Data Point

Used-Vehicle Inventories Remain Tight in Final Month of 2023

Friday December 15, 2023

Article Highlights

- Used-vehicle inventory volume at the start of December, at 2.36 million units, was higher by 2.4% than in early November.

- Used days’ supply was 52, a slight decrease from the beginning of November.

- The average used-vehicle listing price fell further to $26,091.

Used-vehicle inventory volume at the start of December, at 2.36 million units, was higher by 2.4% than in early November. Still, days’ supply fell month over month, indicating used-vehicle sales growth outpaced inventory growth last month, according to the Cox Automotive analysis of vAuto Available Inventory data.

2.36M

Total Unsold

Used Vehicles

as of Dec. 4, 2023

52

Days’ Supply

$26,091

Average Listing Price

70,368

Average Mileage

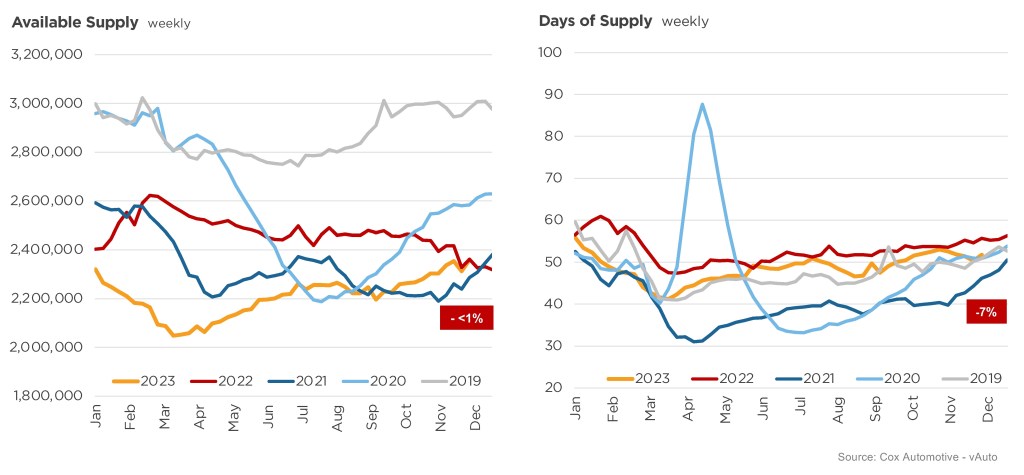

Compared to the start of December one year ago, the total supply of unsold used vehicles on dealer lots across the U.S. – franchised and independent – was virtually unchanged, down less than one-half of one percent.

“Used-vehicle inventory volume at the start of December was roughly unchanged from last month and last year, indicating the used-vehicle market is relatively balanced,” said Chris Frey, Cox Automotive senior manager of Economic and Industry Insights. “It has been stuck in the 2.2 million to 2.3 million range for some time now, which is generally considered tight.”

Using estimates of used retail days’ supply based on vAuto data, an initial assessment indicates December began with 52 days’ supply, little changed from the revised start-of-November number of 53 days’ supply. One year ago, days’ supply was 56 days, suggesting inventory levels now are slightly tighter than they were one year ago.

USED-VEHICLE INVENTORY VOLUME AND DAYS’ SUPPLY

Days’ supply is now at 52, down 7% year over year as inventory declined.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period, ending Dec. 4, when sales were 1.37 million units, up 7.4% compared to the same period in 2022. Year-to-date retail used-vehicle sales at the start of December were on course to finish 2023 near 19 million units, just below levels set in 2022, when approximately 19.1 million units were sold.

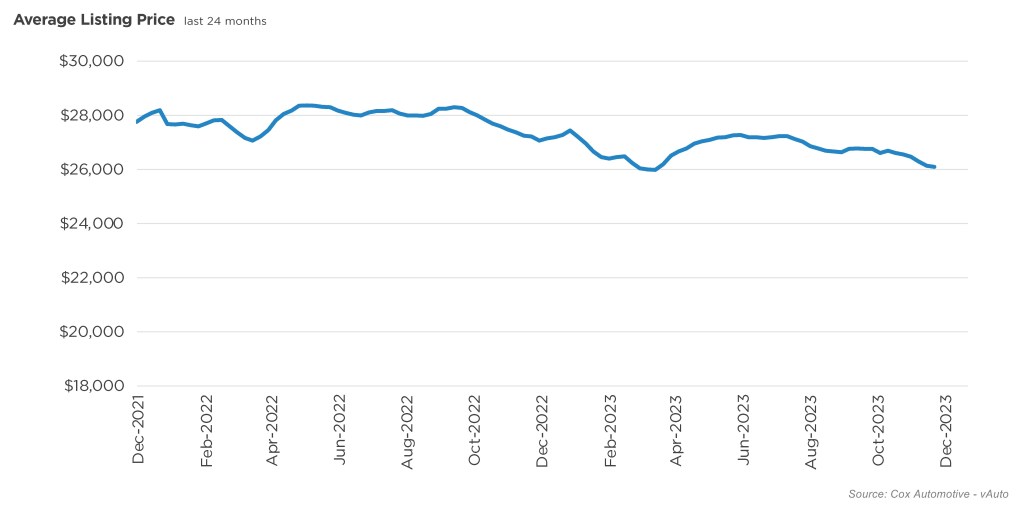

Used-Vehicle Listing Price Drops Further

The average used-vehicle listing price at the beginning of December was $26,091, down month over month and from early December 2022. Average mileage at the start of the month was 70,388 miles, generally unchanged from one month ago.

AVERAGE USED-VEHICLE LISTING PRICE

Prices have been declining marginally in recent weeks and are down 2% in the last two months.

Since mid-summer, used-vehicle listing prices have been steadily falling, following general declines in the Manheim Used Vehicle Value Index. Save for a slight uptick in August and September, wholesale used-vehicle prices have been declining from their 2023 peak reached in March. Seasonally adjusted wholesale values in November were lower by 2.1% month over month and down nearly 6% year over year. Lower wholesale prices are resulting in lower retail prices for consumers.

As with new cars, and as has been the case for months, the lower the price segment, the tighter the inventory. Used vehicles priced under $10,000 had a days’ supply of 37, with days’ supply increasing with every higher price segment to the over $35,000 category with the highest days’ supply of 63.

Once again, the supply of used vehicles from Honda, Toyota and Subaru were tightest at the beginning of the month. There were 43 days’ supply of Honda vehicles available in the U.S., while Toyota and Subaru supplies stood at 44 and 46 days, respectively.

Rebecca Rydzewski

Rebecca Rydzewski is an automotive analyst with over 20 years of experience in the automotive industry. She provides industry and data analysis using consumer and industry data from Cox Automotive and its brands including Autotrader and Kelley Blue Book. Rydzewski joined Cox Automotive in March 2022.