Data Point

With Older, High-Mileage Used Vehicles In Short Supply, List Prices Vault Into Record Territory

Thursday June 24, 2021

The headline for June is hard to miss: Used-Vehicle List Prices Hit an All-Time High. The record, however, was mostly expected, as used-vehicle values at the wholesale level were climbing relentlessly through the spring and, ultimately, drove higher retail prices.

The price jump this spring was created by a number of factors, including government stimulus putting more money into circulation. Demand has been healthy, inventories tight, and dealers have felt little pressure to lower prices.

While improving inventory levels might help keep price increases in check, the challenge in the used-vehicle market is a structural one – specifically a lack of high mileage, older vehicles.

High-mileage vehicles are often the most affordable models and are tough to find in the retail market. In June 2020, approximately 19,600 high-mileage used vehicles were available on retail lots across the country – average miles 126,000. This year, in early June, high-mileage vehicles (average miles 121,000) with low list prices numbered around 11,700.

Older vehicles – again, oftentimes the least expensive – are tough to find as well. In June 2020, the cohort of vehicles model year 2014 or older made up 32.3% of used-vehicle retail inventory. This year, 2014MY-or-older vehicles account for 27.8% of the available used inventory.

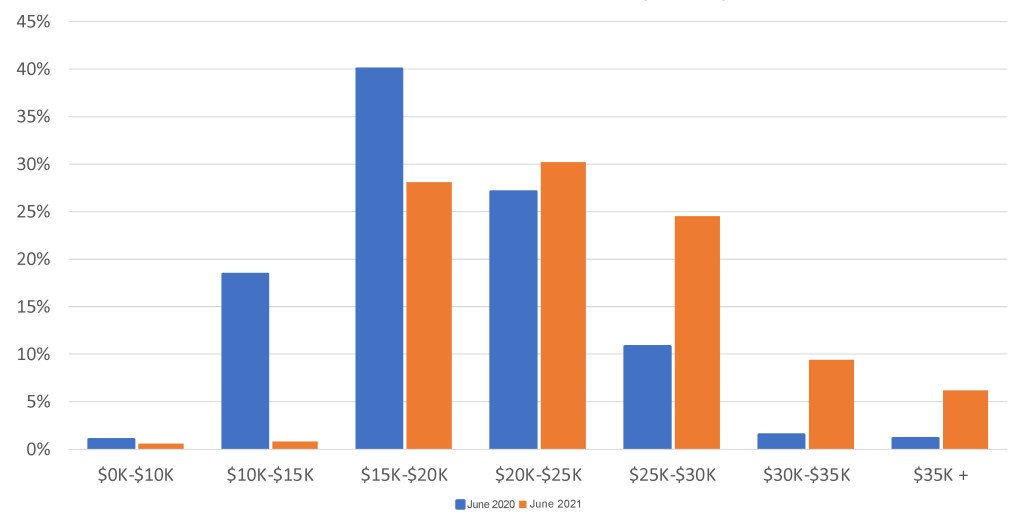

This lack of older model, high-mileage vehicles is helping push the average list prices upward and well into record territory. As shown in the chart, used vehicles in the “under $15,000” price range are all but non-existent now in retail, whereas last year they accounted for more than 18% of the market.

Retail Used-Vehicle Available Inventory Mix by Price

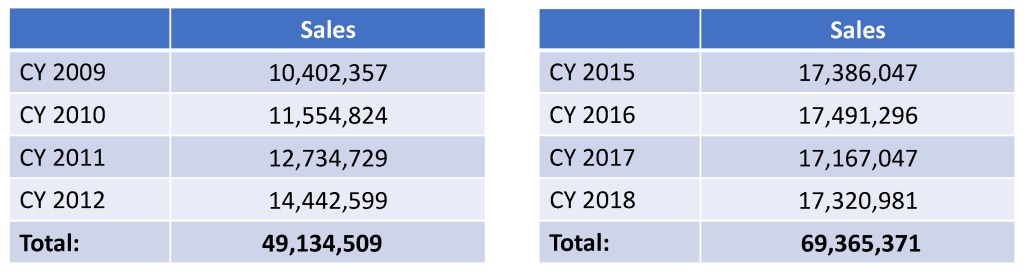

Charlie Chesbrough, senior economist at Cox Automotive, notes that ghosts of the Great Recession are still haunting the market today. “Lost car sales in the 2009-2013 timeframe, coupled with the Cash for Clunkers program and the fact people are holding onto their vehicles longer, have put older-model vehicles in short supply. These older vehicles are an important product group for many price-driven buyers. With interest elevated and supply scarce, prices for these products are at a record high, and pushing the entire market higher.”

Unfortunately, considering the supply reality, this situation won’t begin to noticeably change for another three to four years, as more vehicles from the industry’s best sales years find their way into the used-vehicle market.