Data Point

Fleet Sales Decrease in September, Stay Slightly Above 2020 Year-to-Date Level

Wednesday October 6, 2021

Article Highlights

- In September, 98,415 total fleet units were sold, a 12% month-over-month decrease compared to August and a 21% decrease from September 2020.

- This brings the 2021 year-to-date total fleet purchases of new vehicles to 1.3 million units, a 3% increase from this time in 2020 and a 41% decrease from the same time in 2019.

- Nissan saw the largest growth last month with more than 4,500 deliveries with General Motors seeing the largest decrease compared to September 2020.

In September, 98,415 total fleet units were sold, a 12% month-over-month decrease compared to 112,069 in August and a 21% decrease from September 2020 which recorded 124,930 units. This brings the 2021 year-to-date total combined large rental, commercial, and government purchases of new vehicles to 1.3 million units, a 3% increase from this time in 2020 when 1.2 million units were sold and a 41% decrease from the same time in 2019 when 2.2 million units were sold.

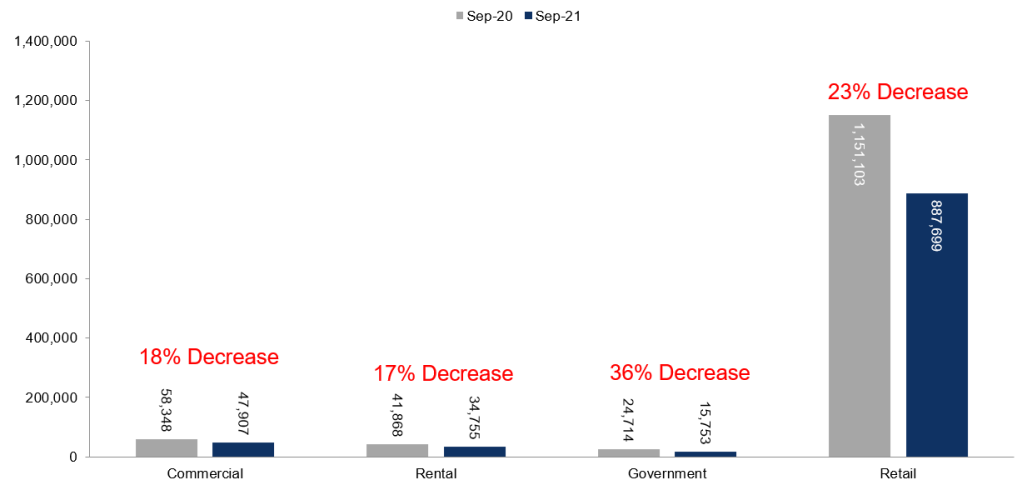

FLEET UNIT SALES – SEPTEMBER 2020 VERSUS SEPTEMBER 2021

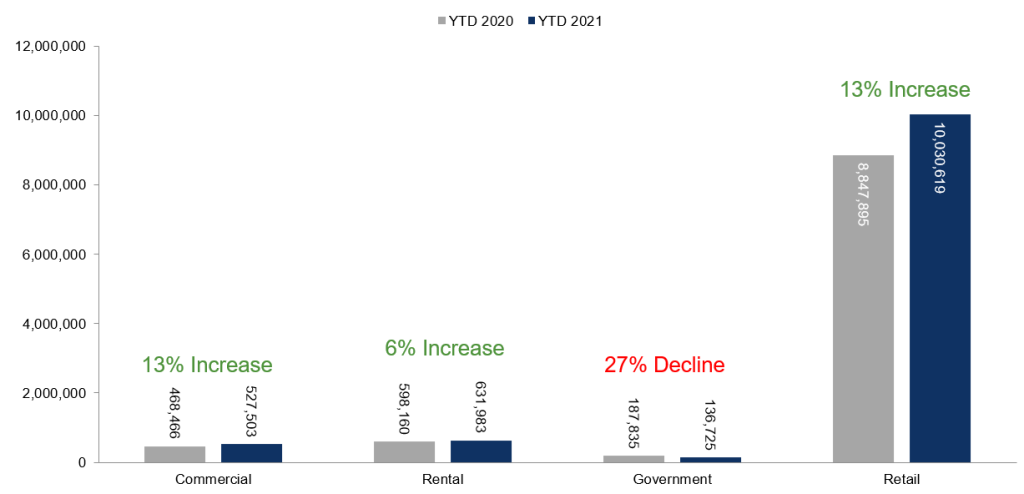

Combined sales into large rental, commercial, and government buyers were down 21% year over year in September. Sales into rental decreased 17% year over year in September and are up 6% compared to the same time period last year. Commercial sales are down 18% year over year in September and are up 13% year-to-date 2021 versus 2020. Including an estimate for fleet deliveries into the dealer and manufacturer channel, we estimate that the remaining retail sales were down 23% year over year in September, leading to an estimated retail seasonally adjusted annual rate (SAAR) of 10.7 million, which was down from 14.0 million last September and down from September 2019’s 13.8 million rate.

YEAR-TO-DATE FLEET SALES – 2020 VERSUS 2021

September total new-vehicle sales were down 25% year over year, with the same number of selling days compared to September 2020. Month over month, September new-vehicle sales were down 7%. The September SAAR came in at 12.2 million, a decrease from last year’s 16.3 million and September 2019’s 17.2 million rate.

Looking at automakers, year-over-year changes in fleet sales differed by manufacturer, ranging from a decline of 62% to an increase of 183%. Nissan saw the largest growth last month with more than 4,500 deliveries with General Motors seeing the largest decrease compared to September 2020.