Data Point

New-Vehicle Inventory Rises Despite UAW Strike; GM Most Vulnerable

Thursday October 5, 2023

Article Highlights

- New-vehicle inventory opened September at 2.21 million units, the highest since spring 2021.

- GM is most vulnerable to the strike with tight inventory; Stellantis is less so with the highest.

- Days’ supply hit “ideal” 60; the average asking price dipped.

Updated, Nov. 10, 2023 – Despite a UAW strike against Detroit’s three automakers and brisk sales, October opened with the highest new-vehicle inventory since early spring 2021, according to Cox Automotive’s analysis of vAuto Available Inventory data. But the strike has left GM with 60 days’ supply at the start of October and the most vulnerable with short supplies of big profit-generating Chevrolet and Cadillac models. Ford Motor Company started October with 90 days’ supply, and Stellantis at 111.

2.21M

Total Inventory

as of Oct. 2, 2023

60

Days’ Supply

$47,313

Average Listing Price

The total U.S. supply of available unsold new vehicles climbed to 2.21 million units, the highest level since early spring 2021. That is up 60% from the same time a year ago. However, inventory remains 35% lower than pre-pandemic 2019. Inventory numbers include vehicles available on dealer lots and some in transit.

Days of supply stood at 60 at the start of October, the same as the start of September. Inventory, measured as days’ supply, was 14 days higher than the same time a year ago. Supply has been inching toward that 60-day level, which the industry once considered normal and ideal, throughout the year. It was last in the 60s in March 2021.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period ended Oct. 2. Initial estimates of September and third-quarter sales suggest the U.S. light-vehicle industry rose by 20% in September from a year ago and was up 17% for the third quarter versus last year.

“Inventory levels remain relatively stable, and, with the exception of some GM models, Detroit automakers have ample inventory for now to keep them operating through the coming month,” said Charlie Chesbrough, Cox Automotive senior economist. “Some brands have inventory buildup, so production disruptions will take time to feed through the distribution network. However, the strike could start to have an impact in the coming weeks if it continues.”

Chevrolet, Cadillac Supplies Tight as the UAW Strike Goes On

In reporting its third-quarter sales, GM reported that it ended the quarter with the largest inventory of new vehicles on dealer lots since 2020, the first year of the pandemic. However, of the Detroit automakers being struck by the UAW, GM’s Chevrolet and Cadillac brands have the lowest inventory, making them the most vulnerable to a lengthy strike.

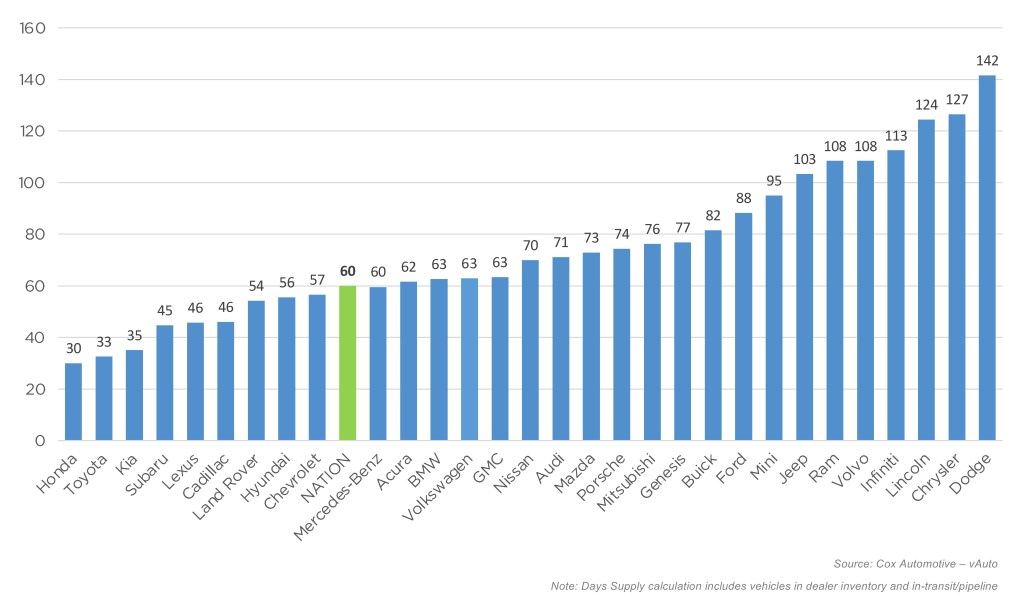

SEPTEMBER DAYS’ SUPPLY OF INVENTORY BY BRAND

Chrysler and Dodge have the highest inventory levels, while Honda, Kia and Toyota are lowest.

