Commentary & Voices

Q4 2020 Kelley Blue Book Brand Watch Report: Hey, Bottom-for-Cars, Are We There Yet?

Thursday February 4, 2021

Article Highlights

- Shopping consideration for pickups surpasses car shopping for the first time.

- Top 10 most-shopped list includes no cars for the first time.

- Subaru moved toward dominating the most important factors to consumers.

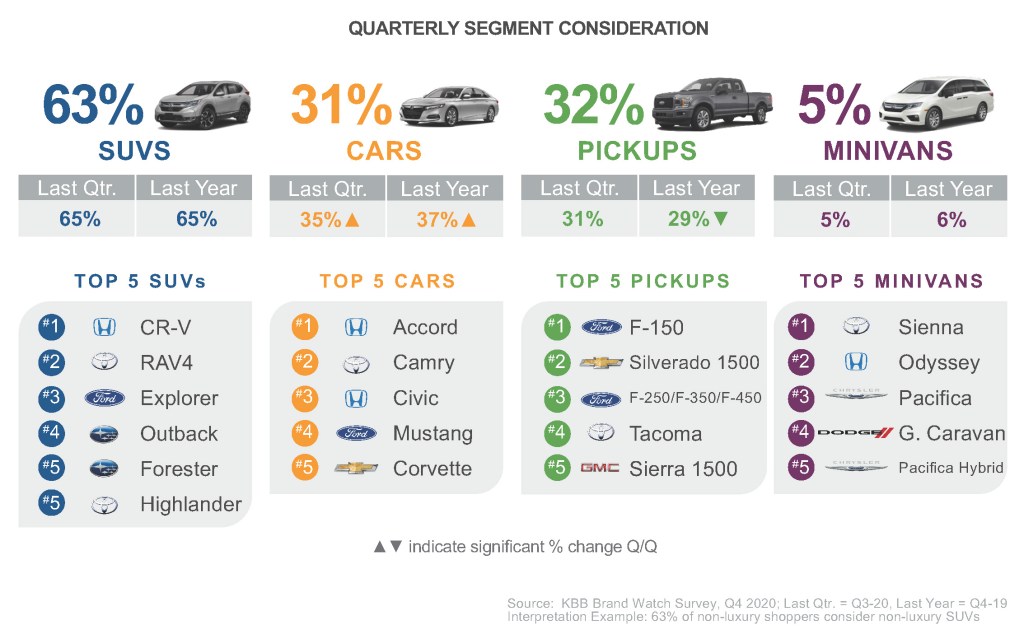

Shopping consideration for pickup trucks overtook shopping consideration for cars during 2020’s fourth quarter, a first in the history of the Kelley Blue Book Brand Watch Report. SUV shopping reigned supreme.

The Brand Watch Report is a consumer perception survey that also weaves in shopping behavior to determine how a brand or model stacks up with its segment competitors on a dozen factors key to a consumer’s buying decision. Kelley Blue Book produces separate Brand Watch reports for non-luxury and luxury brands each quarter.

