Data Point

A Record 1.2 Million EVs Were Sold in the U.S. in 2023, According to Estimates from Kelley Blue Book

Tuesday January 9, 2024

A record 1.2 million U.S. vehicle buyers chose to go electric last year, according to estimates from Kelley Blue Book, a Cox Automotive company. More specifically, 1,189,051 new electric vehicles (EVs) were put into service as the slow shift to an electrified future continued unabated. In 2023, the EV share of the total U.S. vehicle market was 7.6%, according to Kelley Blue Book estimates. That is up from 5.9% in 2022.

EV sales in the fourth quarter set a record for both volume and share: 317,168 and 8.1%, respectively. And while records were set, the oft-reported slowdown is real. Q4 EV sales increased year over year by 40% – a strong result by any measure, except when compared to the growth the industry saw in previous quarters. The market posted a 49% gain in Q3, and EV sales were up 52% year over year in Q4 2022. By volume, EV sales in Q4 were higher than in Q3 by roughly 5,000 units. The EV market in the U.S. is still growing, but not growing as fast.

The Cox Automotive Economic and Industry Insights team is calling 2024 “the Year of More” when it comes to EVs. More new product, more incentives, more inventory, more leasing, more infrastructure – all the more will combine to push EV sales higher in the year ahead. The team forecasts EV share of the U.S. market in 2024 will reach 10%.

According to December transaction price data shared during the Cox Automotive Industry Insights Webcast early in January, transaction price parity between internal combustion engine vehicles and EVs looks more realistic in the coming years. Still, EVs remain expensive. Last month, the average price paid for a new EV was $50,789, according to Kelley Blue Book estimates. Shifts in tax incentives will both help and hurt buyers in the year ahead – fewer vehicles now qualify, but the ability for dealers to apply any tax credits at the point of sale will help. Generally speaking, shoppers are still hard-pressed to find a new EV with a manufacturer’s suggested retail price below $40,000. In fact, there were two last month: The Chevy Bolt and Nissan Leaf.

Tesla remains the undisputed champion of EV sales in the U.S., capturing 55% of the EV market in 2023. That’s down from 65% in 2022, but lower prices are clearly fortifying the company’s position. Tesla’s share increased in Q4 after falling to an all-time low in Q3. Notably, the Model Y accounted for 33% of all EVs sold in 2023. Tesla’s share of the total U.S. market reached an all-time high of 4.20% in calendar year 2023, a number that was not lost on Tesla boss Elon Musk and his humor. Tesla outsold VW, Subaru and others in 2023.

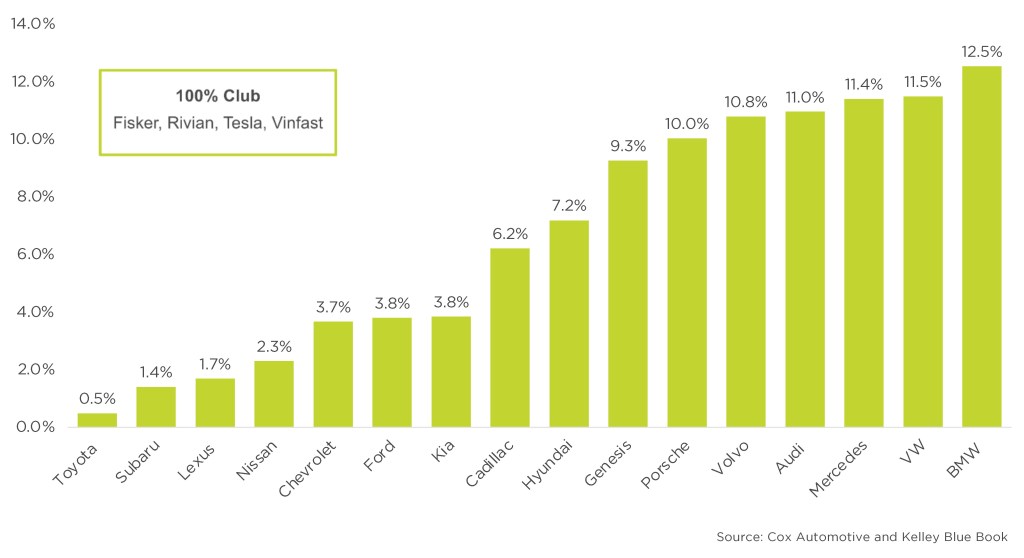

The German luxury brands have all lost share to Tesla over the past five years, but new products are certainly attracting luxury EV buyers back to the traditional Bavarian nameplates. Last year, 12.5% of BMW sales were EVs. Audi and Mercedes also increased their EV sales, which now account for 11% and 11.5% of total brand sales, respectively. Nearly all automakers should see their share of EV sales increase in the year ahead, and those not currently in the game will jump in.

2023 EV SHARE OF TOTAL BRAND SALES

Still, in the automobile business, nothing happens quickly. EV growth will continue to slow, and in the year ahead, we may even report the first quarter-over-quarter sales decline in more than three years. Regardless, the Cox Automotive Industry Insights team is forecasting more growth in the EV market. The momentum is there and is not going away.