Data Point

Kelley Blue Book Report: New-Vehicle Prices Climb in November, While Higher Incentives Continue to Entice Buyers

Wednesday December 11, 2024

Article Highlights

- New-vehicle prices in November were higher year over year for the second straight month, as vehicle costs reached $48,724.

- Incentive spending jumped to 8.0% of the average transaction price in November, an increase from 7.8% in October. Incentive spending has increased for five consecutive months as new-vehicle inventory builds.

- New-vehicle sales surprised to the upside in November, as pent-up demand and improving consumer sentiment drove the market.

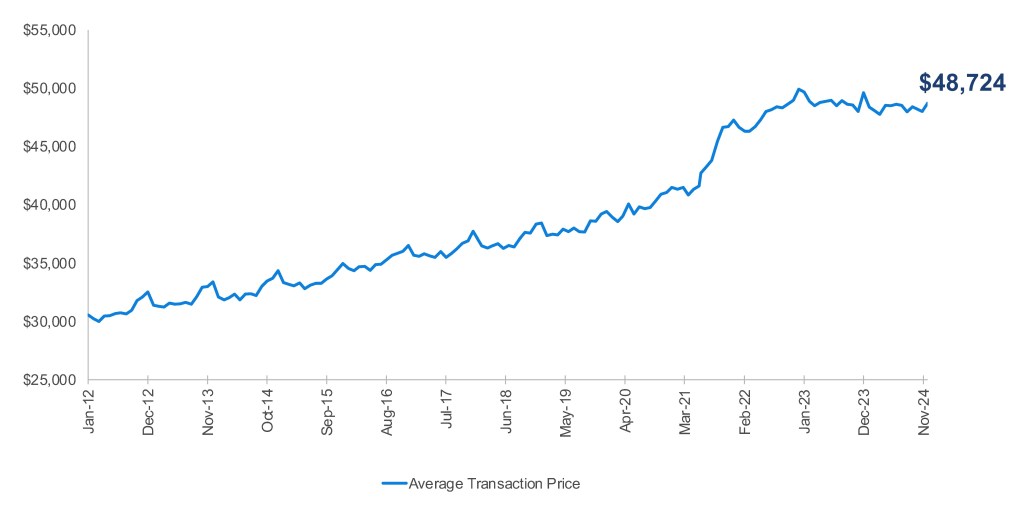

New-vehicle prices in November climbed higher year over year for the second straight month, according to data from Kelley Blue Book released today. Last month, the average transaction price (ATP) for a new vehicle was $48,724, an increase of $699, or 1.5%, from November 2023. The November ATP was also higher by $720 compared to the downwardly revised ATP in October of $48,004.

NEW-VEHICLE AVERAGE TRANSACTION PRICE

New-vehicle inventory at the start of November was above 3 million units for the first time since 2020, providing new-vehicle shoppers with excellent buying opportunities. And buy they did. Despite higher prices, sales last month topped 1.36 million units, according to Kelley Blue Book, and delivered a seasonally adjusted annual rate (SAAR) of sales of 16.5 million, the best sales pace since the spring of 2021.

“Higher prices were met with higher discounts in November, which has kept the retail business moving,” said Cox Automotive Executive Analyst Erin Keating. “Following the national election, pent-up demand and some improvements in consumer confidence seem to be driving the market. And higher incentives are certainly helping as well.”

