Data Point

CPO Sales Beat Record 2019 Level in First Half

Wednesday July 14, 2021

Article Highlights

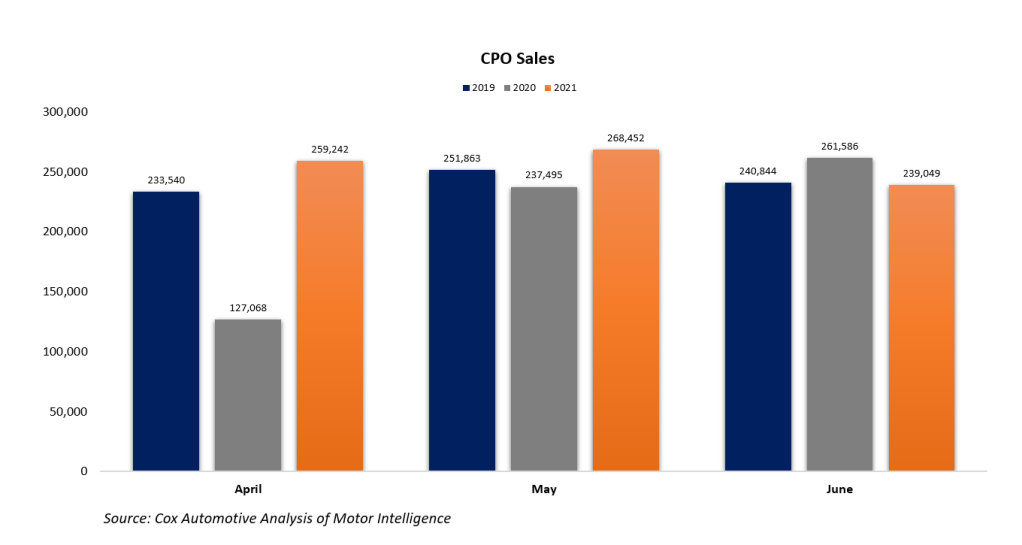

- June certified pre-owned sales were down 9% year over year and down 11% month over month

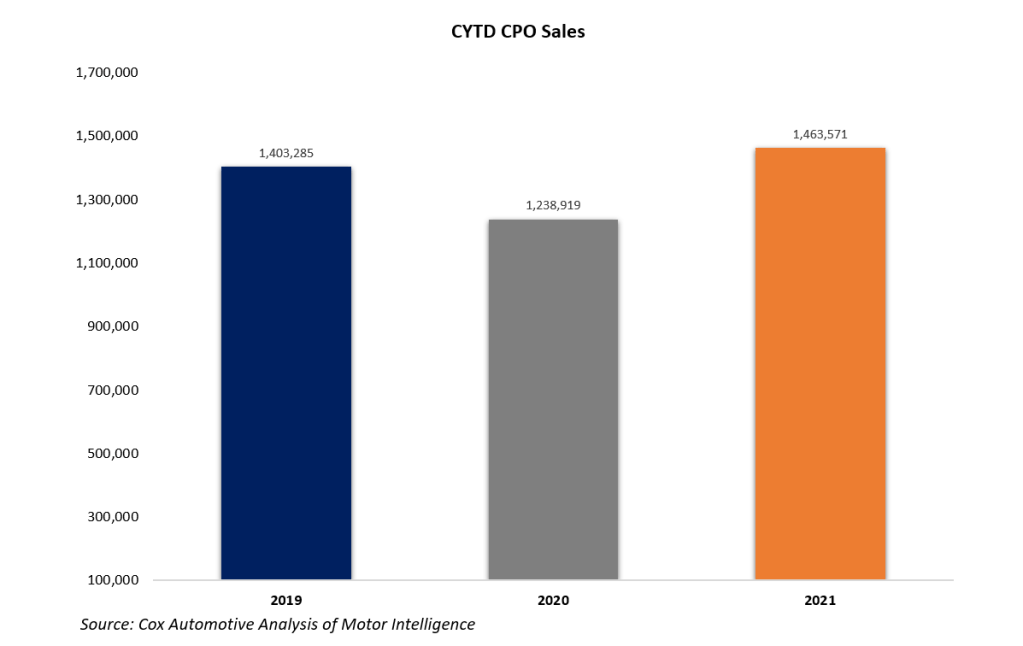

- With 1,463,571 units sold through the first half of 2021, CPO sales are up 18% compared to the first half of 2020 and up 4.3% compared to the same time in 2019.

- Credit conditions remain favorable, as it is now easier to get a CPO loan than it was a year ago, and lower average interest rates on CPO loans are helping to mute the effect of higher prices.

Certified pre-owned (CPO) sales had a frenzied spring, just like the broader used-vehicle retail market. However, like the market, the frenzy cooled down as spring ended and transitioned into summer. In June, 239,049 CPO units were sold. June CPO sales were down 9% year over year and down 11% month over month as waning stimulus programs slowed consumer spending growth overall and record vehicle prices took effect. The comparison to 2020 was also harsh as June last year was the beginning of the surge in retail used sales as the country reopened following the lockdowns. Much more relevant is the June comparison to 2019, as CPO sales were only down 0.7% compared to that more normal period.

With 1,463,571 units sold through the first half of 2021, CPO sales are up 18% compared to the first half of 2020 and up 4.3% compared to the same time in 2019 when 1,403,285 units were sold. 2019 set an all-time record for CPO sales at 2.80 million units. For the first half of 2021, the CPO market is up more than 220,000 units above 2020 and 60,000 units above the 2019 level.

According to Cox Automotive estimates, total used vehicle sales were down 11.1% year over year in June. We estimate the June used seasonally adjusted annual rate (SAAR) to be 39.0 million, down from 43.6 million last June and down compared to May’s 40.0 million SAAR. The June used retail SAAR estimate is 21.3 million, down from 23.1 million last year and down month over month from May’s 21.9 retail SAAR.

Record-high prices are likely to impact demand this summer, but as used vehicle prices begin to reflect depreciation again, consumers will be more encouraged to buy. In the new market, record low inventory, record-high prices, and record low incentives will also keep certified pre-owned units as very attractive alternatives. Credit conditions also remain favorable, as it is now easier to get a CPO loan than it was a year ago, and lower average interest rates on CPO loans are helping to mute the effect of higher prices.