Data Point

Wholesale Used-Vehicle Prices Decrease in First Half of September

Tuesday September 17, 2024

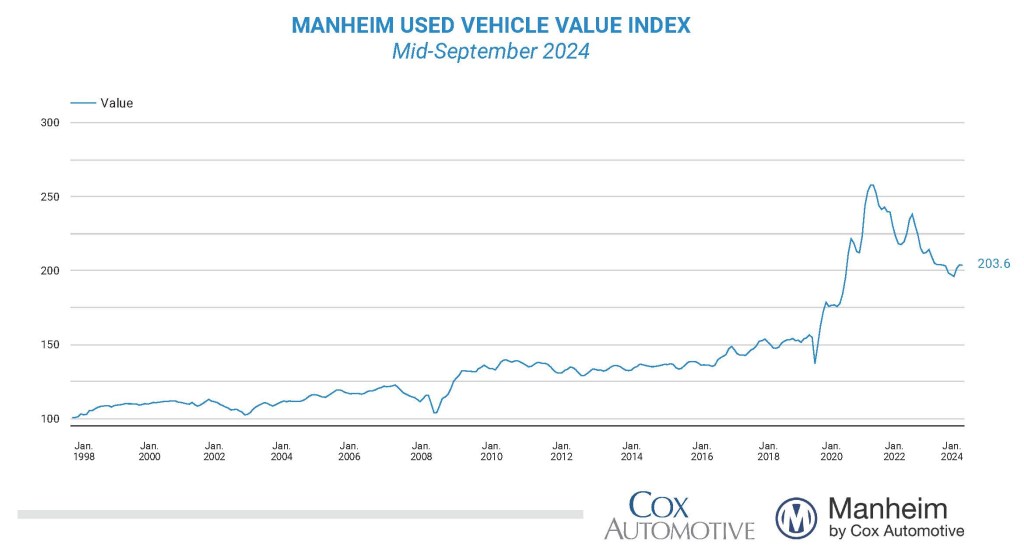

Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) declined 0.2% from August in the first 15 days of September. The mid-month Manheim Used Vehicle Value Index decreased to 203.6, down 5.0% from the full month of September 2023. The seasonal adjustment softened the results. The non-adjusted price change in the first half of September rose 0.2% compared to August, while the unadjusted price was down 4.6% year over year. The average change for the month of September is an increase of two-tenths of a point for seasonally adjusted values, so the current measure is below trend for the early read of the month.

“It’s normal for seasonally adjusted values to cool a bit in the first half of September as results include the impact from the Labor Day holiday week, which has a lingering effect on the industry over a few weeks,” said Jeremy Robb, senior director of Economic and Insights at Cox Automotive. “We typically see non-seasonally adjusted values decline for the full month of September, yet they are currently higher by two-tenths of a point even through the holiday period. This suggests we are currently continuing to see lower than normal depreciation trends in the wholesale industry.”

Over the last two weeks, the Manheim Market Report (MMR) prices in the Three-Year-Old Index declined an aggregate of 0.4%, which was less than the typical normal decline of 0.7% observed at this time of year. Over the first 15 days of September, MMR Retention, the average difference in price relative to current MMR, averaged 98.8%, indicating that valuation models are slightly further away from market prices early in September. MMR retention is down one-tenth of a point compared to the prior year at the beginning of September, and it is in line with the last two years.

The average daily sales conversion rate of 61.3% in the first half of the month was above the September 2019 daily average of 55.3%, yet it has moved a bit lower the last two weeks, seasonally normal with the Labor Day holiday. The conversion rate has declined one and a half points from August 2024, indicating that buying demand has declined over the last two weeks, much of which is driven by the holiday period.

