Data Point

Inventories Rise; Automakers Cut Production

Tuesday August 13, 2019

Article Highlights

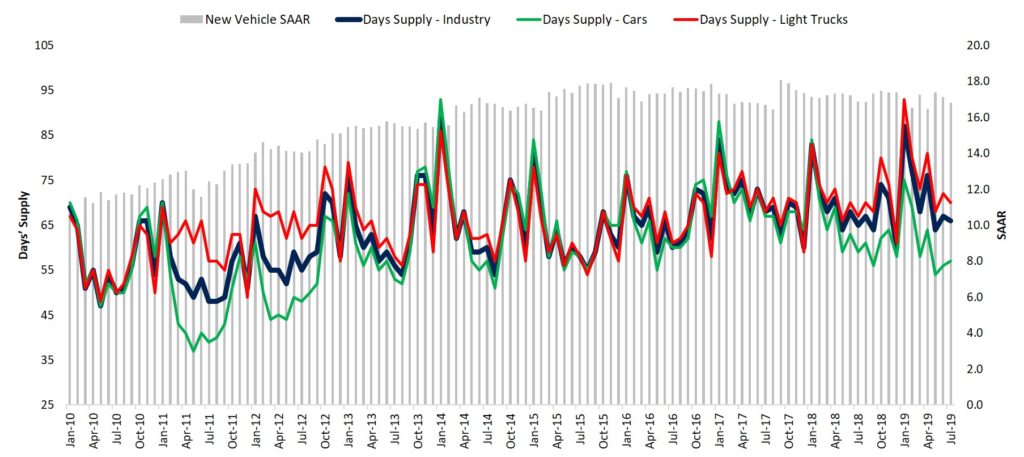

- The U.S. auto industry entered August with days’ supply of vehicle inventories trending higher at a time of the year when inventories traditionally are lowest.

- For July, days’ supply was 66, up one day from a year ago with all of the increase coming from light trucks.

- The supply of cars continues to drop, down two days to 57 days’ supply, largely because automakers have dropped some car lines.

The U.S. auto industry entered August with days’ supply of vehicle inventories trending higher at a time of the year when inventories traditionally are lowest as automakers sell down the previous model year to make way for new model year vehicles.

New-vehicle inventories came in under 4 million units for the third consecutive month, but sales are weakening, pushing the days’ supply up. For July, days’ supply was 66, up one day from a year ago.

All of the increase is coming from light trucks – pickup and utility vehicles. Light truck days’ supply was 70 in July, up three days from last year. The supply of cars continues to drop, down two days to 57 days’ supply, largely because automakers have dropped some car lines, notably General Motors stopped producing the Chevrolet Cruze and Ford quit the Focus and Fiesta. GM will be ending production of more cars by early next year.

Automakers have two ways to reduce inventories: cut production at plants and/or boost incentives. Some are doing both.

General Motors recently announced it was trimming production of its Chevrolet Equinox SUV at two North American car plants. It will also scale back production of two other utility vehicles, the GMC Terrain and Chevrolet Trax. GM will end one of the three crews working at its Mexico plant that makes the trio of utilities. GM also will idle for a week a Canadian plant that makes only the Equinox.

Ford will trim operations at its Canadian plant, idling 200 workers. The plant makes sport utilities – the Ford Flex and Edge and the Lincoln MKT and Nautilus. Ford warned it might have to make more cuts.

Honda is reducing production of its top-selling Accord and Civic in Ohio. Nissan has trimmed some production at its plants in Mississippi and Mexico.

On the incentives side, automakers offered 2,923 unique incentive packages in July, up 27% from the volume a year earlier and up 9.7% from a month earlier, according to our team at Cox Automotive Rates & Incentives. More incentive packages means dealers have more ways to make the sale. [Find out more in the article 2019 is the Summer of Incentives.]