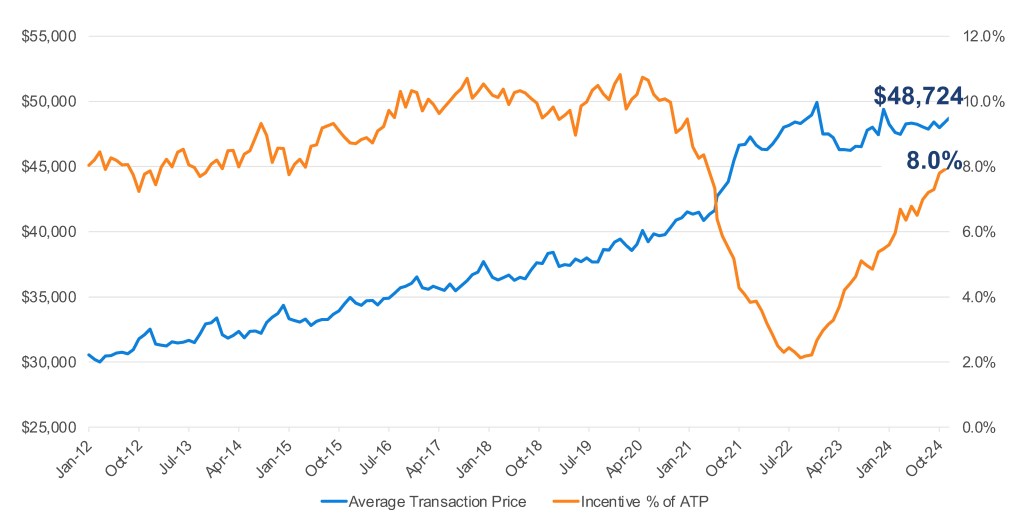

Sales incentives for new vehicles in November averaged 8.0% of ATP, up from 7.8% in October. Incentives have now increased for five straight months. One year ago, in November 2023, incentive spending was equal to 5.3% of ATP. Incentives last month were higher by more than 50% year over year (approximately $1,300), while vehicle prices increased by only 1.5% (approximately $700), helping improve affordability and likely boosting vehicle sales.

INDUSTRY AVERAGE TRANSACTION PRICE VERSUS INDUSTRY AVERAGE INCENTIVE SPEND AS % OF ATP

Transaction prices in November, at $48,724, were at the highest point of 2024 and are up 2.3% since January. In any given year, vehicle transaction prices typically peak in December. ATPs reached an all-time high of $49,926 in December 2022. Last December, the Kelley Blue Book ATP estimate was $49,023, the highest ATP of 2023.

“The end of the year typically sees an increase in transaction prices, as luxury sales pick up as the year winds down,” added Keating. “If sales volumes in November are any indication, we think 2024 will end on a positive note for the auto business. Yes, prices are trending higher year over year, but higher incentives and discounts are bringing in buyers.”

New-Vehicle Incentives Vary Widely

While the average new-vehicle incentives in November were equal to 8.0% of the ATP, the amount of discounting in the market varied widely across the many brands, with a majority exceeding the industry average. Of the mainstream brands tracked by Kelley Blue Book, 14 posted incentive spending below the industry average in November, with Porsche, Land Rover, Toyota and GMC continuing to offer some of the lowest incentive levels in the market. Last month, Porsche’s incentive spending per vehicle averaged just 2.9% of the vehicle transaction price, which was over $115,000 last month for the German sports car brand.

Meanwhile, 20 brands had above-average incentive spending in November, with 11 of the 20 spending above 10% of ATP. Volkswagen, Ram, Audi and Nissan were a few of the market’s most generous brands in terms of incentive spending in November.

Segments with the lowest incentive spending last month were High-Performance Cars, Compact Cars and Small/Midsize Pickups. On the high side, according to the latest Kelley Blue Book report, were Luxury Cars, Full-Size Pickups and Compact SUVs.

The Compact SUVs segment, which accounts for nearly 1-in-5 new-vehicle sales in the U.S. market, continues to be the most popular and competitive segment in the U.S. market. More than 20 excellent models are competing in the segment, and the average price for a new Compact SUV in November was $36,858, higher year over year by 1% but lower than the industry average by more than 30%. Last month, incentive spending in the Compact SUV segment was 10.2% of ATP, a jump from 9.4% in October and an indication of the competitiveness of the popular Compact SUV segment. Only the High-End Luxury Cars segment (BMW 7-Series, Mercedes S-Class, Lexus LS, etc.) had higher incentives, at 11.6% of ATP.

EV Incentive Climb Higher, Prices Fall from October

New electric vehicle sales were also strong in November, with initial estimates suggesting that November volume in the U.S. market was the second-best ever, behind only August 2024. And the story is likely similar to the broader market – higher incentives are helping.

In November, Kelley Blue Book estimates show that the average transaction price for a new EV was $55,105, a decrease of 1.8% from the downwardly revised October price. EV prices last month were lower year over year by 3.8%. Incentive spending on EVs jumped, reaching 14.9% of ATP, the highest level since the pandemic and an increase from the upwardly revised 14.6% in October. At 14.9% of ATP, the typical incentive package last month for a new EV exceeded $8,200, which includes, when applicable, point-of-sale government-backed incentives.

“We have said consistently that 2024 will be the ‘Year of More’ for electric vehicles,” added Keating. “There are certainly more incentives being offered. EVs right now are the best deals in the market.”