Data Point

Kelley Blue Book Report: New-Vehicle Incentives Climb Higher in October, as Many Automakers Work to Clear Inventory

Tuesday November 12, 2024

Article Highlights

- New-vehicle prices in October were up modestly year over year, at $48,623, according to the latest Kelley Blue Book data. Prior to October, transaction prices had been trending lower year over year through most of 2024.

- New-vehicle incentives in October climbed higher, reaching 7.7% of the average transaction price – an increase of more than 60% year over year.

- The Last One: In October, the Mitsubishi Mirage continued to hang on as the final new vehicle in the U.S. transacting for under $20,000.

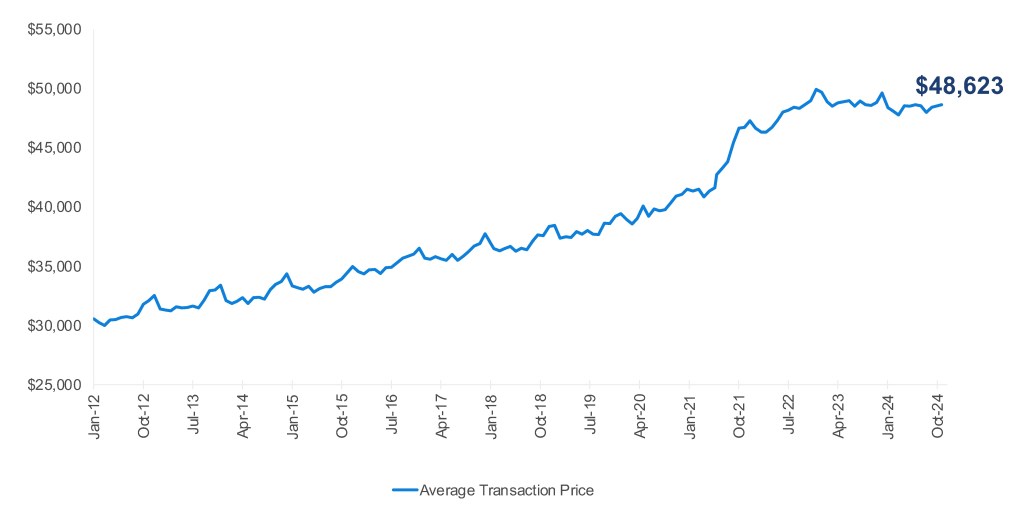

The average transaction price (ATP) paid for a new vehicle in the U.S. in October was $48,623, according to new data from Kelley Blue Book. Transaction prices last month were higher than the revised September price ($48,423) and higher by 1.7% from year-earlier levels ($47,826). For more than a year now, new-vehicle prices in the U.S. have remained mostly unchanged and near $48,500, as higher inventory levels continue to hold downward pressure on the market.

