Commentary & Voices

Q2 2022 Kelley Blue Book Brand Watch Luxury Report: BMW on Top, Luxury Cars Gain Share, Rivian Arrives, and, SURPRISE!, Volvo not #1 in Safety

Tuesday August 9, 2022

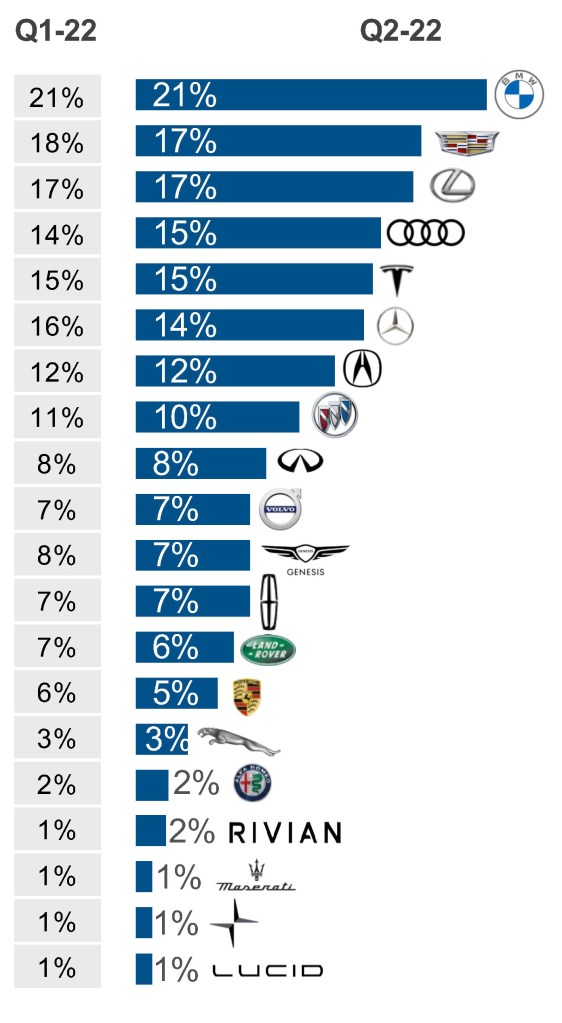

BMW remained the most-shopped luxury brand for the second consecutive quarter on increased interest in its sedans, likely due to high gas prices, according to the Q2 2022 Kelley Blue Book Brand Watch™ report. Overall, shopping for luxury cars increased due to high fuel costs and better availability of cars during the global computer chip shortage.

The Kelley Blue Book Brand Watch report is a consumer perception survey that also weaves in consumer shopping behavior to determine how a brand or model stacks up with its segment competitors on a dozen factors key to a consumer’s buying decision. Kelley Blue Book produces a separate Brand Watch report for non-luxury and luxury brands each quarter. Beginning in Q1 2022, the methodology includes surveying both mobile and desktop users instead of only desktop users.

BMW Remains No. 1

BMW had been the most-shopped luxury brand for three straight years until the fourth quarter of 2021 when Lexus squeaked by the German automaker. BMW took back the title in the first quarter of this year and held onto it in the second. Of all luxury shoppers in the second quarter, 21% considered a BMW, the same percentage as the first quarter this year. BMW’s strength came from increased shopping for its 3 Series, 4 Series and 7 Series cars, while the X5 SUV lost a bit of traction, as did many SUVs.

QUARTERLY BRAND CONSIDERATION

Cadillac pulled marginally ahead of Lexus for second most-shopped luxury brand. Both had approximately 17% of luxury shoppers considering the brands. Cadillac lost one percentage point of shopping despite making a lot of news in the second quarter that created more interest in the brand. It launched its first EV, the Cadillac Lyriq, and doled out intriguing hints about the upcoming flagship Cadillac Celestiq EV. Cadillac also had healthy inventory while Lexus continued to suffer a supply drought. Throughout the quarter, Lexus was last or near last for low inventory among luxury brands.

