Data Point

Cox Automotive Analysis: Stellantis’ Q4 2022 Market Performance

Tuesday February 21, 2023

Article Highlights

- Stellantis posted a 15.5% decline in U.S. sales in Q4 for a 9.6% market share.

- Stellantis slashed incentive spending by 31% to an average of $1,658 per vehicle.

- Stellantis’ average transaction price increased by 5.1% to $55,281.

Stellantis has steered skillfully through the global computer chip shortage, maintaining the most abundant vehicle inventory in the U.S. auto industry for the past year while other automakers struggled with skimpy supply. Still, Stellantis posted a decline in U.S. sales in the fourth quarter while also cutting incentives. Its average transaction price rose to over $55,000, thanks mostly to a pair of pricey new Jeeps and strong Dodge pricing increases.

Europe and the U.S. are Stellantis’ most important markets. Here are some data points from Cox Automotive on Stellantis’ U.S. Q4 market performance.

Stellantis’ Q4 Sales Pulled Down by Jeep

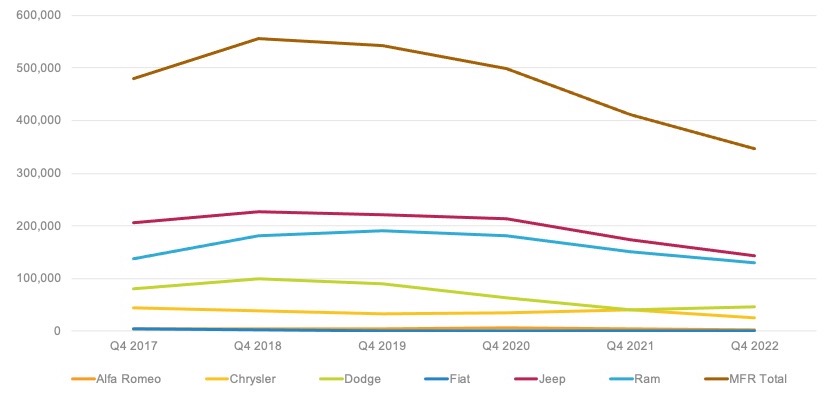

Stellantis Q4 sales totaled 347,649 vehicles, down 15.5% from Q4 2021. That compares with a high of 542,519 sales in pre-pandemic Q4 2019.

STELLANTIS U.S. SALES PERFORMANCE FOR Q4 2022

Jeep, Stellantis’ highest-volume brand, saw a significant sales decline of 18% to 143,317 vehicles. That was its lowest sales for the quarter in at least six years. Pre-pandemic, Jeep sold over 200,000 in the quarter.

Almost all Jeep models saw declines except for the Compass and Wagoneer, which saw year-over-year sales increases of 9% and 12%, respectively. The biggest drop was the Grand Cherokee at a 32% decline or 50,800 units, followed closely by the Renegade with a decline of 27%. The newer Grand Wagoneer and Wrangler were both down 14% year over year in Q4.

Ram sales dropped by 14.5% to 129,873 units, the lowest sales for the quarter in six years. The volume-leading Ram 1500 pickup truck saw a decline of 22% to 105,255 units. Promaster van sales increased 33% to 18,905.

Dodge sales jumped by 15% to 46,278. All three of the brand’s models gained in the quarter: Charger was up 3% to 17,414 cars; Durango sales climbed 22% to 15,890 SUVs, and Challenger rose 28% to 12,966 units. The Charger and Challenger are in their final year in their current form, and Dodge is selling special editions to commemorate their final run.

The Chrysler brand, with only two models, had the steepest decline of all major Stellantis brands, with a 39% drop to 25,052 units, driven by the 42% drop in Pacifica minivan sales. Sales of the 300 sedan, popular with fleets, were up 15% to 2,300 units.

Alfa Romeo sales fell 25% to 3,031 vehicles. Fiat had quarterly sales of a mere 118 units of the 500X, the only model sold in the U.S., down 56% from a year ago.

With the sales drop, the total Stellantis market share was 9.6%, the first time the automaker’s share dropped below 11% for the quarter in the past several years. Market share slipped for Stellantis’ highest-volume brands. Jeep share was 4%, down more than a full percentage point from a year ago. Ram dipped one percentage point to 3.6% and Chrysler was down 0.5 points to 0.7%.