Chevrolet, at 57 days’ supply, and Cadillac, at 46, have supply levels below the industry average. They had the lowest supply of all domestic brands going into the strike and are being squeezed further as the strike progresses. They are the only two domestic brands with below-average inventory. Of GM’s other brands, Buick has the most stock at 82 days’ supply. GMC, at 63, is also above average.

More importantly, the Chevrolet and Cadillac models that are in the tightest supply are its most popular ones and, in many cases, the biggest profit generators.

The volume-leading, hefty profit-producing Chevrolet Silverado pickup truck had a decent-sized inventory with a 90 days’ supply at the start of October, the kick-off to what is normally the busiest selling season for full-size pickup trucks. The Silverado heavy-duty, however, had a low supply. The Chevrolet Corvette had the lowest supply among GM models at 23 days’ supply.

The Chevrolet Tahoe and Suburban, which also generate huge profits for GM, had inventory under 30 days’ supply. Likewise, the Cadillac Escalade models had only a 30 days’ supply.

The Chevrolet Traverse SUV, which had its Lansing, Mich., production site added to the list of strike targets on Sept. 29, had only 55 days of supply. However, the Buick Enclave, also built at the plant, has a beefy 141 days of supply.

The mid-size Chevrolet Colorado and GMC Canyon pickups, which were just revamped and were in launch mode when the strike started, had only 29 days of supply. The Wentzville, Missouri, plant where the pickups are made is on strike. The plant also makes GM’s cargo vans, which have average to below average supply depending on the model.

The Chevrolet Trax, just revamped and priced attractively in the mid-$20,000s, is in tight supply at 33 days due to its popularity and fresh launch. However, it is not affected by the strike as it is made in South Korea.

Stellantis has Plenty of Supply to Weather the Strike

As has been the case all year, Stellantis brands had the heftiest supply of not only Detroit automakers but all brands, suggesting it can best weather the strike.

Stellantis’ four volume brands have days’ supply in the triple digits. Dodge and Chrysler had the highest days’ supply of all brands – luxury and non-luxury – at 142 and 127, respectively. Those brands, along with Ram, at 108, and Jeep, at 103, have the highest days’ supply among non-luxury brands. The strike has made barely a dent in inventory for Jeep models produced at the Toledo, Ohio, plant, which makes them and is on strike. The Jeep Wrangler and Gladiator have days’ supply of 77 and 116, respectively.

Ford has Some Shortages; Lincoln Swimming in Inventory

Ford Motor Company’s inventory levels vary widely depending on make and model. Ford’s Lincoln brand has the highest days’ supply at 124 of all luxury brands.

Ford brand is at 88 days’ supply. The all-important F-150 had 97 days of supply at the start of October. The Ford Explorer had the beefiest inventory of any of the top 30 selling models, with 119 days’ supply.

Last Friday, the UAW struck the Chicago plant that produces the Explorer and the Lincoln Aviator, which has a whopping 256 days’ supply. The plant also produces Ford’s police vehicles, which are also in low supply.

Workers are also on strike at the Ford Wayne assembly plant in Michigan that makes the Bronco and Ranger. The popular Bronco had its supply drop to 45 days. The Ranger is at 33. Made in Mexico, Maverick is perpetually in low supply and has a scant 32 days of supply. The most affordably priced pickup from Ford, it has been a hit with buyers since it launched in the second half of 2021.

Aside from these few shortages, Ford has ample stock of other models, including the Escape and Bronco Sport. Some models have days’ supply in the triple digits.

Low Import Inventory Prevents Capitalizing on the UAW Strike

The UAW strike against the Detroit automakers could have allowed competitors to grab sales and market share. However, competitors have scant inventory.

As usual, Honda, Toyota, Kia, Subaru and Hyundai have the lowest supply among non-luxury brands. Of luxury brands, Lexus, Mercedes-Benz and Acura have the lowest.

Eight of the top-selling 30 models with the lowest supply are Asian imports, specifically from Toyota, Honda and Kia. At the very bottom are the Honda CR-V and its hybrid version, the new Toyota Grand Highlander and the Toyota Corolla.

Eight of the top-selling 30 models with the highest inventory are domestic trucks and SUVs, led by the Ram 1500 at 119 days’ supply.

Average New-Vehicle Price Dipped

The average listing price – or asking price – bounced around a bit throughout September. At the start of October, it was $127 lower than a month earlier. The average listing price of $47,313 was 2.5% above the same time a year ago.