BMW’s fellow German rival Mercedes-Benz saw a 2-percentage point decline in shopping, the biggest drop of any luxury brand. However, Mercedes, with more inventory on hand, beat BMW in sales for the second quarter.

Tesla was the top-selling luxury brand again in the U.S. in the second quarter. Tesla ranked fifth in shopping, and Audi marginally surpassed Tesla, due to the A4 sell-down ahead of the introduction of the next generation. Tesla buyers often know precisely what they want and tend to do less comparative shopping than buyers of other luxury makes.

EV startup Rivian is gaining traction in the market and beginning to outpace other EV startups, like Lucid and Polestar, doubling its shopping consideration from the first to the second quarter. Even though only 2% of luxury shoppers considered the brand—sales only began late last year—Rivian had the same percentage of shoppers as Alfa Romeo, a long-time established luxury brand.

Buick, Genesis, Land Rover, and Porsche each lost one percentage point of shopping in Q2. Acura, Volvo, Lincoln, and Jaguar held steady from the previous quarter.

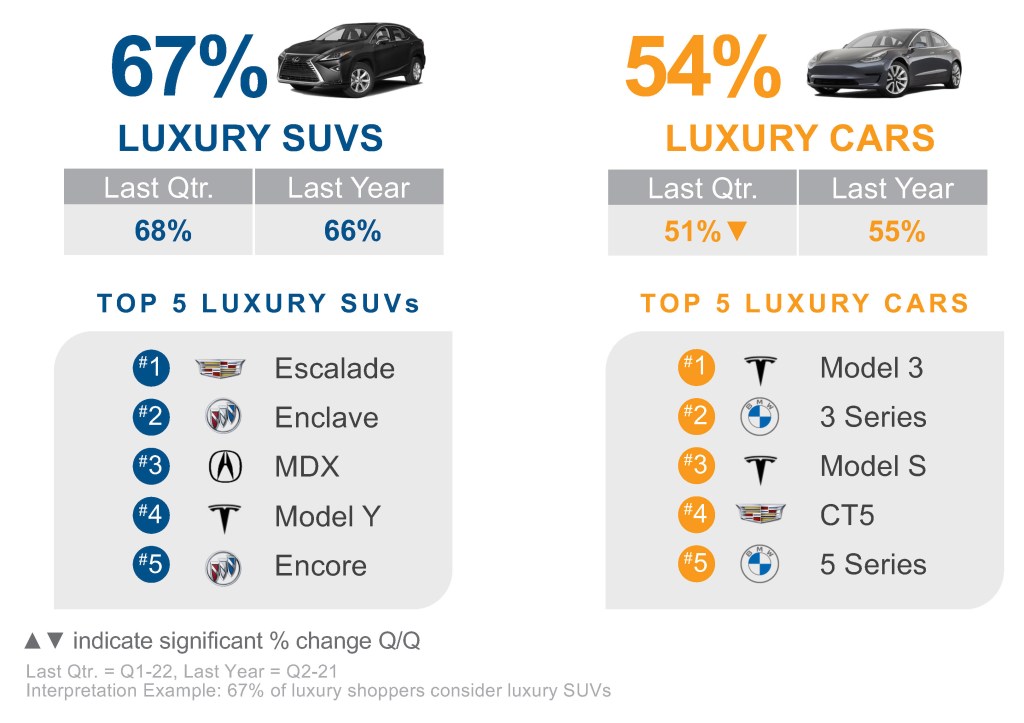

Luxury Car Shopping Made a Slight Comeback

Shopping for luxury cars made a bit of a comeback in the second quarter, rising three percentage points, likely due to higher fuel costs and better inventory of cars during the chip shortage. Of all luxury vehicle shoppers, 54% considered a luxury car, up from 51% in the first quarter but below the 55% of the second quarter a year ago. BMW, Tesla and Cadillac sedans pushed car shopping higher.

