Data Point

New-Vehicle Inventory Increases Again in April, Supporting Stronger Sales

Thursday May 11, 2023

Article Highlights

- The active supply of new vehicles totaled 1.90 million for a 54 days’ supply.

- April’s new-vehicle average listing price climbed to $47,368.

- Bloated inventories for some brands led to more discounts.

Updated, June 15, 2023 – New-vehicle inventory closed April up from a month earlier to its highest level in two years, supporting surprisingly brisk sales, according to Cox Automotive’s analysis of vAuto Available Inventory data. Meanwhile, days of supply dipped on higher sales. The average listing price of a new vehicle returned to above $47,000 in April.

1.90M

Total Inventory

as of April 24, 2023

54

Days’ Supply

$47,368

Average Listing Price

The total U.S. supply of available unsold new vehicles stood at 1.90 million units at the end of April, up from a revised 1.89 million at the end of March. Inventory numbers include vehicles available on dealer lots and some in transit. The close of April marked the highest level of supply since April 2021. Supply was up 71% from a year ago, or 790,000 units higher.

Days of supply stood at 54 at the end of April, down from an upwardly revised 57 at the end of March but up 47% from the same time a year ago. Historically, a 60 days’ supply across the industry was considered normal and ideal.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period that ended April 24, when about 1.08 million vehicles were sold, up 16% from the same period in the previous year.

“New-vehicle inventory continues to improve, supporting a pick-up in the sales pace,” said Charlie Chesbrough, Cox Automotive senior economist. “Clearly, pent-up demand is being unleashed. How much pent-up demand exists is the question. We still expect sales to slow in the second half as economic headwinds, particularly rising interest rates, grow.”

For the full calendar month of April, total new-vehicle sales were up 9% from a year ago for a sales pace, or seasonally adjusted annual rate (SAAR), of 15.9 million, solidly beating analysts’ forecasts. April’s SAAR increased from last year’s 14.3 million and March’s 14.8 million. As has been the case for the last several months, the strength in April was supported by strong sales growth into fleets. The month also saw more leasing and discounts.

While inventory is up substantially from 2021 and 2022 levels, it remains low by historical standards. At the end of the pre-pandemic, pre-chip shortage in April 2020, the total supply was 3.51 million vehicles for days’ supply in the triple digits. In April 2019, supply was 3.88 million vehicles for a 95 days’ supply.

New-Vehicle Prices Rise Throughout April

After falling week after week through March to below $47,000, the average new-vehicle listing price – the asking price – climbed every week in April past $47,000, ending the month at $47,368. It was the highest average listing price since early February and was up 5% over a year ago.

“Prices have been at this growth rate since February and are holding up well despite economic uncertainty and rising interest rates,” said Chesbrough.

The average transaction price (ATP) – the price paid – in April was relatively flat from March, closing the month at $48,275, down 0.03% or $14 from March, according to Kelley Blue Book, a Cox automotive company. Still, ATP is up 3.7%, or nearly $1,744, from a year ago.

The average price Americans paid for a new vehicle in April remained below the manufacturer’s suggested retail price (MSRP) for the second straight month. Incentives climbed to their highest level in the past year at 3.6% of the April ATP, averaging $1,714 per vehicle.

“Some brands and segments have far too much inventory, so we are seeing discounts and incentives increase,” said Chesbrough. “We also are seeing more lease deals that have been almost non-existent that past couple of years.”

Inventory Varies by Brand, Segment, Price and Region

At the close of April, the industry had non-luxury vehicle inventory totaling 1.61 million vehicles, up from 1.60 million at the end of March, for a 52 days’ supply. The inventory of luxury vehicles (excluding uber-luxury ones) stood at 291,520, about the same as at the end of March, but for a lower 52 days’ supply due to higher sales.

