Data Point

Auto Credit Availability Shifted in March, Impacted by Banking Crisis

Monday April 10, 2023

Article Highlights

- In March, which featured the failure of several banks, access to auto credit loosened slightly, according to the Dealertrack Credit Availability Index for all types of auto loans.

- The All-Loans Index increased 0.2% to 98.2 in March, reflecting that auto credit was easier to get in the month compared to February.

- New-vehicle loans saw loosening in March while all types of used-vehicle loans tightened.

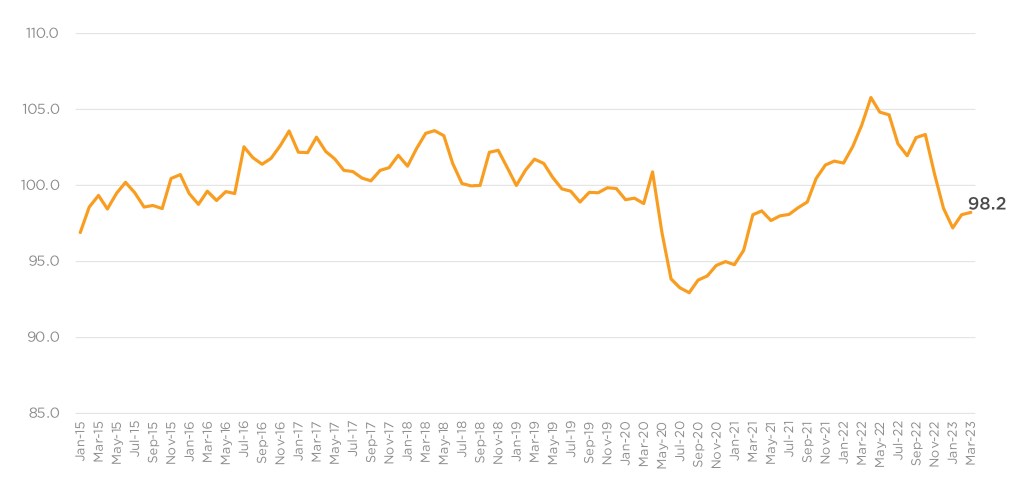

In March, which featured the failure of several banks, access to auto credit loosened slightly, according to the Dealertrack Credit Availability Index for all types of auto loans. However, the aggregate measure masked varied moves happening in vehicle channels and by lender. The All-Loans Index increased 0.2% to 98.2 in March, reflecting that auto credit was easier to get in the month compared to February. Even with the increase in March, access was tighter by 5.5% year over year, and compared to February 2020, access was tighter by 1.0%.

Dealertrack Credit Availability Index

Auto loan access increased slightly in March but remained down year over year

All Auto Loans Index (Jan2019=100)

Credit Availability Factors Mixed in March

Movement in credit availability factors was mixed in March. Yield spreads widened and average terms shortened, and those moves limited credit access for consumers. However, the approval rate increased, and the subprime share increased, and those moves expanded credit access for consumers. Other factors were little changed from February.

Within the month, credit had tightened more initially following the failure of Silicon Valley Bank, most notably with yield spreads widening even more. However, by the end of the month, yield spreads narrowed some, and more variation in approach by lender and by channel became more significant.

For the full month, the average yield spread on auto loans widened by 55 BPs, so rates consumers saw on auto loans were less attractive in March relative to bond yields. The average auto loan rate increased by 43 Basis Points (BPs) in March compared to February, while the 5-year U.S. Treasury declined by 12 BPs, resulting in a wider average observed yield spread.

The approval rate increased by 0.5 percentage points in March but was down 1.9 percentage points year over year. The subprime share increased to 13.4% from 11.9% in February but was down 1.0 percentage points year over year. The share of loans with greater than 72-month terms declined 0.3 percentage points and was down 0.5 percentage points year over year.

Access to New-Vehicle Loans Loosened While Used Loans Tightened in March

The modest movement in the All Loan index masked significant differences in moves in the new market versus the used car market. New-vehicle loans saw loosening in March while all types of used-vehicle loans tightened. On a year-over-year basis, all channels were tighter, with certified pre-owned (CPO) loans having seen the most tightening.

Credit access changes were mixed by lender types in March. Banks and captives loosened slightly, while credit unions and auto-focused finance companies tightened. Finance companies tightened the most. On a year-over-year basis, credit access was tighter across all lender types, with auto-focused finance companies tightening the least while credit unions tightening the most.

The differences in the new-vehicle market compared to the used-vehicle market and comparing banks and captives to credit unions and finance companies suggest shifts in risk strategy may be behind the contrasting moves. Captives and banks play a much larger role in the new market than in the used market. The credit profile in the new market also skews to higher credit quality consumers.

While yield spreads widened for all types of loans and for all lenders, they widened the least in new loans. By lender, captives widened the least, and all other lender types widened yield spreads substantially.

The varied moves reflect the benefits of having a large, diversified and professional auto credit market in the United States. No type of lender dominates the market, so when economic and financial market circumstances change, differing strategies and perspectives can lead to some lenders pulling back. In contrast, other lenders see opportunities to grow. The fact that yield spreads widened suggests that most lenders are being compensated for taking on more risk.

Each Dealertrack Auto Credit Index tracks shifts in loan approval rates, subprime share, yield spreads and loan details, including term length, negative equity, and down payments. The index is baselined to January 2019 to show how credit access shifts over time.

Measures of Consumer Confidence Mixed in March

The Conference Board Consumer Confidence Index® increased by 0.8% in March, as views of present situation declined by 1.2%, but future expectations increased by 3.7%. Consumer confidence was down 3.2% year over year. Plans to purchase a vehicle in the next six months increased, yet was lower than in January but higher than a year ago. The confidence index did not decline as much during the pandemic as the sentiment index from the University of Michigan, and the two series diverged again in March. The Michigan index fell 7.5% in March but was up 4.4% year over year. Views of both current economic conditions and expectations declined. Consumers’ views of vehicle buying conditions fell in March but remained better than a year ago. The daily index of consumer sentiment from Morning Consult measured declining sentiment in March that worsened as the month progressed, following an up month in February. That index fell 2.2% in March as the price of gasoline increased. According to AAA, the national average price for unleaded gas increased 4.3% in March to $3.51 per gallon on March 31, down 16% year over year.

The Dealertrack Credit Availability Index is a monthly index based on Dealertrack credit application data and will indicate whether access to auto loan credit is improving or worsening. The index will be published around the 10th of each month.