Data Point

Used-Vehicle Inventory Hits High Point for the Year, As Sales Edge Higher on Lower Prices

Friday August 11, 2023

Article Highlights

- Used-vehicle inventory rose to 2.25 million units at the end of July.

- Used days’ supply stood at 45, a decrease from June.

- The average used-vehicle listing price decreases slightly, but remains above $27,000.

Used-vehicle inventory in July hit a new high for the year, according to the Cox Automotive analysis of vAuto Available Inventory data. And while volume reached a year-to-date high, the used-vehicle market saw prices and days’ supply decrease as sales rose for the second consecutive month.

2.25M

Total Unsold

Used Vehicles

as of July 31, 2023

45

Days’ Supply

$27,028

Average Listing Price

69,950

Average Mileage

The total supply of unsold used vehicles on dealer lots – franchised and independent – across the U.S. stood at 2.25 million units at the close of July. That was up from a revised 2.21 million at the end of June but down 9%, or 209,537 units, from the same time a year ago.

Total days’ supply at the end of July stood at 45, compared with 49 at the start of the month. The days’ supply was down 12% from year-ago levels. Days’ supply has been fluctuating in the mid-to-high 40s since April.

“Used-vehicle inventory has seen an improvement since March, but the overall inventory volume is still considered tight,” said Chris Frey, senior manager of Economic and Industry Insights at Cox Automotive. “Days’ supply, at 45, is on par with levels seen in 2019, but there has been a decline over the last several weeks, owing to increased used retail sales. Usually, we’d expect days’ supply to increase through year-end, but moderating prices and surprising summer demand may keep inventory numbers down.”

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period, ending July 31, when sales were 1.49 million units, up 4.2% compared to July 2022. Total retail sales through the first seven months of the year are now up 6% compared to the same timeframe of last year.

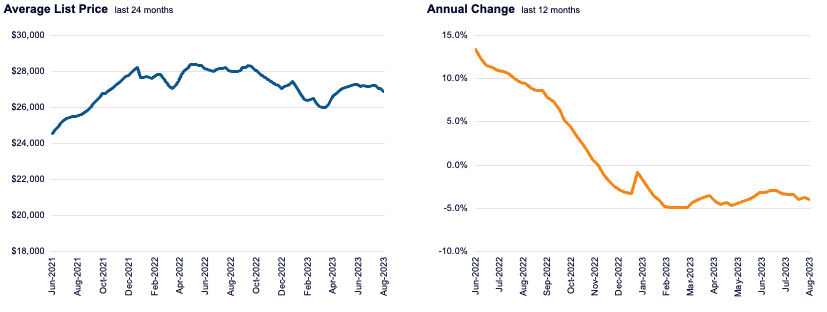

The average used-vehicle listing price ended July lower than when the month opened and was down 4.1% compared to July 2022. The average used-vehicle listing price closed the month at $27,028, down 0.5% from the revised $27,167 at the end of June. Meanwhile, according to the Manheim Used Vehicle Value Index, wholesale prices saw a decline of 1.6% in July from June and were down 11.6% year over year.

JULY 2023 AVERAGE USED-VEHICLE LISTING PRICE

Prices still falling, with fairly steady declines in the last two months.

As with new cars, and as has been the case for months, the lower the price segment, the tighter the inventory. Used vehicles priced under $10,000 had a days’ supply of 32, with days’ supply increasing with every higher price segment to the over $35,000 category with the highest days’ supply of 55.

Honda, Subaru and Toyota were the non-luxury brands with the lowest inventory of used vehicles in July. Honda had 38 days’ supply, while Subaru and Toyota both had 39 days’ supply. They were the only brands with sub-40 days’ supply. Most other mainstream brands – both luxury and non-luxury – had used-vehicle days’ supply under 60.

Rebecca Rydzewski

Rebecca Rydzewski is an automotive analyst with over 20 years of experience in the automotive industry. She provides industry and data analysis using consumer and industry data from Cox Automotive and its brands including Autotrader and Kelley Blue Book. Rydzewski joined Cox Automotive in March 2022.