Data Point

CPO Sales Continue to Climb in March, Q1 Up 10% Year Over Year

Wednesday April 12, 2023

Article Highlights

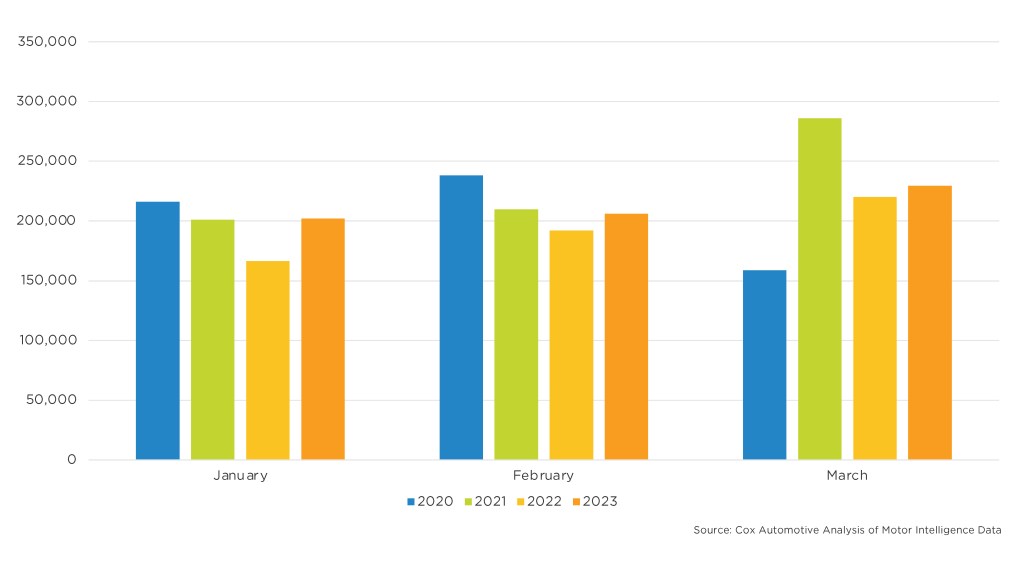

- Certified pre-owned (CPO) sales in March rose 4.2%, over 9,000 units, from last March to finish at 229,542.

- This total is up nearly 23,500 units, or over 11%, from February’s number.

- So far in 2023, CPO sales are up 10%, nearly 59,000 units, over the first three months of 2022.

Certified pre-owned (CPO) sales in March rose 4.2%, over 9,000 units, from last March to finish at 229,542. This total is up nearly 23,500 units, or over 11%, from February’s number.

March CPO Sales

Assessing retail vehicle sales based on observed changes in advertised units tracked by vAuto, we initially estimate that used retail sales increased 13% in March from February but failed to see the normal March lift. Used retail sales in March are estimated to be down 6% year over year.

So far in 2023, CPO sales are up 10%, nearly 59,000 units, over the first three months of 2022. CPO sales finished 2022 at 2.47 million units, a decline of nearly 280,000 units, or 10.2% from 2021 CPO sales.

According to Chris Frey, senior manager of economic and industry insights at Cox Automotive: “CPO sales have seen a pop to start the year compared to 2022. The monthly average sales volume of 212,000 is up nearly 7,000 units versus last year’s monthly average. As we’re clawing our way back to pre-pandemic levels, shifts in strategies for CPO may be bearing fruit. While we don’t have full visibility into what age and mileage constitute total sales, expanding the pool of eligible vehicles could be a boon to the CPO market.”

Among the large manufacturers, Toyota had the highest CPO sales volume in March. Hyundai had the largest year-over-year percentage gains in CPO sales, while Honda had the largest decline.