Smoke on Cars

UAW Strike Update

Friday September 29, 2023

Earlier this week, our team posted its new-vehicle sales forecast for September and the third quarter. Overall, as our senior economist Charlie Chesbrough notes, many analysts can’t help but be ‘pleasantly surprised’ with industry performance so far. There are certainly headwinds blowing in the automotive business, but our industry – thanks in large part to recovering fleet sales – continues to post solid new-vehicle sales that are most certainly profitable for dealers and automakers alike.

September is expected to see new-vehicle sales near 1.3 million and a SAAR of 15.5 million. Cox Automotive has updated its full year forecast, with expectations now that we will see total new-vehicle sales this year between 15.3 and 15.4 million units, a sizeable increase from the 13.8 million counted by our Kelley Blue Book team in 2022.

As I noted earlier this week during the Q3 Forecast and Insights call, if you were unaware of the industry’s headlines right now and came independently to the current sales and pricing data, you would not know the United Auto Workers had called a strike against the major domestic automakers and begun disrupting new vehicle production and parts distribution. Thus far, the impact has been fairly muted.

A defining characteristic of the automotive market so far in 2023 has been recovering new vehicle production leading to increasing new-vehicle inventories, growth in new-vehicle sales, improving affordability through modest price declines—or at least not increases—and more sales incentives. In other words, in many ways, we’ve seen a shift to more normal trends in most parts of the auto market.

The UAW strike which was expanded on Friday with new targets at Ford and General Motors is clearly a major factor that could, if it persists, disrupt the trends we have been observing through the first three quarters of 2023. Progress on normalization could give way to tightening supply and increasing prices for both new and used.

It is very hard to predict what will happen with this strike. The sides remain far apart on multiple issues. The “Stand Up” tactic by the UAW minimized the initial disruption, impacting only three production sites at first, but now the impact is beginning to grow. Recently, the UAW took aim at parts distribution facilities for GM and Stellantis across the U.S., sparing Ford, a tactic that is clearly intended to ratchet up pressure on the automakers’ bottom lines – the parts business is highly profitable – and also disrupt business at dealerships and directly impact consumers, who may see longer waits for repairs and service.

The Stand-Up approach could also enable a much longer disruption than historically has been possible. Time will determine how much of an impact we will see on aggregate sales, supply, and pricing of vehicles in the U.S.

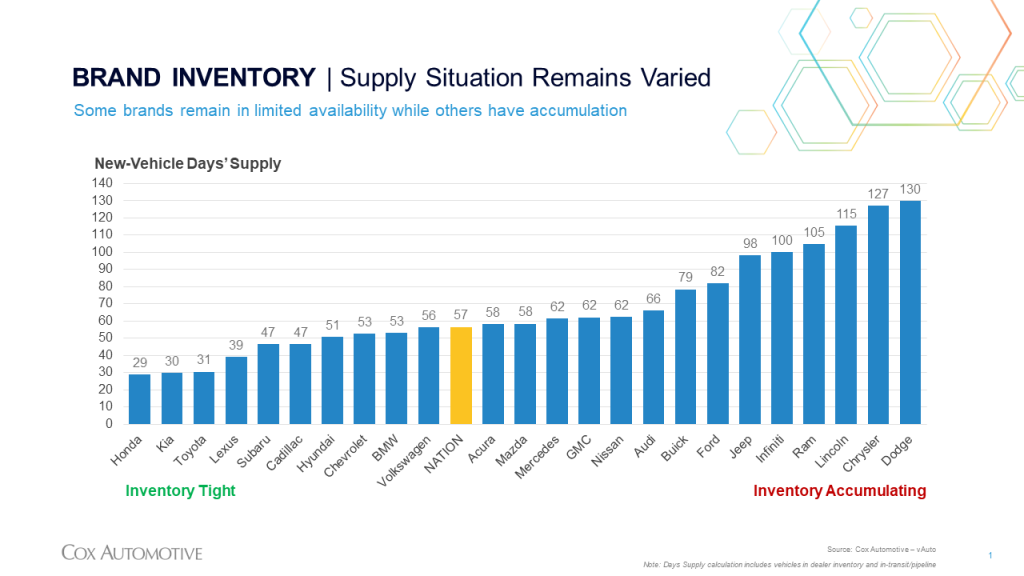

When the strike began, the industry had 800,000 more units in inventory than a year ago, roughly 2 million vehicles sitting on dealer lots across the U.S. The major domestic automakers represent about 40% of U.S. sales, but the D3 are heavy in pickups and SUVs and higher priced vehicles. Inventory levels across the D3 were generally higher than the overall industry when measured in days’ supply.