NEW-VEHICLE AVERAGE TRANSACTION PRICE

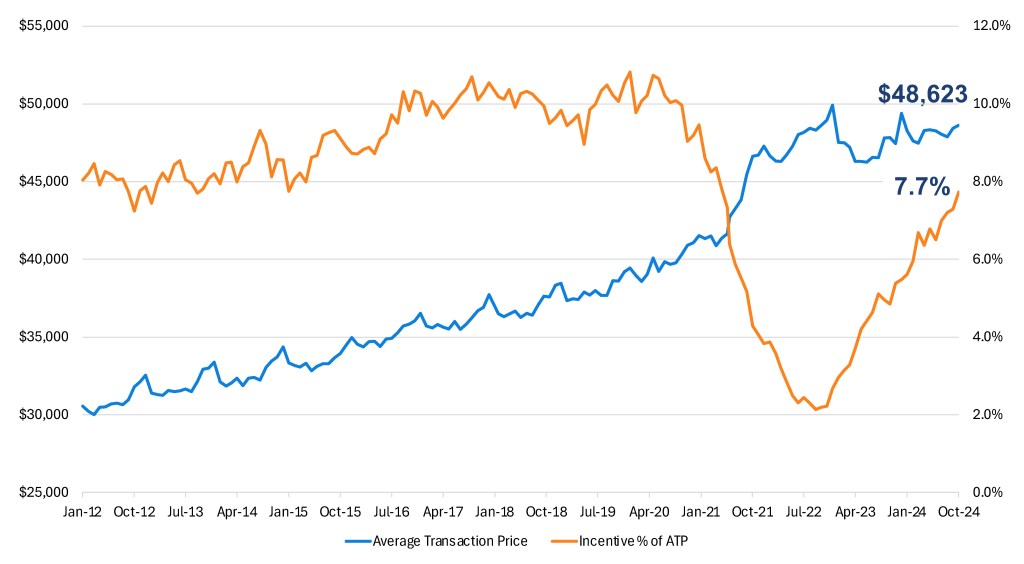

New-vehicle sales incentives climbed higher in October, jumping from a revised 7.2% of the ATP in September to 7.7% in October, an increase of more than 6% month over month. Compared to one year ago, new-vehicle incentives have increased more than 60% as automakers compete for sales.

INDUSTRY AVERAGE TRANSACTION PRICE VERSUS INDUSTRY AVERAGE INCENTIVE SPEND AS % OF ATP

“’Tis the season for automakers to make their final push for 2024 sales,” said Cox Automotive Executive Analyst Erin Keating. “While some automakers focus on managing production, many will likely maintain or even increase their seasonal incentives to attract buyers. With competition intensifying, these strategies will be crucial in maintaining market share and driving end-of-year sales. Our team is generally optimistic for new-vehicle sales to close out the year – extra incentives will certainly help.”

New-vehicle incentives have been climbing for more than two years after hitting a floor in the Fall of 2022. In October, eight mainstream automakers had average incentive packages above 10% of average transaction price, and all four of the Stellantis “domestic brands” – Chrysler, Dodge, Jeep and Ram – had incentive packages above the industry average, as the company works to clear inventory. Ram incentives were among the highest in the industry. Porsche, Toyota, Land Rover and Cadillac continue to have the lowest incentive spend.

Incentives Climb Higher in Major Market Segments

In the U.S. market, the top three vehicle segments routinely account for more than 45% of all vehicle sales, according to Kelley Blue Book analysis, and competitive price pressures have ATPs moving in different directions. Full-size pickup trucks, where sales have been relatively soft in 2024, saw year-over-year ATPs lower in October by 1.3% at $65,389, down from $66,256 in October 2023. ATPs for compact SUVs were mostly flat year over year, while midsize SUVs prices increased, but by less than 1.0%, below industry average.

Among the Big Three segments, incentives were highest – averaging 9.4% of ATP – in the competitive compact SUV segment, where 25 different models are fighting for sales. The average transaction price for a new compact SUV was $36,769 in October, nearly 30% below the industry average. Full-size pickup truck incentives averaged 8.7% of ATP last month, while midsize SUVs had incentive packages averaging 8.0% of ATP. In the midsize SUV segment, 30 models are vying for attention, including some EV models, such as the new Honda Prologue and Chevrolet Blazer EV. In the midsize SUV segment, average transaction prices are average indeed: $48,977 in October, within 1% of the industry average.

EV Transaction Prices

Electric vehicle ATPs, at $56,902 in October, were lower than the revised September estimate of $57,580. Year over year, EV prices were higher by 0.9%, and compared to the industry average, electric vehicle ATPs in October were higher by just more than 14%, roughly in line with the premium paid one year ago.

EV incentives in October, however, were much higher than one year ago, helping make electric vehicles more affordable for consumers. The average incentive package offered on an EV, including estimates for government incentives when applicable, was 13.7% of ATP, up from a revised 11.6% in September and well more than double the level seen one year ago when incentives were 5.6% of ATP. EV incentives have been elevated throughout 2024, according to Kelley Blue Book data, averaging near 11% of ATP, well above industry average.

The average transaction price for a new Tesla – the industry’s EV leader – declined in October from September to $56,705, according to an initial estimate, but was higher year over year by more than 10%. Lower month-over-month Tesla prices in October were likely influenced by a drop in Cybertruck ATPs, which fell below $100,000 for the first time since launch. In October, the Cybertruck ATP was $98,495. Sales were also lower, dropping to 4,254, the lowest total since June.