Data Point

New-Vehicle Inventory Increases as 2025 Model Years Begin to Arrive; Automakers Take Notice

Thursday June 13, 2024

Article Highlights

- Days’ supply decreases to 74 days, down four days from the start of May and up 43% year over year.

- Older inventory finally starts to move, making way for 2025 model year units, which have begun to arrive in force, more than doubling from the end of April.

- The average listing price for a new vehicle is stable, though affordability remains an issue for most customers.

After starting slow, May new-vehicle sales picked up toward the end of the month as expected with the Memorial Day holiday, one of the larger selling holidays for the automotive market. Spurred in part by higher sales, new-vehicle days’ supply declined four days at the start of June to 74 days, according to an analysis of Cox Automotive’s vAuto Live Market View data.

2.89M

Total Inventory

as of June 3, 2024

74

Days’ Supply

$47,455

Average Listing Price

Dealers were able to move the older metal, reducing the previous model year’s supply by 2%; however, this welcome news was offset by the arrival of 2025 models, which increased by over 3%. Just this week, Ford CFO John Lawler spoke about the need for the industry to balance production carefully with demand. Also, General Motors CFO Paul Jacobson lowered the expected production for EVs in 2024. All signaling that while inventory remains high, manufacturers are taking notice and plan to adjust.

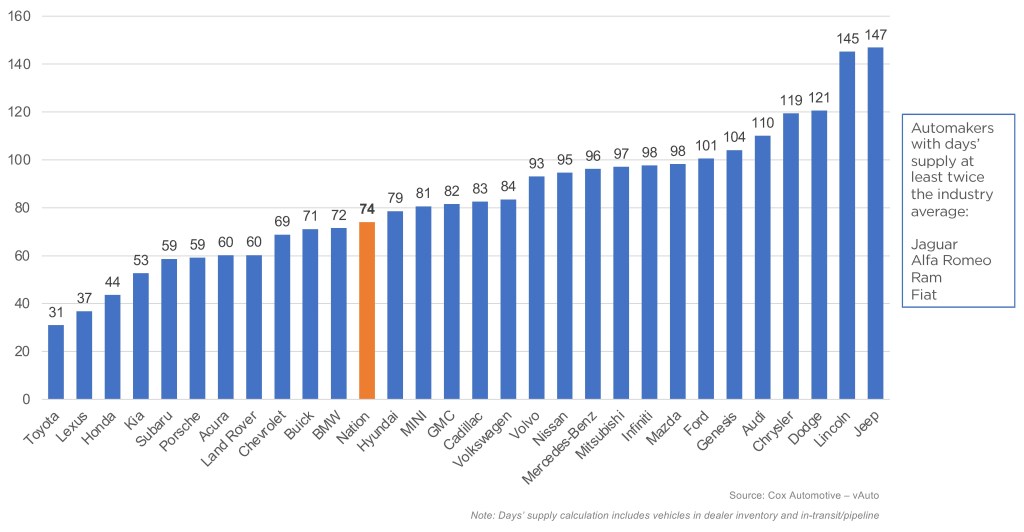

There is little new with the higher end of the inventory range story; Stellantis brands continue to hold some of the highest inventory in the country. Nearly two-thirds of auto brands are above the national average, while Toyota, Honda and Lexus remain on the other side of this story, with inventory levels near half the national average.

Buick remains one of the most affordable brands on the market, with an average listing price of $32,689. However, the company has a decent supply of MY2023 cars, keeping them at around 71 days’ supply. While this is high, it’s still below the industry average of 74.

At Ram, Jeep and Dodge, previous model year vehicles heavily weigh down their inventory, as Dodge sits on nearly 48% of older inventory, some of the industry’s highest. For now, Jeep and Dodge aren’t further hampered by new model year inventory flooding their lots, but that won’t be the case for long as they both expect exciting new additions in September. Ram, however, is already seeing their newest models arrive while still holding onto about 6% of older models, and they remain one of the industry outliers with days’ supply well in excess of twice the industry average.

The total U.S. supply of available unsold new vehicles opened June at 2.89 million units. Inventory volume has increased by more than 1 million in the past year, which means we are now at 55% more than a year ago. Inventory volume at the start of June was up from a revised 2.84 million at the start of May when days’ supply was 78.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period, which ended June 3. Sales during that period ran 9% ahead of a year ago. According to Kelley Blue Book estimates, the seasonally adjusted annual rate (SAAR) of sales in May was 15.9 million, the fastest sales pace of 2024 and keeping the industry generally on track to be the best new-vehicle sales year since 2019.

MAY DAYS’ SUPPLY OF INVENTORY BY BRAND

The average listing price for a new vehicle at the start of June was $47,390, lower by $107 compared to one year ago. Listing prices have seemingly stabilized, and while this is good for consumer expectations and planning, affordability remains an issue, with prices still well above 2019. To compound this, lower-priced inventory remains in short supply, with vehicles listing at $40,000 or below sitting at an average 60 days’ supply.

The average transaction price (ATP) of a new vehicle in the U.S. in May was $48,389, statistically unchanged from a month prior, according to Kelley Blue Book. As expected with the Memorial Day kick-off to the summer selling season, we saw higher incentives and discounts at 6.7% of average transaction price, an increase from April and the highest level since May 2021. As noted earlier, new model year vehicles are starting to fill up dealer lots. Therefore, we expect that incentives and discounts are here to stay and may increase, especially with the latest Fed decision meaning there will be no relief on interest rates.

Erin Keating

Erin Keating is an Executive Analyst and Senior Director of Economic and Industry Insights at Cox Automotive. She has 25 years of experience in marketing and communications, including 10 years with Audi of America, where she also ran Audi Motorsport North America. With a focus on the wider industry, the individual automakers, and consumer shopping and buying behavior for new vehicles, Erin provides analysis and insights leveraging the breadth and depth of data from DRiVEQ, Cox Automotive’s data intelligence engine. Upon joining Cox Automotive, Erin was responsible for Enterprise Data Strategy – Partnerships. Erin is based in Atlanta.