Data Point

Eight Straight: New-Vehicle Prices Mark Another Record High in November, According to Kelley Blue Book

Friday December 10, 2021

Article Highlights

- A larger mix of SUVs and pickups helped drive up prices in November; car mix dropped from nearly 30% in 2018 to under 22% in 2021, among the lowest levels ever.

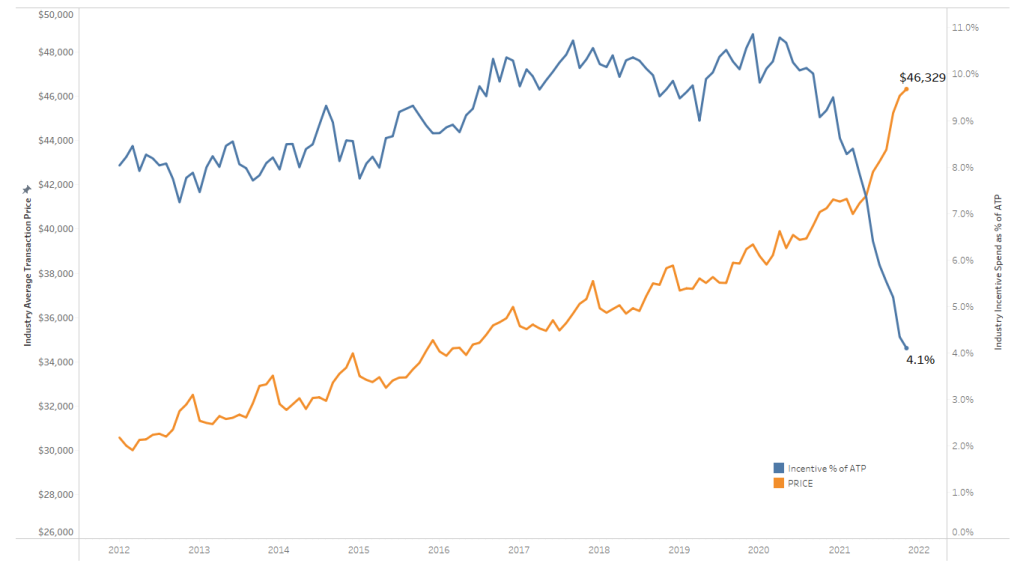

- Incentives fell to a record low, averaging only 4.1% of average transaction price.

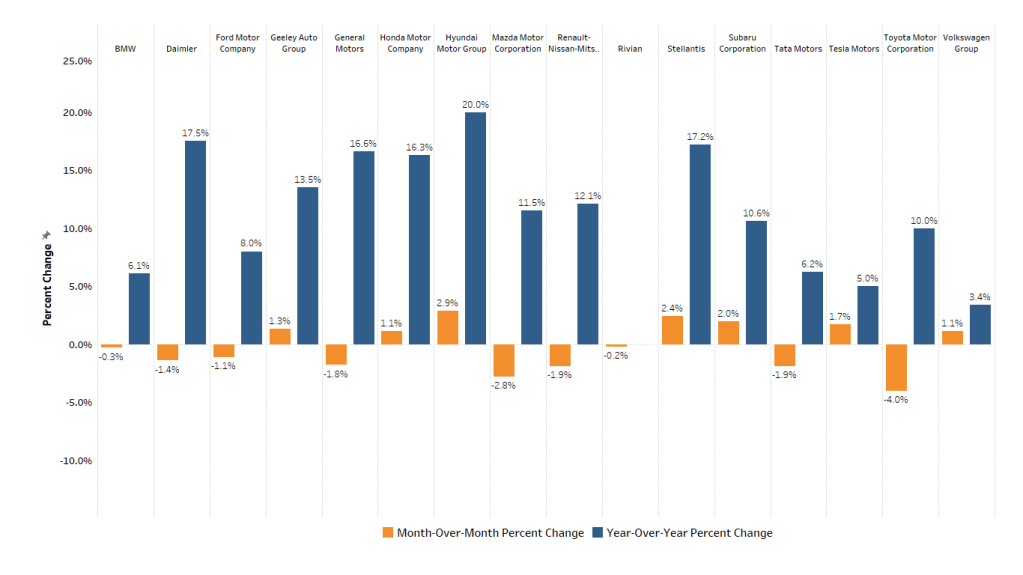

- Mitsubishi, Acura, Jeep and VW delivered the largest year-over-year price gains, all up more than 20% in November.