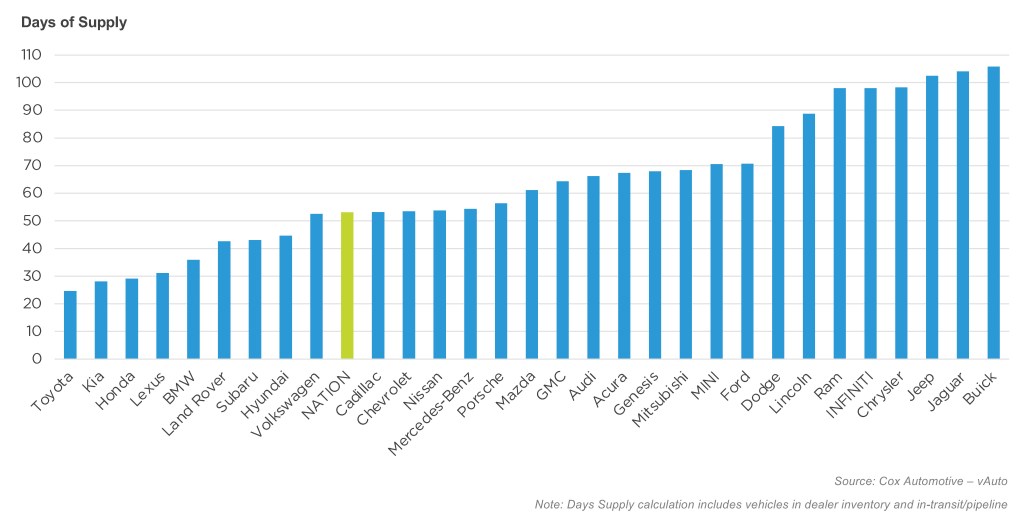

Import non-luxury and luxury brands had the lowest inventories. The highest inventories were a mix of non-luxury domestic brands, dominated by Stellantis’ makes, and a mix of luxury brands.

Non-luxury brands with the lowest inventory were Toyota, Kia and Honda, all with under 30 day’s supply, followed by Subaru, Hyundai and Volkswagen, all with below-industry average supply. Luxury brands at the low end were Lexus, at under 30 days of supply, followed by BMW and Land Rover, both below the industry average.

Non-luxury brands with the highest inventory were mostly Stellantis brands, with four among the top for supply – Jeep, at 102 days’ supply, Chrysler, Ram and Dodge, at 88 days’ supply. Buick, Jaguar, Infiniti and Lincoln were the luxury brands with the highest inventory.

April Days’ Supply of Inventory By Brand

Aside from low-volume, high-performance cars, compact, midsize and subcompact cars had the lowest inventory, all with below 40 days of supply. This year, these cars have seen an increase in market share penetration due to somewhat improved production and supply from Asian automakers. Other segments with supply at the low end of the spectrum were minivans along with compact and subcompact SUVs.

Segments with the highest inventories were a mix of electric vehicles, hybrids and full-size pickup trucks plus super luxury vehicles. It should be noted, however, that segments like EVs, hybrids, as well as super luxury and sports cars, can show wild fluctuations in days’ supply due to low sales volumes.

Of the 30 best-sellers for the 30 days that ended April 24, Honda Civic had the lowest supply, followed by Honda CR-V, Kia Forte and Toyota Corolla. Honda posted particularly strong sales in April, drawing down its lean inventory.

Full-size pickup trucks from the Detroit Three had the biggest supply. The Ford F-150 had the most at 99 days’ supply, followed by Ram 1500 and Chevrolet Silverado.

As has been the case for months, Florida and California DMAs had the lowest supply while northern ones had the highest, but April marked an exception. Orlando had the lowest inventory at 45 days’ supply, followed by Los Angeles and Miami. Cleveland landed at the low end as well. Detroit had the highest at 59 days’ supply, followed by Houston and Seattle.

Lower price categories had the tightest supply by the end of April. The under $20,000 segment had an active supply of fewer than 3,000 units, a 26-day supply. New vehicles priced between $20,000 and $40,000 had days’ supply of 41 or less. The $40,000 to $50,000 category had a 50 days’ supply. The $50,000 to $80,000 category had days’ supply of more than 70. The over $80,000 segment had 55 days of supply.

Non-luxury brands with the highest inventory were mostly Stellantis brands, with four among the top for supply. Ram was the highest with 119 days’ supply, followed by Jeep and Chrysler. Luxury brands with the highest inventory were Buick, at 117 days’ supply, followed by Jaguar and Infiniti.

More insights are available from Cox Automotive on new-vehicle inventory, using a 30-day rolling sales methodology to calculate days’ supply.