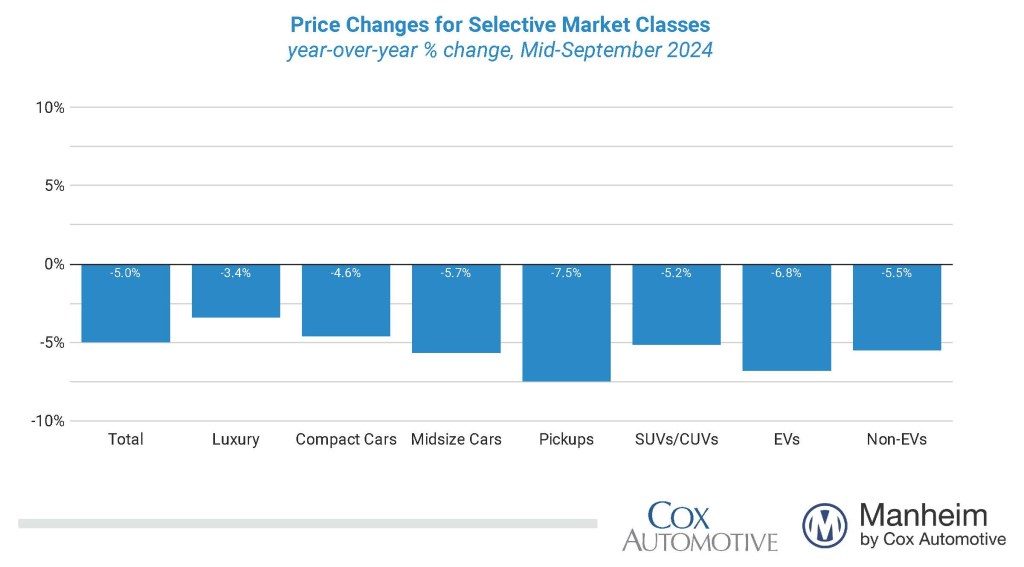

All major market segments saw seasonally adjusted prices that remained lower year over year in the first half of September, yet the declines have continued to be lower than earlier in the year. Compared to the industry’s year-over-year decline of 5.0%, the luxury segment declined by just 3.4% against 2023, and compact cars fell by 4.6% over the same period. Falling more than the average, SUVs were down 5.2%, midsize cars fell by 5.7%, and pickups declined 7.5% year over year.

Comparing results against the end of August, segment results were mixed. The overall industry fell by 0.2% against the prior month, with a few segments performing better overall. For the month, the compact car segment was higher by 2.4%, with SUVs up by 0.2% and pickups flat. Conversely, the midsize car segment fell more than the industry overall in the first half of September, decreasing by 0.5%, while the luxury segment was lower by 1.0% against August 2024. Electric vehicles (EVs) were down 6.8% against September 2023, while the non-EV segment decreased by 5.5% over the same period. Continuing the trend from August’s results, EVs increased 1.1% in the first half of September against August 2024, while non-EVs were down 0.4%.

Wholesale Supply Higher in Mid-September

Leveraging Manheim sales and inventory data, estimated wholesale supply ended August at 25 days, down two days from the end of July and essentially flat against August 2023 at 25 days also. Wholesale supply is relatively tighter for this time of year, running two days lower than the longer-term levels for this week. As of Sept. 15, wholesale supply increased by one day from the end of August, moving to 26 days, flat against year-over-year levels.

Measures of Consumer Sentiment Showing Improvement in September

The initial September reading on Consumer Sentiment from the University of Michigan increased 1.6% to 69.0, which was better than expected and the highest level since May. With the gain in September, the index is now up 1.6% year over year. The underlying views of both current conditions and future expectations improved. Expectations for inflation in one year declined to 2.7%, the lowest level since December 2020. Still, expectations for inflation in five years increased to 3.1%, the highest level since last November. Consumers’ views of buying conditions for vehicles improved to the best level since June 2021 as views of vehicle prices improved. The daily index of consumer sentiment from Morning Consult is also up midway through September. The index increased 0.6% in June, 1.9% in July, and 0.3% in August and is up 0.8% through Sept. 15, with the index up 8.6% year over year. The average unleaded gas price, according to AAA, has declined 3.8% month to date to $3.21 per gallon as of Sept. 15. Gas prices are down 17% year over year but up 3.2% year to date.

The next complete suite of monthly MUVVI data will be released on Oct. 7, 2024, and the Q3 MUVVI call will be held at 11 a.m. EDT. Register to attend.

For questions or to request data, please email manheim.data@coxautoinc.com. If you want updates about the Manheim Used Vehicle Value Index, as well as direct invitations to the quarterly call sent to you, please sign up for our Cox Automotive newsletter and select Manheim Used Vehicle Value Index quarterly calls.

Note: The Manheim Used Vehicle Value Index was adjusted to improve accuracy and consistency across the data set as of the January 2023 data release. The starting point for the MUVVI was adjusted from January 1995 to January 1997. The index was then recalculated with January 1997 = 100, whereas prior reports had 1995 as the baseline of 100. All monthly and yearly percent changes since January 2015 are identical. Learn more about the decision to rebase the index.