The Pilot had the biggest jump, up 10% to $49,432, making it Honda’s most expensive model. The top-selling CR-V had a 4% gain to $37,962. Today’s CR-V has an ATP of about $10,000 more than in 2018. The Civic and HR-V are Honda’s least expensive models at just shy of $30,000.