Commentary & Voices

Why Are Prices So High? The Used-Car Factory Was Shut Down.

Wednesday May 3, 2023

Every year many automakers shut down their assembly plants to retool and prepare for the new model year or product changeover. Factory employees love shutdowns because they typically cash in on some overtime hours leading up to the changeover, and they get to enjoy a little vacation time.

When COVID-19 hit in the spring of 2020, there was no time for planning or preparation. Factories around the globe halted production for 2-3 months, some even longer, and supply chain managers canceled parts orders as fast as they could. There was plenty of reason for pessimism about the forward-looking view of the new-car market at that time. It was a shutdown we had never seen before.

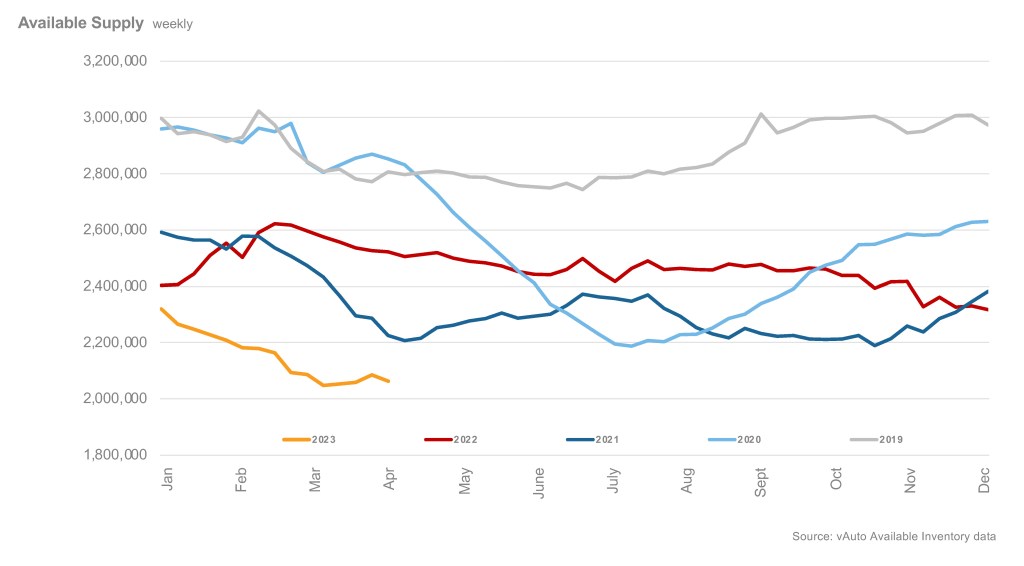

Nobody could have predicted how quickly the new-car market would rebound. Driven by pent-up demand and an economy awash with cash, new-vehicle demand skyrocketed at the exact moment when microchip and other suppliers turned their attention elsewhere. As a result, new-vehicle inventories plummeted from 3.8 million in the spring of 2020 to a mere 820,000 by the fall of 2021.

This dramatic loss of production led to the industry selling 8.1 million fewer vehicles from 2020-2022 compared to the 2017-2019 timeframe. This also meant 8.1 million vehicles would never show up in the used-car market.

We didn’t fully appreciate what was happening at that moment, but for the first time, the industry was experiencing a used-car factory shutdown. Cox Automotive is reporting that used-vehicle inventories are now near the lowest levels seen in 10+ years at 2.0 million vehicles, down about 1.0 million units from the spring of 2020.

Fewer Lease Turn-Ins and Rental Units Led to Tighter Used-Vehicle Availability

What’s interesting is looking deeper into where the 8.1 million lost sales occurred. The industry is down 3.6 million leases (-28%) and 3.1 million (-53%) fewer rental cars. An incredible 83% of the lost sales volume came from the prime reservoir of used-car inventory: lease turn-ins and rentals.

Over the past three years, we’ve seen a significant increase in the number of off-lease cars purchased by lessees, with return rates plummeting from 62% to 11%. The big rental companies have been so tight on inventory they often rent vehicles with over 80,000 miles. This all adds up to a much tighter used-vehicle market.

Used-Vehicle Inventory

Used-Vehicle Prices Are 35% Higher Than Pre-Pandemic Average

Simple economics tells us that lower supply coupled with high demand will drive higher prices. Before the pandemic, the average price of a used car was $19,827, but it’s now $26,686 (a 35% increase). And that’s only half of the tough news. The pre-pandemic average used vehicle had 65,000 miles on it, but now the average mileage is 71,000 miles (+9%).

I feel sorry for today’s used-vehicle buyers: they’re paying 35% more for a vehicle with 9% more wear and tear. That does not sound like a smoking deal.

As many automakers transitioned their business models from a volume focus to a margin focus, there’s been a notable reduction in the most affordable segments. In fact, 74% of the production cuts happened in these three key segments: compact sedan (-2.6 million), midsize sedan (-1.8 million), and compact SUV (-1.6 million).

This situation has made it very difficult for mid- to lower-income households to find affordable transportation. These market dynamics may help explain why AutoZone and O’Reilly’s Auto Parts have experienced revenue growth of 37% and 42%, respectively, since 2019. Consumers are repairing vehicles and holding them longer to avoid historically high used-car prices.

The real question is: How long will used-car inventory remain tight and prices high?

We need to turn back to the new-car factories and their product mix to answer that question. Most plants are currently running at about 80% of their pre-pandemic production levels and are continuing to build a very expensive mix of new vehicles. If the wealthiest Americans continue buying $65,000 trucks and SUVs, the automakers will have no incentive to dial back their mix, provide special lease offers or increase their sales to rental or fleet companies.

While the factory workers may still get to enjoy some time off during the next model year changeover, the used-car market will not feel like a vacation for any buyer for the next 3-5 years.

Brian Finkelmeyer

Brian Finkelmeyer is Senior Director of Enterprise Insights and Advisory at Cox Automotive. Brian leads a team dedicated to providing car companies with actionable business intelligence to drive their performance. Brian has spent his entire career in the auto industry, working at Nissan for nearly 20 years in various sales leadership positions. Upon joining Cox Automotive, Brian was responsible for the vAuto New Car Inventory solution – Conquest. Brian lives in Nashville, TN.