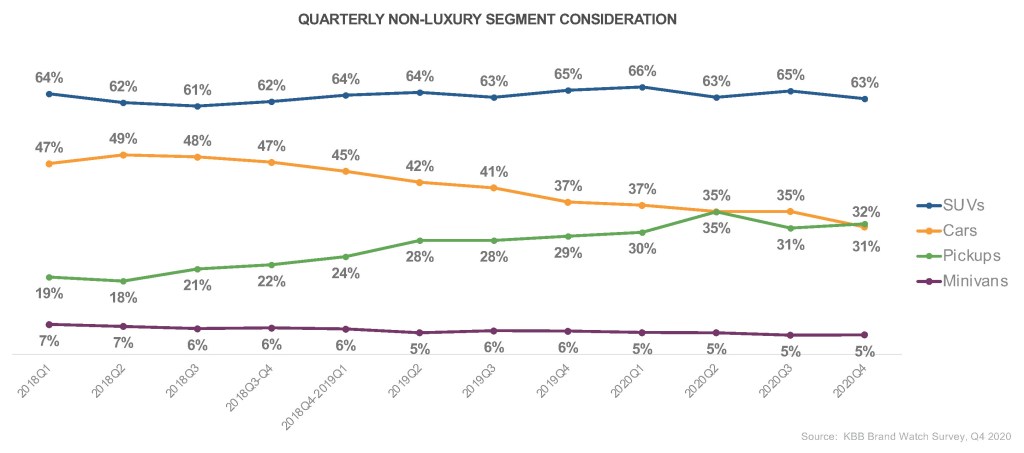

Pickup truck consideration surpassing car consideration was due to the falloff of cars more than the rise of trucks, according to the Q4 2020 Kelley Blue Book Brand Watch Report for non-luxury vehicles. Shopping consideration for cars has been on the decline for five years. In Q4 2020, a scant 31% of all non-luxury shoppers considered a car. Sales also fell, with car market share falling to an all-time low of 23.5% in Q4 2020 and closing the year at 24.4%.

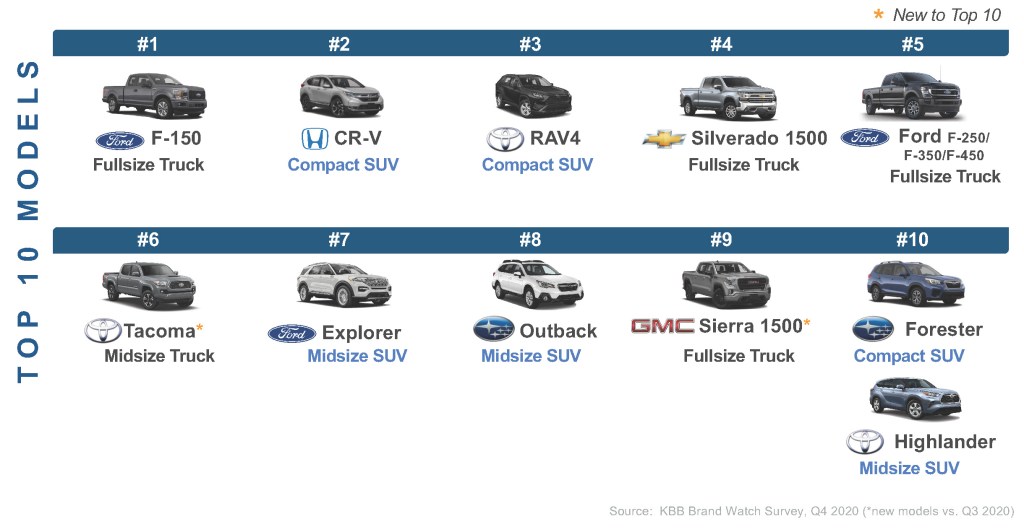

Not a single car made the Top 10 most-shopped vehicles list in Q4 2020 for the first time. Instead, half were pickup trucks with two models making their debut on the list. The rest were SUVs.

Trucks pick up steam

Shopping consideration for pickup trucks has been rising for a few years. In the latest Cox Automotive Car Buyer Journey study, 28% of truck buyers replaced a truck that was over 10 years old compared with 20% of SUV buyers and 21% for car and minivan buyers.

A record 35% of all non-luxury vehicle shoppers in the second quarter of 2020 considered a pickup truck, lured by pandemic-induced incentives, most notably 0% financing. Truck consideration then took a slight breather in Q3 2020 but picked up steam again in Q4 2020. Truck shopping converted into sales as the market share for trucks rose to 19.9% of all sales in the fourth quarter and closed the year at 20.2%.

New entries likely will continue to buoy sales. The redesigned Ford F-150 is just hitting the market. Nissan launches a new Frontier this year. Ford and Hyundai are expected to roll out compact pickups. And there’s a host of EV pickup trucks headed to the market as well.

Making their debut on the Top 10 most-shopped list were the GMC Sierra and Toyota Tacoma. The full-size Sierra climbed three spots to No. 9, thanks to a 22% gain in shopping consideration. Its Q4 sales rose 14%. The GMC’s sibling, the Chevrolet Silverado 1500, retained its No. 4 position with an 8% rise in shopping consideration; its sales rose 10% in the quarter. Tacoma, the best-selling midsize truck for 14 years, jumped five places to No. 6 with a 20% surge in shopping consideration.

The Ford F-150 remained the No. 1 considered non-luxury model for the fourth straight quarter and, of course, the most-shopped pickup truck. However, the F-150’s shopping consideration fell 10% in Q4 2020 as it began rolling out the completely revamped model, a seemingly slow launch. F-Series fell 15% in the quarter.

