Data Point

New-Vehicle Affordability Unchanged in September

Wednesday October 16, 2024

Article Highlights

- New-vehicle affordability was unchanged in September, as various factors offset any potential benefits for consumers.

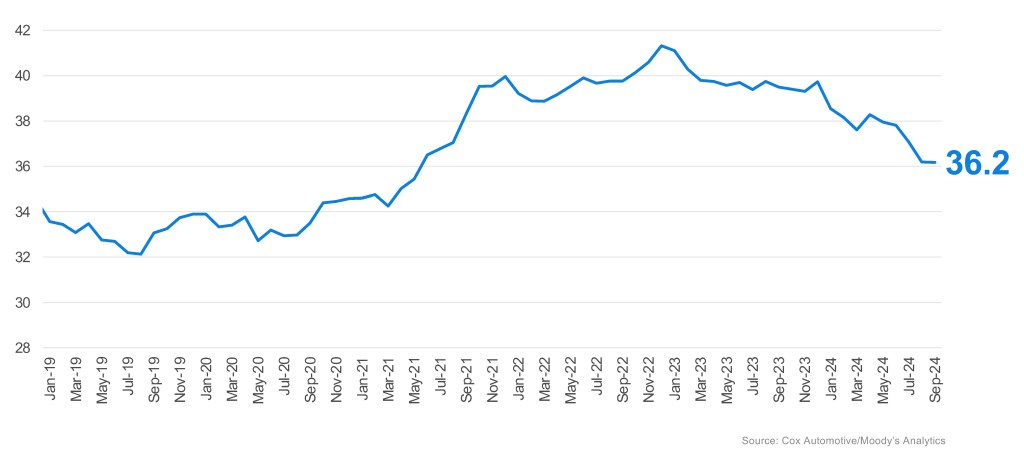

- The number of weeks of median income needed to purchase the average new vehicle remained steady at 36.2 weeks, following a slight upward revision in August.

- The typical payment in September increased 0.2% to $740.

New-vehicle affordability was unchanged in September, as various factors offset any potential benefits for consumers, according to the Cox Automotive/Moody’s Analytics Vehicle Affordability Index.

“Even with a larger-than-expected rate cut by the Fed in September, there hasn’t been a material improvement in auto loan rates or the overall affordability of new vehicles,” said Cox Automotive Chief Economist Jonathan Smoke. “Despite the minimal movement this fall, September was the first month in two and a half years in which auto loan rates decreased on a year-over-year basis.”

The estimated average auto loan rate declined in September by 30 basis points to 9.53%1, the lowest average rate in more than a year. However, the average new-vehicle price increased by 0.8% for the month. Countering the price increase were higher incentives and income growth, which was up 3.6% year over year.

The typical payment in September increased 0.2% to $740. The number of weeks of median income needed to purchase the average new vehicle remained steady at 36.2 weeks, following a slight upward revision in August. The last two months have seen the best affordability level since May 2021. The average monthly payment peaked at $795 in December 2022.

COX AUTOMOTIVE/MOODY’S ANALYTICS VEHICLE AFFORDABILITY INDEX

September 2024

Weeks of Income Needed to Purchase a New Light Vehicle

New-vehicle affordability in September was better than a year ago when prices were 0.4% higher and interest rates were higher. Incomes and incentives were also lower a year ago. The estimated number of weeks of median income needed to purchase the average new vehicle in September was down 8.4% from last year.

Click here for the full methodology for the Cox Automotive/Moody’s Analytics Vehicle Affordability Index.

The next update of the Cox Automotive/Moody’s Analytics Vehicle Affordability Index will be published on Nov. 15, 2024.

1 The index input of the average interest rate paid by consumers is calculated to reflect a 72-month, fixed-rate loan. For the latest Dealertrack estimated, volume-weighted average new loan rate, visit the Auto Market Snapshot.

The Cox Automotive/Moody’s Analytics Vehicle Affordability Index (VAI) is updated monthly using the latest data from government and industry sources, including key pricing data from Kelley Blue Book, a Cox Automotive brand. This important industry measure will be released at mid-month to indicate if the prices paid for new vehicles are moving out of consumers’ financial reach or becoming more affordable over time.