QUARTERLY LUXURY SEGMENT CONSIDERATION

The top five most shopped cars were Tesla Model 3, BMW 3 Series, Tesla Model S, Cadillac CT5 and BMW 5 Series. The Cadillac CT5, available as a 2023 model and with the performance Black Wing version, had a 15% hike in shopping. The Model 3 and Model S also had some of the biggest increases in shopping in Q2, up 13% and 8%, respectively.

SUVs Still Supreme

Still, SUVs remained more popular than cars. Of all luxury vehicle shoppers, two-thirds considered an SUV, about the same percentage that it has been for some time.

For the second consecutive quarter, the Cadillac Escalade was the most-shopped luxury SUV and thus the most shopped luxury vehicle, even though shopping consideration for the big Cadillac fell 10%. Rounding out the top 5 most-shopped luxury SUVs were, in order, the Buick Enclave, Acura MDX, Tesla Model Y and Buick Encore

Losses and gainers in shopping among the top 5 were mixed. The Buick Enclave suffered a 20% drop in shopping, but the Encore was up 17%. The Encore is a small, inexpensive gas sipper that GM is discontinuing after the 2022 model year. Moving up three positions to No. 4 was the Acura MDX, with a 4% gain in shopping traffic even though supply is low. Shopping for the Tesla Model Y fell 10%.

SUV shopping will get a boost in the second half of 2022 with several new models, including performance variants, along with redesigned versions of current SUVs, like the market-leading Lexus RX and Mercedes-Benz GLC.

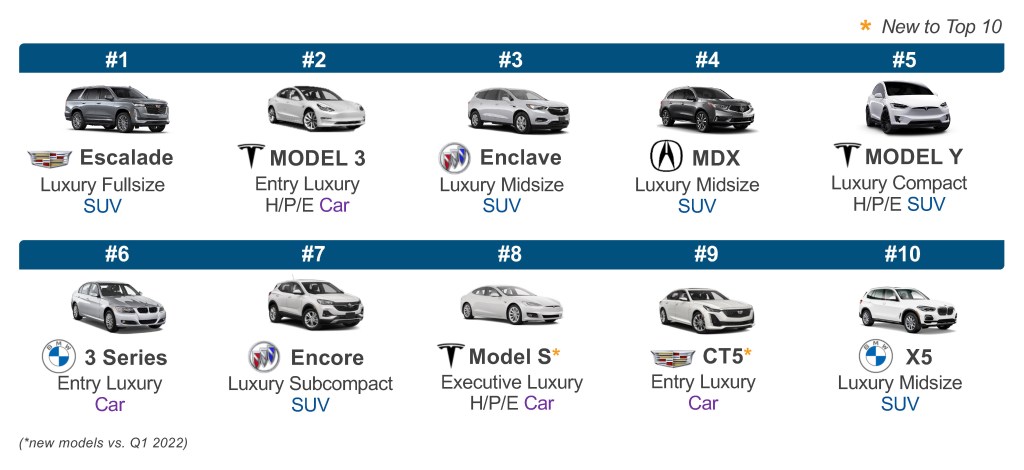

SUVs, Domestics Dominate Top 10

For the Top 10 most-shopped luxury vehicles—cars and SUVs combined—SUVs dominated with six on the list. Seven of the 10 most-shopped luxury vehicles were made by domestic brands, which have had better inventory than Asian and European makes.

TOP 10 LUXURY MODELS CONSIDERED

Tesla had the most models on the top 10 list at three. Cadillac, Buick and BMW each had two. Acura rounded out the list with one.

The Acura MDX moved up three positions to No. 4. The Tesla Model S sedan returned to the Top 10. The Cadillac CT5 sedan made its debut on the top 10.

