Data Point

Tariffs Trigger Surge in March New-Vehicle Sales, Inventory Levels Decline

Thursday April 10, 2025

Article Highlights

- New-vehicle inventory dropped to 2.69 million units at the start of April following a surge in late-March sales.

- New days’ supply fell to 70, down from the upwardly revised 91 days at the end of February.

- The average new-vehicle listing price decreased to $47,962 month over month and is $895 above year-ago levels.

As the automotive industry starts to navigate the impact of new tariffs, the supply of new vehicles on dealer lots across the U.S. has significantly decreased, according to the Cox Automotive analysis of vAuto Live Market View data. New-vehicle inventory levels at the start of April decreased from March and were lower than in early April 2024. New-vehicle sales surged in March, driven by strong seasonal trends and the urgency created by the import tariff announcement.

2.69M

Total Inventory

as of March 31, 2025

70

Days’ Supply

$47,962

Average Listing Price

As April opened, the total supply of new vehicles on dealer lots across the U.S. was at 2.69 million units, down 10.2% from the 2.99 million units at the start of March and down 2.4% from a year ago.

Sales of new vehicles increased both month over month and year over year in March. The 30-day weekly sales pace in the final measure of March was up 17.2% compared to late February and up 11.9% compared to the same period last year.

Retail vehicle sales have shown strong seasonal trends so far this year. The new retail sales pace increased almost every week in February and March, with a strong surge at month-end with the import tariff announcement creating urgency in the final five days of the month.

The Cox Automotive days’ supply is based on the estimated daily retail sales rate for the most recent 30-day period. The new-vehicle days’ supply was 70 at the beginning of April, down 21 days from the upwardly revised 91 days at the beginning of March. To start April, days’ supply was down 10 days compared to last year, returning inventory to levels last seen in 2023.

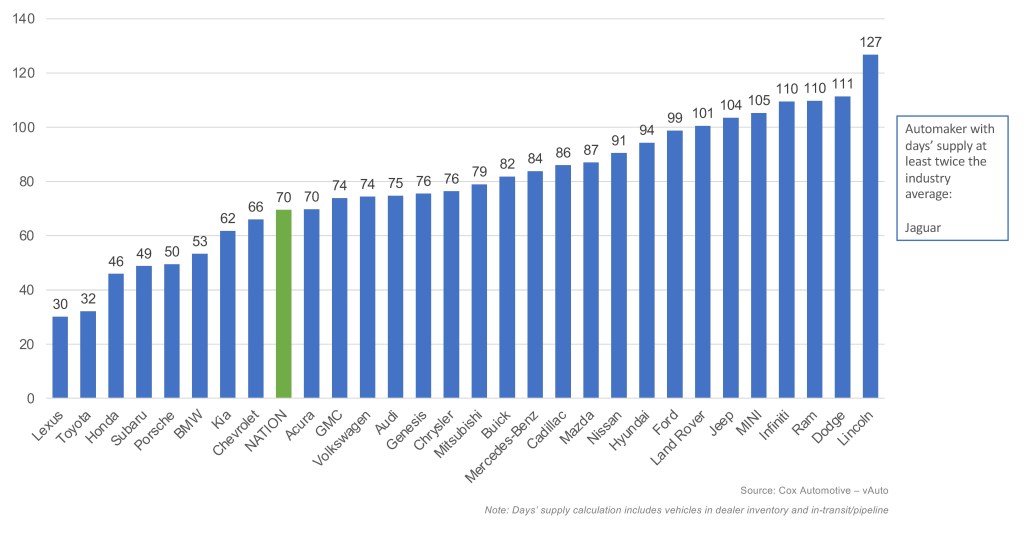

MARCH DAYS’ SUPPLY OF INVENTORY BY BRAND

New-vehicle inventory had been relatively stable until the end of March when the sales surge reduced inventory and days’ supply tightened even more. Among the mainstream automakers we track, 10 have seen their days’ supply decrease by 30 days or more month over month, with Lincoln dropping the most with a 54-day decrease. With import tariffs now in place and parts tariffs likely to start in May, we expect supply to tighten even more in the weeks ahead.

New-Vehicle Pricing Declines in March

The average new-vehicle listing price was $47,962, down 0.6% from the revised $48,272 at the start of March but higher by 1.9% from a year earlier. At the beginning of April, among the five top-selling automakers, Ford’s average listing price experienced the largest drop of $599, followed by Hyundai with a decrease of $380, and Chevrolet, which was only $57 lower compared to the previous month. Both the average listing prices for Honda and Toyota rose at the beginning of April, increasing by $212 and $187, respectively.

As reported earlier, the average transaction price (ATP) of a new vehicle was $47,462 in March, down 0.2% month over month and up 0.3% year over year. In March, new-vehicle sales incentives were 7.0%, or $3,339, virtually flat month over month.

What to Expect in April and Beyond

The implementation of tariffs will significantly increase the costs of imported new vehicles. As pre-tariff inventory is depleted, automakers distribute these additional costs across their entire portfolio of vehicles. Tariffs led to a surge in March sales, reducing inventory levels, especially for manufacturers with already low stock levels.

As a result of these tariffs and the tightening inventory, and without a policy change in Washington, consumers should anticipate higher prices and fewer discounts on new vehicles by summer. Over time, we can expect a decline in both production and sales, leading to increased prices for both new and used cars. Additionally, some models may be discontinued as automakers adjust their strategies to cope with the new economic landscape.

Starting in Q2, the tighter supply and higher prices will likely mirror the conditions we saw in 2021, when the chip shortage affected global vehicle production. Tariffs will drive higher prices, lower production and supply, and slower vehicle sales, creating a challenging environment for both consumers and automakers.