Data Point

New-Vehicle Affordability Declined in June

Monday July 15, 2024

Article Highlights

- In June, new-vehicle affordability experienced a slight decline.

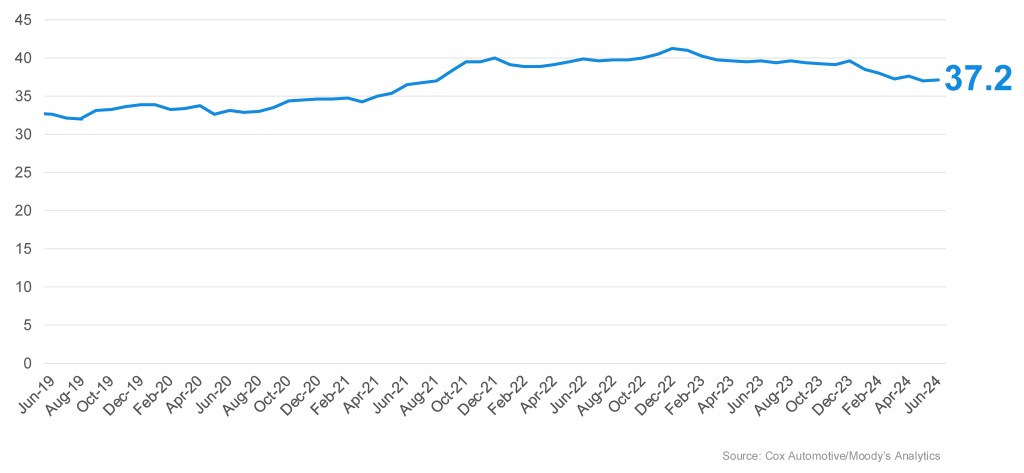

- The number of median weeks of income needed to purchase the average new vehicle rose to 37.2 weeks from 37.1 weeks in May.

- The typical monthly payment increased by 0.6% to $756.

In June, new-vehicle affordability experienced a slight decline, according to the Cox Automotive/Moody’s Analytics Vehicle Affordability Index.

“Dealers and manufacturers became less aggressive with pricing due to widespread software disruptions,” said Cox Automotive Chief Economist Jonathan Smoke. “Despite this, consumers benefited from rising incomes and lower interest rates, keeping overall affordability better than last year.”

The estimated average auto loan rate fell by 13 basis points in June to 9.83%1, marking the lowest average rate in a year. Continued income growth resulted in a 3.7% improvement year over year.

The typical monthly payment increased by 0.6% to $756, and the number of median weeks of income needed to purchase the average new vehicle rose to 37.2 weeks from 37.1 weeks in May. The average monthly payment had previously peaked at $795 in December 2022.

COX AUTOMOTIVE/MOODY’S ANALYTICS VEHICLE AFFORDABILITY INDEX

JUNE 2024

Weeks of Income Needed to Purchase a New Light Vehicle

New-vehicle affordability in June was better than a year ago when prices were 0.6% higher, interest rates were slightly lower, and both incomes and incentives were lower. The estimated number of weeks of median income needed to purchase the average new vehicle in June was down 6.3% from the same time last year.

Click here for the full methodology for the Cox Automotive/Moody’s Analytics Vehicle Affordability Index.

The next update of the Cox Automotive/Moody’s Analytics Vehicle Affordability Index will be published on August 15, 2024.

1 The index input of the average interest rate paid by consumers is calculated to reflect a 72-month, fixed-rate loan. For the latest Dealertrack estimated, volume-weighted average new loan rate, visit the Auto Market Snapshot.

The Cox Automotive/Moody’s Analytics Vehicle Affordability Index (VAI) is updated monthly using the latest data from government and industry sources, including key pricing data from Kelley Blue Book, a Cox Automotive company. This important industry measure will be released at mid-month to indicate if the prices paid for new vehicles are moving out of consumers’ financial reach or becoming more affordable over time.