Shopping for the larger F-Series pickups – F-250, F-350, F-450 – picked up steam, growing 17% and pushing them to No. 5 among most-considered vehicles.

A year ago, the big story was Ram, when its sales surged in the second half of 2020 to beat Chevrolet Silverado for the year. In Kelley Blue Book Brand Watch, Ram’s shopping consideration and consumer perception soared. But it appears that performance was temporary. Ram fell back behind Silverado in sales and has settled back down to being No. 12 in consideration with only 6% of all consumers shopping the brand.

Japanese, sports cars dominate

Toyota and Honda insist they remain solidly committed to cars. To that end, Honda just launched a brand new Civic. Still, the Honda Accord tumbled from the Top 10 most-shopped list in Q4 2020, leaving no cars on the list.

Among the Top 5 most-shopped cars, the Chevrolet Corvette popped onto the list. The sports car was recently redesigned but has been plagued with production issues and supply chain disruptions throughout the pandemic. Regardless, it still did well in sales compared to 2019 and should perform even better in 2021 once production is ramped up. The Toyota Corolla fell off the Top 5 list, leaving the usual suspects – Toyota Camry, Honda Civic and Ford Mustang – to round out the list.

SUVs rule

Shopping consideration for SUVs overwhelmingly leads all vehicle segments, driven largely by interest in midsize and compact SUVs, now the No. 1 and No. 2 best-selling vehicle segments. Of all shoppers in the quarter, 63% considered an SUV, down a bit from a year earlier and the third quarter when it was at 65%.

Of the most-shopped non-luxury vehicles, three spots were occupied by compact SUVs. The Honda CR-V held onto the No. 2 spot, even though consideration was down by 16%, and Toyota RAV4 stayed at No. 3, with shopping consideration up 3%. The Subaru Forester tied for No. 10. The rest of the Top 10 list was rounded out by the midsize SUVs: Ford Explorer, No. 7; Subaru Outback, No. 8; and Toyota Highlander, tied for No. 10.

Minivans hold steady

Shopping consideration for minivans held steady at 5% of all shoppers – where it has been for the past four quarters, sliding from 7% in 2018.

The Toyota Sienna was the most-shopped minivan. At the end of the quarter, Toyota introduced a totally redesigned Sienna, available only as a hybrid. The Chrysler Pacifica hybrid popped onto the Top 5 list of minivans. The non-hybrid Pacifica, Honda Odyssey and Dodge Grand Caravan, which is being discontinued, rounded out the list. The Kia Sedona, which is scheduled for a redesign this year to give it a more SUV flavor, fell off the Top 5 list.

Toyota is tops; Chevrolet passes Honda

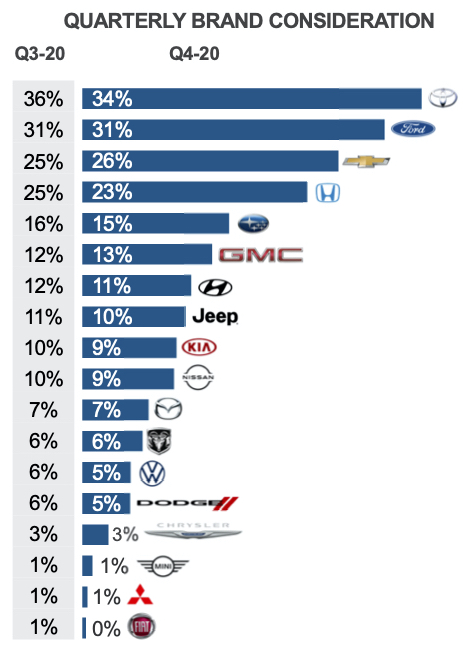

Toyota remained the most-shopped brand in the Q4 2020 Kelley Blue Book Brand Watch non-luxury report. However, its shopping consideration slipped. Of all shoppers, 34% considered a Toyota, down from 36% in the previous quarter. The RAV4 and Tacoma saw gains in shopping consideration. The Highlander saw a big drop of 15%.

Ford maintained the No. 2 spot with 31% of consumers considering the brand. Despite the steep decline in F-150 consideration, the bigger F-Series trucks made up for it. Ford could be in line for further gains in consideration as it launches a host of new models in 2021, starting with the redesigned F-150, the all-new Mustang Mach-E, and later in the year, the Bronco, which follows up the Bronco Sport that rolled out last year.

