Data Point

Used-Vehicle Inventory Flat to Start December, Days’ Supply Drops With Strong Sales

Friday December 20, 2024

Article Highlights

- Used-vehicle inventory increased to 2.18 million units at the start of December.

- Used days’ supply increased to 46.

- The average used-vehicle listing price increased to $25,565.

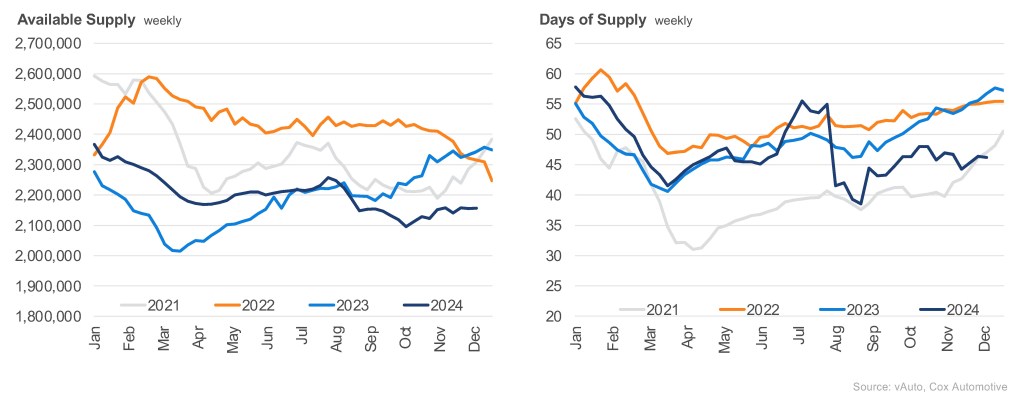

According to the Cox Automotive analysis of vAuto Live Market View data, used-vehicle inventory levels at the start of December were unchanged from November but lower than in early December 2023.

2.18M

Total Unsold

Used Vehicles

as of Dec. 5, 2024

46

Days’ Supply

$25,565

Average Listing Price

69,734

Average Mileage

As December opened, the total supply of used vehicles on dealer lots – franchised and independent – across the U.S. was at 2.18 million units, unchanged from the 2.18 million units at the start of November and down 6% from a year ago.

The retail used-vehicle sales pace increased month over month in the most recent 30-day period. Used retail sales of 1.42 million vehicles during November were higher than the 1.39 million reported in October, an increase of 2%. Used-vehicle sales were seasonally stronger than normal last month and higher year over year by 13%.

USED-VEHICLE INVENTORY VOLUME AND DAYS’ SUPPLY

The Cox Automotive days’ supply is based on the estimated daily retail sales rate for the most recent 30-day period. Days’ supply was 46 at the beginning of December, down one day from the beginning of November and down nine days compared to last year. While we have seen lower days’ supply earlier in 2024, this is particularly tight for this time of year.

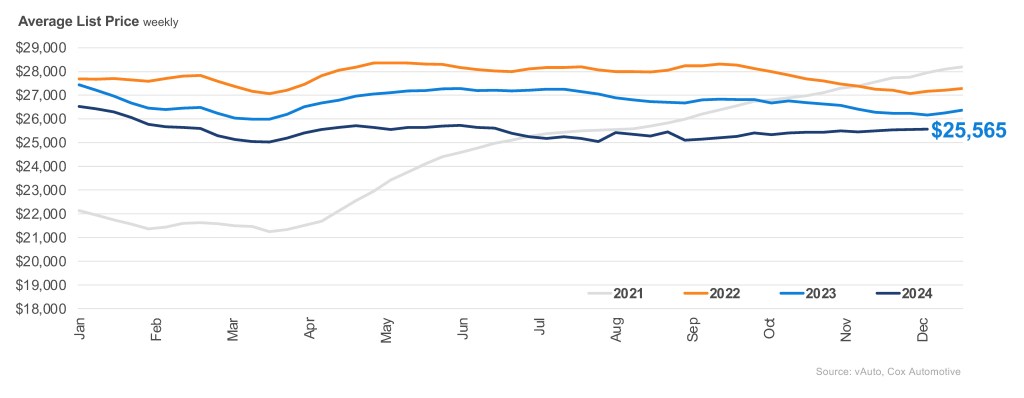

The average used-vehicle listing price was $25,565, up slightly from the revised $25,493 at the start of November and now down 3% from a year earlier. Retail used-vehicle listing prices have been consistently lower through the first 11 months of 2024 compared to year-ago levels.

AVERAGE USED-VEHICLE LISTING PRICE

Used-vehicle listing prices increased month over month, mostly due to a shift in mix.

Affordability remains challenging for consumers, and supply is more constrained at lower price points. Used cars below $15,000 continue to show low availability, with only 34 days’ supply, nine days lower than the same time last year and 12 days below the industry average. The top five sellers of the month were listed at an average price of $23,882, about 7% below the average listing price for all vehicles sold. Once again, Ford, Chevrolet, Toyota, Honda and Nissan were the top-selling brands, accounting for 49% of all used vehicles sold.

Scott Vanner

Scott Vanner is a senior analyst of Economic and Industry Insights at Cox Automotive, which works to find actionable insights for the industry posed by Cox Automotive clients. Scott works with the Sales, Finance, and Data Science organizations and creates innovative solutions often combining proprietary data from other Cox Automotive brands. Scott joined Cox Automotive in 2022.