So far, as September winds down, any impact on prices cannot be discerned clearly in our data. We have gone from 57 days’ supply when the strike started to an aggregate of 52 days, with every single one of the brands impacted having seen some tightening, but it’s not to a level that appears to be materially moving prices.

The sales pace for the market has actually quickened since the strike started, but admittedly the strike started at the middle of the month when pace is typically the lowest, so basically what we are observing in the sale and inventory data are typically close-out-the-month trends. At this point, there is nothing out of the ordinary in the data.

The UAW’s initial strike targets hit midsize pickup and SUV production. In some cases, days’ supply of the targeted products was very high. Exhibit One: The Jeep Gladiator pickup had enough inventory in place at the start of the strike to weather five months or more of work stoppage before any notable shortage would be seen or felt by consumers. On the other hand, supply of GMC Canyon, Chevrolet Colorado and the two Ford products targeted, Ranger and Bronco, was much lower and below industry average.

We’ll likely start seeing the first signs of impact in October, particularly with the aforementioned products from GM and Ford. They would be canaries in the coal mine and indicate the first signs of stress, likely in the form of prices going up for new and also going up in the used market, particularly with vehicles that are less than four years old and near substitutes for new. Should the strike against production sites further expand, the more vulnerable products are the large SUVs from Chevrolet and Cadillac, which have tighter inventory levels compared to their domestic rivals.

The impacts of a longer strike could cascade into the used-vehicle market as well, just as we saw in 2021 when new-vehicle shortages started to become evident in the market. Fleet sales have been relatively strong all year and, if automakers begin to steer vehicles away from fleet buyers and into dealerships to support the retail market, some fleet buyers may choose to move into the used-vehicle market in search of inventory. This can quickly drive up wholesale used-vehicle prices, which in turn will push higher what consumers are paying for used vehicles. The used-vehicle market, thanks in part to high loan rates, is already suffering an affordability issue. Higher prices would be unwelcome indeed.

Clearly, if the strike persists and new-vehicle supply tightens, prices will go up and incentives, which have been increasing of late, will come back down. Affordability will get worse, not better. Affordability limits what is possible for the industry. A key source of demand strength for the industry so far this year has been the incremental improvement in affordability. Reversing that improvement would be a setback.

The UAW is not the only factor causing challenges for industry performance in the final quarter of the year. Interest rates have been moving higher in August and September, despite the Fed taking a pause, and have pushed auto loan rates to new levels not seen in 23 years. In the latter part of September, the average new rate crossed above 9.6%. The average used rate is back above 14%, slightly higher than the peak we saw during the banking crisis in March.

Conditions today are very different than they were in the latter part of 2021 and into 2022, the last time new-vehicle inventory fell short of demand. Back then, U.S. households were emerging from COVID lockdowns with flush bank accounts, stimulus money, and low auto loan rates. That combination threw the natural supply and demand balance out of whack and fueled a rapid and historic jump in vehicle prices. Today, with rates high and prices already elevated, tighter inventory will likely only mean lower incentives and modestly higher prices, which will quickly align demand with available supply.

Ultimately, our hope is that we find a positive resolution to the strike soon, and we see loan rates finally peak. If so, we can look forward to progress resuming on vehicle affordability, which continues to be the market’s biggest challenge.

Jonathan Smoke

Jonathan Smoke leads Cox Automotive’s economic and industry insights team, which tracks key metrics and trends impacting both the wholesale and retail markets for vehicles informed by the proprietary data from the company’s businesses and platforms. For 28 years, Smoke has focused on translating data and trends into relevant actionable insights for the industries that represent the biggest purchases that consumers make in their lifetimes: real estate and automotive. Smoke joined Cox Automotive in 2017.