Chevrolet overtook Honda as the third-most shopped brand in the quarter. The two brands have jostled positions for almost two years. In the latest quarter, Chevrolet climbed to 26% shopping consideration from 25%. Honda slipped from 25% to 23%.

Subaru took the No. 5 spot, with 15% of consumers considering the brand, a slight decrease from the previous quarter.

Fiat Chrysler brands, now part of a newly merged company with PSA Group (Peugeot) called Stellantis, fell or were flat in shopping consideration. None of the Fiat Chrysler brands showed a gain. Jeep, most notably, dropped from No. 6 most-shopped a year ago, with 13% of consumers considering the brand, to No. 8 or 9 in the later quarters of 2020, with only about 10% consideration. That could reverse in 2021 as Jeep introduces a slew of new models.

GMC has been on the rise, gaining consideration and grabbing the No. 6 spot for another quarter.

Technology gains importance

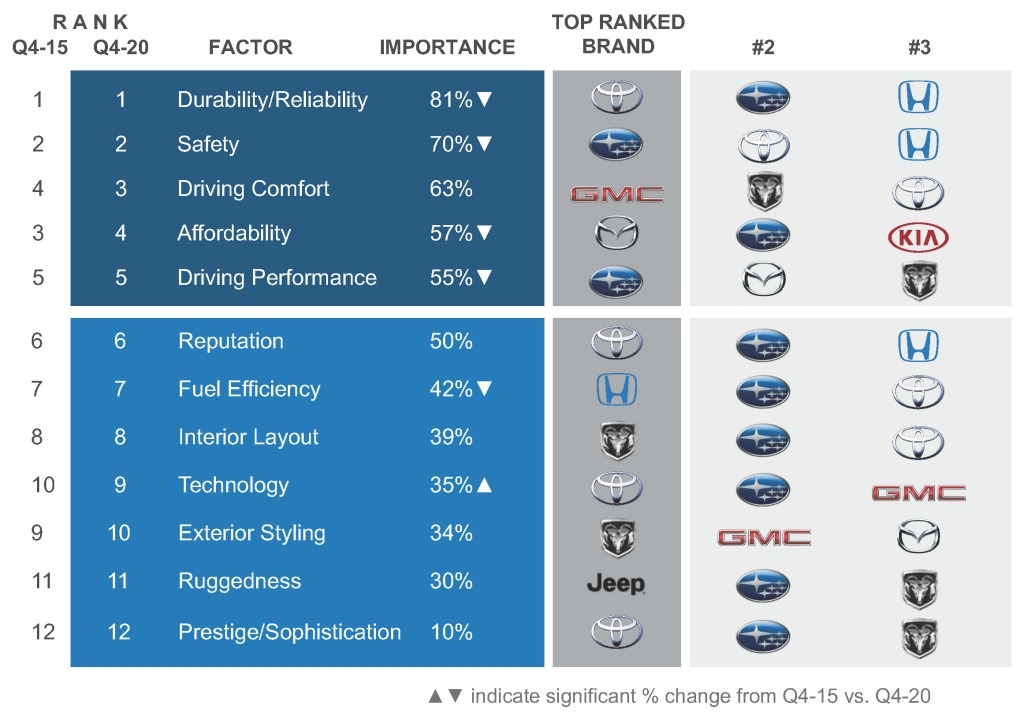

Of the 12 factors most important to shoppers, Durability/Reliability remained the top one again. Most other factors stayed in the same order they have been for five years.

However, Technology and Exterior Styling swapped places, with Technology climbing a rank. The move is indicative of the advancements being made in safety, creature comforts and driver-assist technologies as well as buzz for the future of autonomous, electrified and connected.

Toyota captured the most top spots among the factors, notably Durability/Reliability, Reputation, Technology and Prestige/Sophistication. Q4 2020 marked the first time in more than five years that Toyota took the Prestige/Sophistication title, possibly due to the re-introduction of the upscale Venza crossover.

Subaru’s brand perception came on strong in the quarter. It owned Safety, jumped ahead of Honda in Durability/Reliability, overtook Mazda in Driving Performance and is on the cusp of moving from No. 2 to No. 1 in eight of the top 12 factors important to car buyers.

Since Q3 2018, Honda has been losing dominance in purchase factors. Previously leading in seven categories, it took only the top spot for Fuel Efficiency in Q4 2020.