Data Point

Electrified Vehicle Sales Accelerate in Q2

Monday July 19, 2021

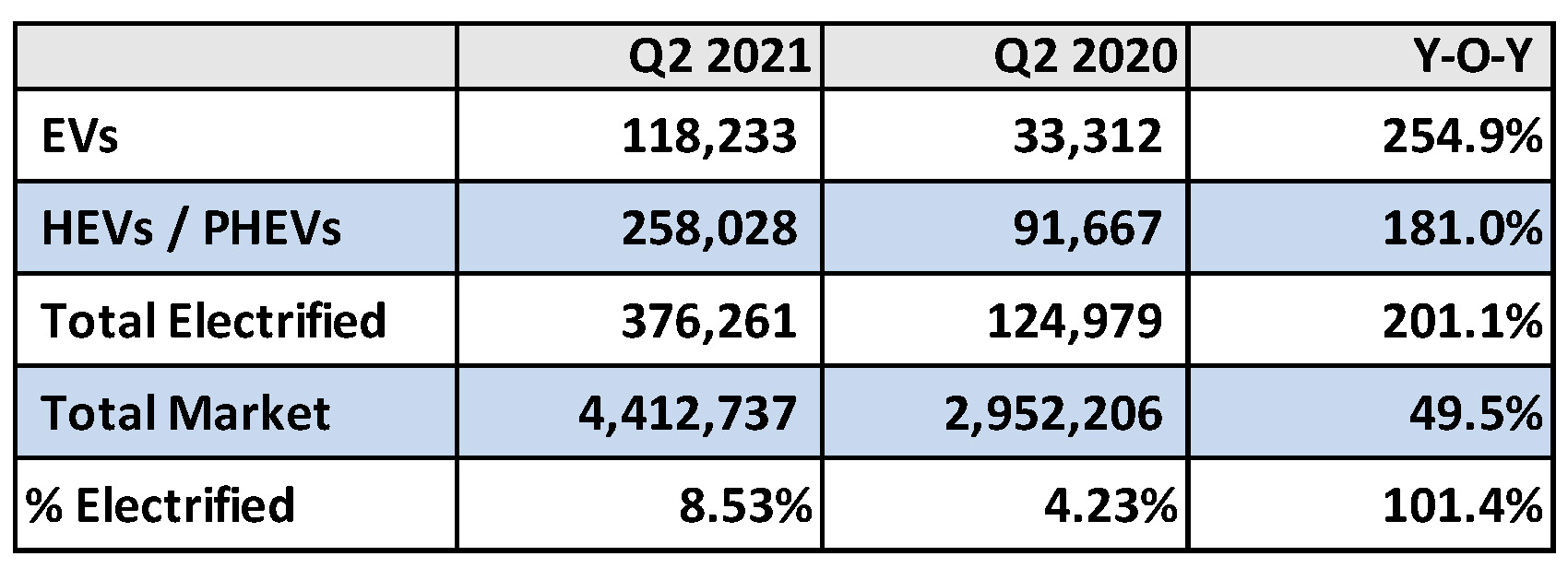

The U.S. auto market has seen growth this year in nearly every segment, but no segment is growing more quickly and more relentlessly than electrified vehicles – the combined total of electric vehicles (EVs), hybrids and plug-in hybrids. According to an analysis of Q2 data from Kelley Blue Book, sales of pure EVs passed 100,000 units in the quarter – a first – and hybrids sales were over 250,000.

In the second quarter, total new-vehicle sales jumped by 49.5%, growing notably from the small base of Q2 2020 Pandemic Edition, but electrified vehicle growth was 201.1%, reaching beyond 375,000 combined EVs and hybrids. As we’ve said before, that’s a lot of batteries.

Q2 U.S. Electrified-Vehicle Sales Growth

According to AAA, gasoline demand is in record territory and prices have risen 40% from the beginning of the year. And this we know: When prices are up, consumers begin dreaming of more efficient vehicles. In a recent Cox Automotive ‘quick poll’, 30% of consumers indicated they would be either “extremely or very likely” to consider an EV for their next purchase. A high percentage indeed, since EV consideration is typically in the 5% to 7% range according to the ongoing Kelley Blue Book Brand Watch study.

There are certainly more EVs and hybrids available today. You can’t buy a Toyota Sienna minivan without buying a hybrid; roughly 25% of Toyota’s total volume is now hybrids. Want a hybrid off-roader? Jeep Wrangler 4xe is now available, albeit in very short supply. More luxury makers are offering excellent plug-in hybrid models and turning bigger volumes of each one.

EV sales were strong in Q2 as well, charged up by new products such as Ford’s Mustang Mach-E and the VW ID.4. The Chevrolet Bolt EV delivered a record second-quarter and first-half deliveries, although it is currently heavily incentivized to make room for two all-new versions arriving this summer.

Tesla is still the dominant force in the EV market and will be for some time. But Tesla’s notable market share lead continues to erode. Yes, the Model Y remains the best-selling EV in the market – 1 in 3 EVs sold is a Model Y – but month after month and quarter after quarter, Musk’s magic brand represents a smaller slice of a growing pie. In Q2, Tesla’s share of the EV segment in the U.S. stood at 64%, down from 71% in Q1 and 83% a year earlier. Tesla has new product coming, but when exactly is unclear and success is not guaranteed. While Tesla sales volume may increase, their share of the pie will continue to decline

While low inventory might change the market’s current trajectory, it is a safe bet that 2021 will be a record-setting year for electrified vehicle sales in the U.S., and 2022 will beat 2021.

Electrified vehicle sales accounted for 8.5% of total sales in Q2, up from 7.8% in Q1 and 4.2% in Q2 2020. The electrified market is still dominated by hybrids and plug-ins, but all the automaker rhetoric today is about future EVs. The progress may be slow, but the path is set.