Data Point

Tax Refund Season Draws To A Close With Retail Used-Vehicle Sales Up More Than 5% Year Over Year

Friday April 19, 2024

Article Highlights

- Used-vehicle inventory fell to 2.22 million units at the start of April.

- Used days’ supply fell to 44.

- The average used-vehicle listing price slipped to $25,407.

Used-vehicle inventory levels at the start of April were lower than in March, according to the Cox Automotive analysis of vAuto Live Market data, as healthy sales fueled by tax refunds drew supply down to the lowest level since the spring of 2023.

2.22M

Total Unsold

Used Vehicles

as of April 4, 2024

44

Days’ Supply

$25,540

Average Listing Price

69,232

Average Mileage

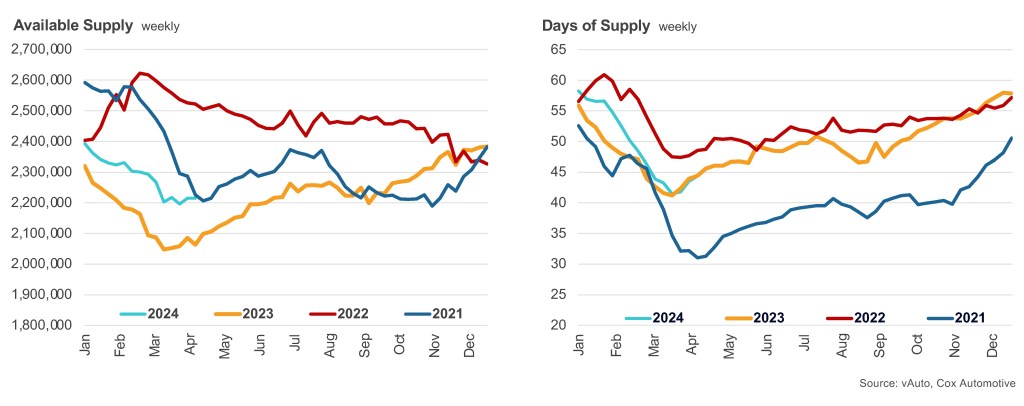

The total supply of unsold used vehicles on dealer lots – franchised and independent – across the U.S. stood at 2.22 million units as April opened, up 6% from a year ago but down from the revised 2.27 million units at the start of March.

As spring fever and tax refund season got underway, the market saw a typical heating of sales in new and used vehicles, which brought down days’ supply. Used-vehicle days’ supply at the start of April fell to 44, compared with the revised 46 at the start of March, a 4% drop. Days’ supply at the start of April was equal to the year-ago level.

USED-VEHICLE INVENTORY VOLUME AND DAYS’ SUPPLY

Available inventory volume was up 6% year over year, while days’ supply was flat year over year.

The Cox Automotive days’ supply is based on the estimated daily retail sales rate for the most recent 30-day period, when sales were 1.50 million units. Used-vehicle sales in the period were up more than 5% year over year, in line with tax refund season.

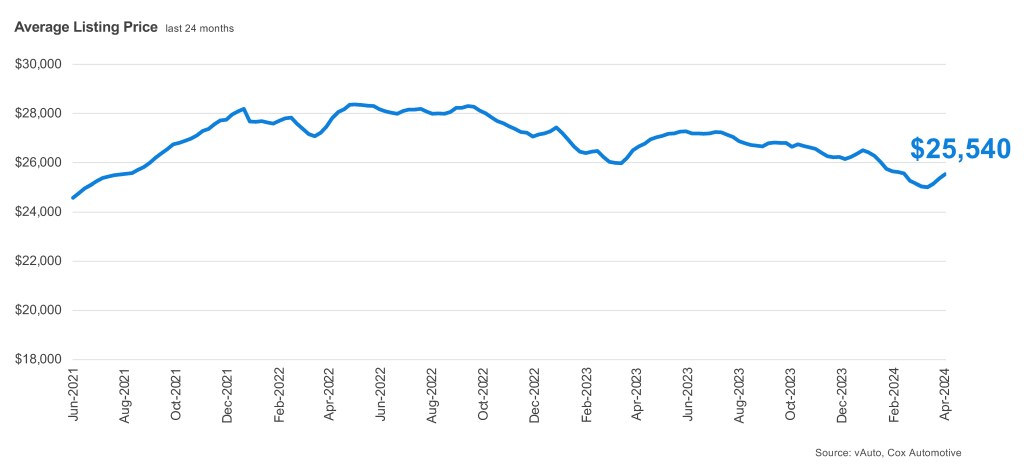

The average used-vehicle listing price was $25,540, up slightly from the revised $25,121 at the start of March but down 4% from a year earlier.

AVERAGE USED-VEHICLE LISTING PRICE

Used-vehicle prices increased month over month.

Interestingly, used cars below $15,000 continue to show constrained availability with only 33 days’ supply, 25% less than all other price ranges. Further, it emphasizes that affordability remains challenging for consumers, and supply is more constrained at lower cost points. The top five sellers of the month, Ford, Chevrolet, Toyota, Honda and Nissan, accounted for 49% of all used vehicles sold at an average price of $23,089, more than 9% below the average listing price for all vehicles sold. The South is running with the lowest days’ supply.

Erin Keating

Erin Keating is an Executive Analyst and Senior Director of Economic and Industry Insights at Cox Automotive. She has 25 years of experience in marketing and communications, including 10 years with Audi of America, where she also ran Audi Motorsport North America. With a focus on the wider industry, the individual automakers, and consumer shopping and buying behavior for new vehicles, Erin provides analysis and insights leveraging the breadth and depth of data from DRiVEQ, Cox Automotive’s data intelligence engine. Upon joining Cox Automotive, Erin was responsible for Enterprise Data Strategy – Partnerships. Erin is based in Atlanta.