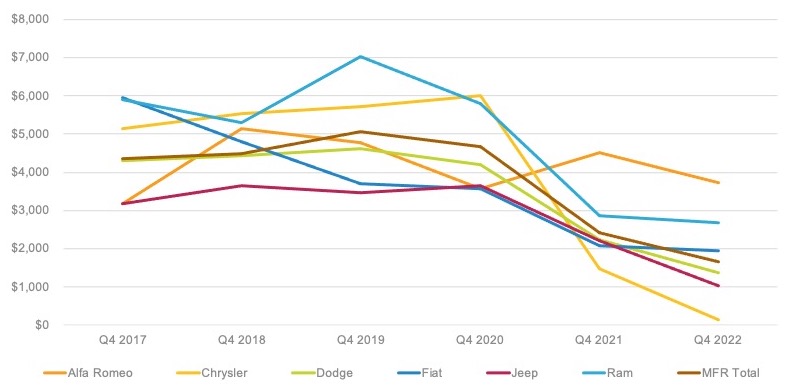

Incentive Spending Slashed to Lowest Level in Six Years

Stellantis slashed incentive spending by 31% in Q4 2022 compared to the prior year. Its average incentive was $1,658 per vehicle, according to Cox Automotive calculations. That’s the lowest in six years by a wide margin. In the pre-pandemic Q4 2019, Stellantis spent over $5,000 per vehicle on incentives.

STELLANTIS U.S. INCENTIVES FOR Q4 2022

Stellantis significantly cut incentives for all brands. Chrysler incentives were down over 90% to just $144, marking the first time incentives for the brand were under $1,000 for the quarter. Incentives for Jeep and Ram were down 53% and 38%, respectively. Alfa Romeo incentives were down 18%, and the Ram brand saw the lowest decline with a drop of 6%.

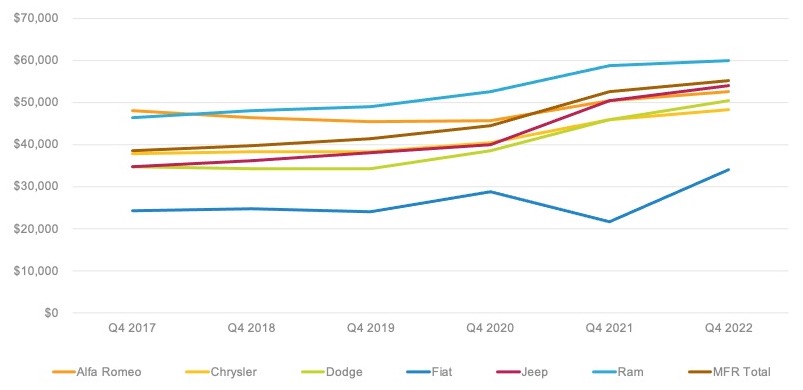

Average Transaction Prices Jump to Over $55,000

Stellantis’ average transaction price (ATP) jumped 5% to $55,281, according to Cox Automotive calculations. By comparison, Stellantis’ ATP was $38,458 in Q4 2017.

STELLANTIS U.S. AVERAGE TRANSACTION PRICES FOR Q4 2022

Ram generates the highest ATPs, up 2% to $59,903. The Ram 1500 got a 4% boost to $63,363. Promaster gained 16% to $48,309.

Jeep’s ATP jumped 7% to $53,968 on the strength of the new higher-priced Wagoneer, with its ATP of $74,461, and even pricier Grand Wagoneer at $95,152. Grand Cherokee had a nearly 12% gain in ATP to $57,262. ATPs for Wrangler and Gladiator also rose.

All three Dodge models had healthy increases, putting the brand’s ATP at $50,369, up 9.5% from a year ago. The Charger had the biggest increase, up 13% to $47,118. The Durango had the highest ATP for Dodge at $53,431, up 4%.

The Chrysler Pacifica had a 6% increase in its ATP, pushing it to $48,976.

Rebecca Rydzewski is a research manager for economic and industry insights for Cox Automotive.