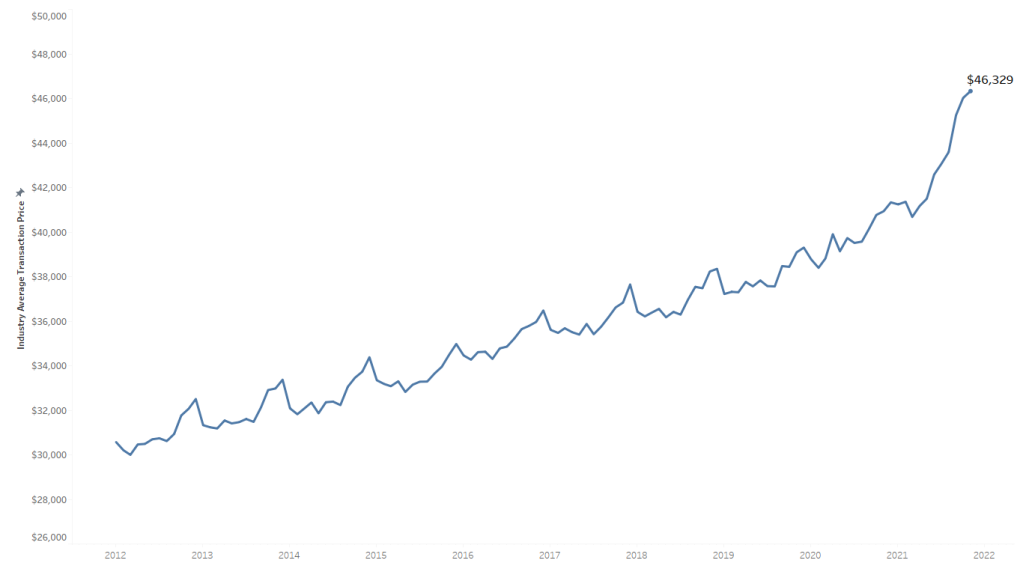

New-vehicle prices increased further into record territory in November, including a modest increase from the month prior. According to new data released today by Kelley Blue Book, average transaction prices (ATPs) are sharply elevated from last year, up more than 13% from November 2020. New-vehicle inventory levels remain tight, and with sufficient consumer demand, dealers have been able to hold prices at or above the manufacturer’s suggested retail price (MSRP). In recent research from Cox Automotive, nearly 70% of franchised dealers indicated their new-vehicle prices are higher than pre-pandemic levels.

NEW-VEHICLE AVERAGE TRANSACTION PRICE

While prices were elevated last month, sales were slow, with sales volume at the lowest level of the year. November was the sixth straight month of volume declines. In fact, at 1,020,355 units, November’s sales hit the lowest level since April 2020, when the global pandemic first shut down the economy.

“High prices and limited choices likely are keeping many car buyers on the sidelines,” said Kayla Reynolds, analyst for Cox Automotive. “It’s still a seller’s market, and we don’t expect things to change anytime soon. However, with high prices being the norm right now for both new and used vehicles, that means trade-in values are very favorable and can help soften the blow for consumers as they purchase their next vehicle.”

Luxury vehicle sales, which normally increase in November and December, comprised 17.4% of total sales in November and helped to drive ATPs higher. For comparison, luxury sales made up only 15.9% of the market six months ago in May, and five years ago in November 2016, luxury sales accounted for only 14.4% of the U.S. market. In November 2021, the average luxury buyer paid $61,455 for a new vehicle, a record-setting sum nearly $1,000 more than sticker price. In comparison, one year ago luxury vehicles were selling for more than $3,000 under MSRP.

INDUSTRY AVERAGE TRANSACTION PRICE VERSUS INDUSTRY AVERAGE INCENTIVE SPEND AS % OF ATP

The average price paid for a new non-luxury vehicle last month was $43,144, also a record high and more than $900 over sticker. For each of the last six months, the average price paid by consumers was above the MSRP.

Even the most affordable segments registered big year-over-year gains, according to the Kelley Blue Book analysis. Subcompact car transaction prices in November were up 17% year-over-year, while compact car prices were up 16%. On the other end of the affordability spectrum, full-size SUVs showed the smallest year-over-year gains, up only 4.8% year-over-year, with average transaction prices climbing above $73,000.

PRICE CHANGE PERCENTAGE BY AUTOMAKER

One reason overall new-vehicle transaction prices remain elevated is because more affordable sedans are taking a smaller share of the market. In November 2021, cars ($41,026 ATP) on average were more affordable than new SUVs ($45,201 ATP), trucks ($54,462 ATP), or vans ($46,523 ATP). Cars also had higher incentives at 4.7%, expressed as a percentage of ATP. Overall, industry incentives fell to a record low, averaging only 4.1%. In addition, market share for cars reached among the lowest levels ever, plummeting to 21.7%. In comparison, in November 2020 cars commanded 24.5% share, and in November 2018 car share was nearly 30%. As fewer cars are sold, trucks and SUVs dominate the market driving ATPs to track higher.