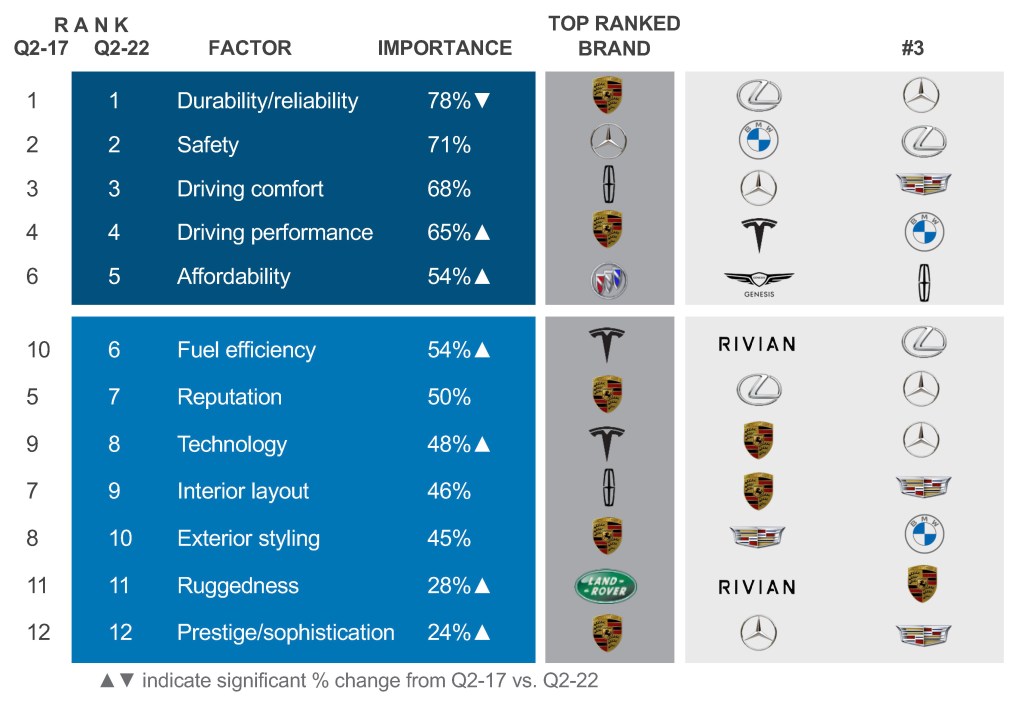

Fuel Efficiency Gains in Importance

In the past five years, and even more so since gas prices soared beginning in March, Fuel Efficiency has increased in importance to luxury vehicle shoppers, ranking now at No. 6—up from No. 10 a year ago—among the dozen most important factors.

With average transaction prices setting records, Affordability also gained in importance as has Technology. Reputation is now ranked No. 7, down from No. 5. Interior fell to No. 9 from No. 7. Exterior Styling also is less important.

FACTORS DRIVING LUXURY CONSIDERATION

Porsche dominated in the dozen factors most important to luxury shoppers. The German brand took the top honors in five categories: Durability/Reliability, Driving Performance, Reputation, Exterior Styling and Prestige/Sophistication. Porsche is the only non-Japanese brand to top the leaderboard in Durability/Reliability. The accolades may be due to improvements in mileage range and faster charging capabilities for the 2023 Porsche Taycan. The 911 Turbo S also has received glowing buzz for its world-class performance and classic striking design.

Newcomer Rivian is the first of the recent EV startups to gain notice in the Kelley Blue Book Brand Watch list of factors important to luxury shoppers. It ranked second only to Tesla in Fuel Efficiency and second to Land Rover in Ruggedness.

Lincoln grabbed two top-place finishes – in Driving Comfort and Interior Layout. Crosstown rival Cadillac was third in those two categories. It was also third in Prestige/Sophistication and second in Exterior Styling.

Mercedes-Benz outperformed Volvo for Safety for the first time since Q3 2014. In fact, Volvo fell out of the top 3 for safety in Q2 2022, and the fall was noticeable: It has been nearly eight years since Volvo was NOT #1 in safety.