Press Releases

Cox Automotive Forecast: Despite Ongoing UAW Strike, U.S. Auto Sales Pace in October Expected to Increase from September

Wednesday October 25, 2023

Article Highlights

- Cox Automotive forecasts annual vehicle sales pace in October to finish near 15.8 million, up 1.1 million from last October’s 14.7 million pace and up slightly from September’s 15.7 million level.

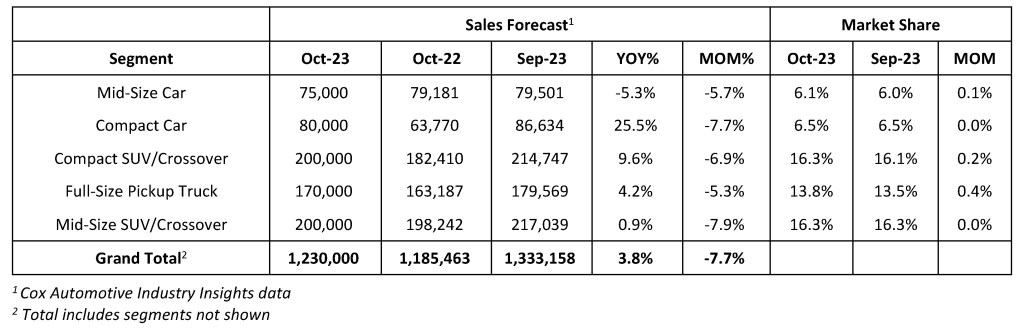

- October’s sales volume is expected to rise 3.8% from one year ago and reach 1.23 million units; volume is forecast to decrease 7.7% from September due to one less selling day in October.

- The expanding United Auto Workers (UAW) strike has yet to materially impact overall new-vehicle sales.

Updated, Nov. 2, 2023 – October new-vehicle sales in the U.S. continued showing healthy results, as forecast by Cox Automotive late last month, with enough buyers shrugging off high loan rates and staying in market. Initial estimates show that the seasonally adjusted annual rate (SAAR), or sales pace, came in right at the year-to-date average of 15.5 million, and sales volume was 1.20 million in October, slightly below our expectations. October marks the seventh consecutive month with a sales pace above 15 million, but a decline in fleet sales for the Detroit Three kept the sales pace from finishing higher. Retail ticked up a bit, perhaps due to the strike ending. Meanwhile, fleet sales were down for the first time this year.

Most foreign automakers benefited from improved inventory and showed sales growth in October. Honda Motor Co. and Toyota Motor Corp posted sales increases in the U.S. Toyota’s inventory has been recovering quickly since the summer, allowing them to regain share from Honda and Nissan. Hyundai and Kia had positive sales growth for the 15th consecutive month.

Meanwhile, U.S. sales for the Detroit brands were likely down for the month, perhaps reflecting a small impact from the UAW strike. Beyond that, the UAW strike had little near-term impact on new-vehicle sales, as inventory levels remained mostly healthy throughout October. However, the market will have to wait and see what the longer-term impact of the strike looks like.

ATLANTA, Oct. 25, 2023 – Despite economic and political uncertainty throughout October, new-vehicle sales remain remarkably stable, according to a forecast by Cox Automotive released today. New-vehicle sales volume in the U.S. is expected to rise nearly 4% over October 2022, a market that was in the early stages of recovery from severe product shortages.

The October seasonally adjusted annual rate (SAAR), or sales pace, is expected to finish near 15.8 million, up 1.1 million from last year’s pace and a slight gain over last month’s 15.7 million level. The sales strength continues to be remarkable, given the current economic climate and the fact that average new-vehicle auto loans are flirting with 10%. However, some of these sales gains and good news can be attributed to seasonal adjustments, as October has one less selling day than both October 2022 and last month.

According to Charlie Chesbrough, senior economist at Cox Automotive: “Though there are many headwinds in the market today, new-vehicle sales continue to show gains over last year’s supply-constrained market. Concerns about high interest rates, a potential economic recession, and the ongoing UAW strike are all likely holding back some potential vehicle buyers. However, there are still enough individuals and businesses with the need and ability to buy vehicles, which has helped sustain the sales recovery.”

New-Vehicle Inventory Levels Continue to Grow

A key driver of new-vehicle sales strength has been growing inventory levels across the industry. Despite the ongoing UAW strike slowing production across the major Detroit-based automakers, estimates from vAuto in mid-October suggest industry-wide, new-vehicle inventory in the U.S. was at 2.3 million units, up from 2.1 million in mid-September, when the strike began, and well above the estimate of 1.5 million for mid-October 2022. Days’ supply in mid-October reached 62, the highest point since the spring of 2021. A year ago, days’ supply was at 48.

Toyota and Honda continue to have the lowest measure of days’ supply, at under 23 days. Of the Detroit brands, where production is being negatively impacted by the UAW strike, Chevrolet and Cadillac had the tightest supply in mid-October, both below the industry average of 62. Ford had 90 days’ supply in the same timeframe, while Lincoln and the core Stellantis brands had inventory levels well above 100 days’ supply.

Added Chesbrough, “While the UAW strike is certainly slowing down production at select assembly plants across the U.S., the impact has not yet fully materialized for consumers in the showroom. Compared to this point last year, industry inventory levels are much higher, which is helping support—to this point at least—relatively healthy new-vehicle sales.”

October 2023 New-Vehicle Sales Forecast

All percentages are based on raw volume, not daily selling rate. There were 25 selling days in October 2023, one less than September and one less than October 2022.

About Cox Automotive

Cox Automotive is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, automakers, dealers, retailers, lenders and fleet owners. The company has 25,000+ employees on five continents and a family of trusted brands that includes Autotrader®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital™ and vAuto®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on Twitter, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com